Instructions For Form Ct-1120a-Iric - 2000

ADVERTISEMENT

FORM CT-1120A-IRIC

FORM CT-1120A-IRIC

FORM CT-1120A-IRIC

FORM CT-1120A-IRIC

FORM CT-1120A-IRIC

Instr

Instr

Instr uctions

uctions

uctions

uctions

Instr

Instr

uctions

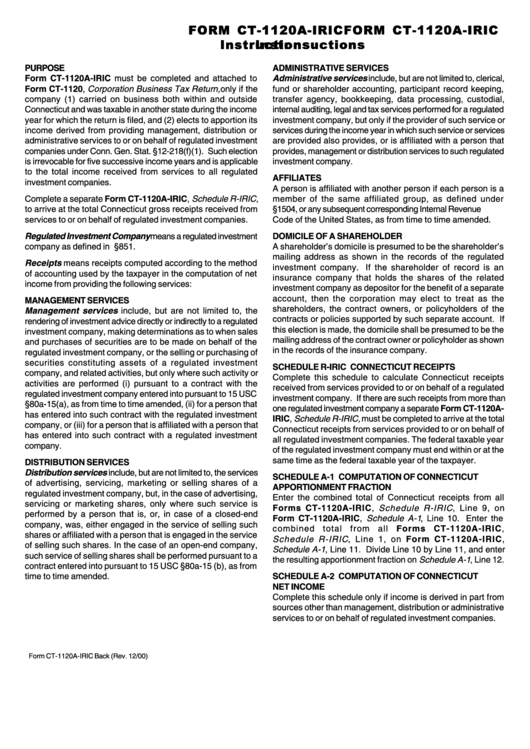

PURPOSE

ADMINISTRATIVE SERVICES

Form CT-1120A-IRIC must be completed and attached to

Administrative services include, but are not limited to, clerical,

Form CT-1120, Corporation Business Tax Return, only if the

fund or shareholder accounting, participant record keeping,

company (1) carried on business both within and outside

transfer agency, bookkeeping, data processing, custodial,

Connecticut and was taxable in another state during the income

internal auditing, legal and tax services performed for a regulated

year for which the return is filed, and (2) elects to apportion its

investment company, but only if the provider of such service or

income derived from providing management, distribution or

services during the income year in which such service or services

administrative services to or on behalf of regulated investment

are provided also provides, or is affiliated with a person that

companies under Conn. Gen. Stat. §12-218(f)(1). Such election

provides, management or distribution services to such regulated

is irrevocable for five successive income years and is applicable

investment company.

to the total income received from services to all regulated

AFFILIATES

investment companies.

A person is affiliated with another person if each person is a

Complete a separate Form CT-1120A-IRIC, Schedule R-IRIC,

member of the same affiliated group, as defined under

to arrive at the total Connecticut gross receipts received from

I.R.C. §1504, or any subsequent corresponding Internal Revenue

services to or on behalf of regulated investment companies.

Code of the United States, as from time to time amended.

Regulated Investment Company means a regulated investment

DOMICILE OF A SHAREHOLDER

company as defined in I.R.C. §851.

A shareholder’s domicile is presumed to be the shareholder’s

mailing address as shown in the records of the regulated

Receipts means receipts computed according to the method

investment company. If the shareholder of record is an

of accounting used by the taxpayer in the computation of net

insurance company that holds the shares of the related

income from providing the following services:

investment company as depositor for the benefit of a separate

account, then the corporation may elect to treat as the

MANAGEMENT SERVICES

shareholders, the contract owners, or policyholders of the

Management services include, but are not limited to, the

contracts or policies supported by such separate account. If

rendering of investment advice directly or indirectly to a regulated

this election is made, the domicile shall be presumed to be the

investment company, making determinations as to when sales

mailing address of the contract owner or policyholder as shown

and purchases of securities are to be made on behalf of the

in the records of the insurance company.

regulated investment company, or the selling or purchasing of

securities constituting assets of a regulated investment

SCHEDULE R-IRIC CONNECTICUT RECEIPTS

company, and related activities, but only where such activity or

Complete this schedule to calculate Connecticut receipts

activities are performed (i) pursuant to a contract with the

received from services provided to or on behalf of a regulated

regulated investment company entered into pursuant to 15 USC

investment company. If there are such receipts from more than

§80a-15(a), as from time to time amended, (ii) for a person that

one regulated investment company a separate Form CT-1120A-

has entered into such contract with the regulated investment

IRIC, Schedule R-IRIC, must be completed to arrive at the total

company, or (iii) for a person that is affiliated with a person that

Connecticut receipts from services provided to or on behalf of

has entered into such contract with a regulated investment

all regulated investment companies. The federal taxable year

company.

of the regulated investment company must end within or at the

same time as the federal taxable year of the taxpayer.

DISTRIBUTION SERVICES

Distribution services include, but are not limited to, the services

SCHEDULE A-1 COMPUTATION OF CONNECTICUT

of advertising, servicing, marketing or selling shares of a

APPORTIONMENT FRACTION

regulated investment company, but, in the case of advertising,

Enter the combined total of Connecticut receipts from all

servicing or marketing shares, only where such service is

Forms CT-1120A-IRIC, Schedule R-IRIC , Line 9, on

performed by a person that is, or, in case of a closed-end

Form CT-1120A-IRIC, Schedule A-1 , Line 10. Enter the

company, was, either engaged in the service of selling such

combined total from all Forms CT-1120A-IRIC,

shares or affiliated with a person that is engaged in the service

Schedule R-IRIC , Line 1, on Form CT-1120A-IRIC,

of selling such shares. In the case of an open-end company,

Schedule A-1 , Line 11. Divide Line 10 by Line 11, and enter

such service of selling shares shall be performed pursuant to a

the resulting apportionment fraction on Schedule A-1 , Line 12.

contract entered into pursuant to 15 USC §80a-15 (b), as from

time to time amended.

SCHEDULE A-2 COMPUTATION OF CONNECTICUT

NET INCOME

Complete this schedule only if income is derived in part from

sources other than management, distribution or administrative

services to or on behalf of regulated investment companies.

Form CT-1120A-IRIC Back (Rev. 12/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1