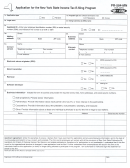

Instructions For Form Pr-584-Mn - 2000

ADVERTISEMENT

PR-584-MN (2000) (back)

Instructions

New electronic filers must submit an application to participate in the

Line 5: Electronic return originator (ERO) — An ERO either

New York State electronic filing program. Refer to Publication 84,

prepares or accepts completed tax returns for taxpayers who

Handbook for Electronic Filers of Personal Income Tax Returns, for

intend to have their returns electronically filed. If you are an ERO,

participation information. The Tax Department will issue a

you must provide the EFIN, assigned by the IRS, in box 6.

Form PR-374, Notification of Acceptance, to each electronic filer

who is accepted.

Line 7: Direct transmitter — A direct transmitter transmits

electronic state returns directly to the IRS or New York State.

Applicants are required to provide several identification numbers.

Please note that an ERO that transmits returns through the

Electronic filers will be assigned an EFIN and an ETIN, as required,

services of another electronic filer (that is, a direct transmitter) is

by the IRS. If you are a retriever, you must provide your electronic

not a direct transmitter. If you are a direct transmitter, you must

mailbox ID that is assigned by the State Tax Return

provide the EFIN, assigned by the IRS, in box 6 and the ETIN,

Acknowledgment Service (StAck) System. If you have not been

assigned by the IRS, in box 8.

assigned these numbers by the time you apply to our program,

write applying in the appropriate box(es) and submit a revised

Line 9: Retriever — A retriever accesses and retrieves state

application when you receive the information. You will not be

acknowledgments directly from the State Tax Return

accepted into the New York State program until you have supplied

Acknowledgment Service (StAck) System. All EROs must either

this information. Note: Electronic filers participating in the NYS

use the services of another electronic filer to retrieve

Direct Program are required to apply to the IRS’ Electronic Filing

acknowledgments, or become a retriever and establish their own

Program to obtain the appropriate filing identification numbers

electronic mailbox. If your software provider accesses this system

(i.e., EFIN and ETIN).

on your behalf, you are not required to register with the system.

You should refer to your software instructions for additional

Line 1a: Application type — If you are submitting an application

information regarding your responsibilities for accessing and

to participate in the upcoming processing season, check the New

retrieving state acknowledgments. If you are a retriever, you must

box. If you need to update your participant information and you

provide the EFIN, assigned by the IRS, in box 6 and the electronic

have already submitted an application for the upcoming

mailbox ID, assigned by StAck, in box 10.

processing season, check the Revised box.

You can call the StAck Help Desk at (828) 349-5750 to request an

Line 1b: Program type — Indicate by checking the appropriate

application. You may also register with the service provider through

box whether this is a professional or on-line program. Separate

applications are needed for on-line programs.

Line 11: Software developer — A software developer develops

Line 2a: Legal name — For a corporation, the legal name is the

software for the purposes of computing, formatting, or transmitting

name that appears on the Certificate of Incorporation filed with the

returns, according to the New York State electronic return

Department of State. For a business that is not a corporation or

specifications. If you are a software developer, you must provide

that is not incorporated in New York State, the legal name is the

the EFIN, assigned by the IRS, in box 6 and the ETIN, assigned

name in which the business owns property or acquires debt. For a

by the IRS, in box 8. A new software developer applicant will be

business that is a partnership, the legal name is the partnership

assigned a software ID by New York State upon receipt of an

name. For a business that is a sole proprietorship, the legal name

application.

is the individual owner of the business.

Line 12: Mailing list — Check Yes if you want your organization’s

Line 2b: Doing business as (DBA) name — If, for the purpose of

name released as part of an electronic filing participants mailing

electronic filing, you and your firm use a trade or (DBA) name(s)

list; check No if you do not want your name released.

other than the name on line 2a, list the name(s) on this line.

Line 13: Business information — Indicate the form of your

Line 2c: Applicant ID — For corporations or partnerships, enter

business by checking the box that best describes it. Applicants

your firm’s employer identification number (EIN). For sole

must provide the name, title, address, and social security number

proprietorships, enter your EIN, or your social security number

for each business owner, partner, or corporate officer.

(SSN) if you do not have an EIN. Indicate by checking the

appropriate box whether the identification number entered on

line 2c is an EIN or SSN.

Where to apply

Submit completed applications to the following address:

Lines 3a and 3b: Mailing and business addresses — If your

NYS TAX DEPARTMENT

mailing and business addresses are the same, write same in

ELECTRONIC FILING PROGRAM - INCOME TAX

box 3b.

PO BOX 5400

ALBANY NY 12205-0400

Lines 4a and 4b: Contact persons — Provide information for

both a primary and alternate contact person. The Tax Department

If you have any questions, you may call the personal income tax

will use this information to contact your office regarding electronic

electronic filing help desk at (518) 457-7296.

filing. The contact representatives should be able to assist in

problem resolution during the application processing period and

during the tax filing season.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1