Instructions For Form Schedule M-Kc - 2000

ADVERTISEMENT

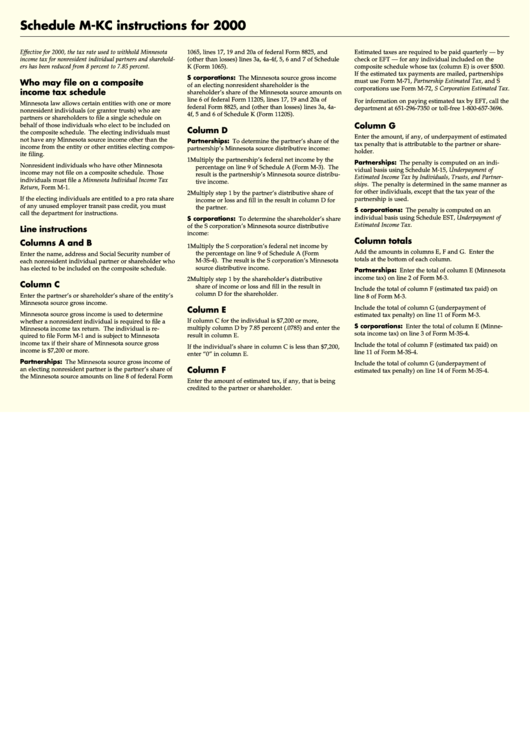

Schedule M-KC instructions for 2000

Effective for 2000, the tax rate used to withhold Minnesota

1065, lines 17, 19 and 20a of federal Form 8825, and

Estimated taxes are required to be paid quarterly — by

income tax for nonresident individual partners and sharehold-

(other than losses) lines 3a, 4a-4f, 5, 6 and 7 of Schedule

check or EFT — for any individual included on the

ers has been reduced from 8 percent to 7.85 percent.

K (Form 1065).

composite schedule whose tax (column E) is over $500.

If the estimated tax payments are mailed, partnerships

S corporations: The Minnesota source gross income

Who may file on a composite

must use Form M-71, Partnership Estimated Tax, and S

of an electing nonresident shareholder is the

corporations use Form M-72, S Corporation Estimated Tax.

income tax schedule

shareholder’s share of the Minnesota source amounts on

line 6 of federal Form 1120S, lines 17, 19 and 20a of

For information on paying estimated tax by EFT, call the

Minnesota law allows certain entities with one or more

federal Form 8825, and (other than losses) lines 3a, 4a-

department at 651-296-7350 or toll-free 1-800-657-3696.

nonresident individuals (or grantor trusts) who are

4f, 5 and 6 of Schedule K (Form 1120S).

partners or shareholders to file a single schedule on

Column G

behalf of those individuals who elect to be included on

Column D

the composite schedule. The electing individuals must

Enter the amount, if any, of underpayment of estimated

not have any Minnesota source income other than the

Partnerships: To determine the partner’s share of the

tax penalty that is attributable to the partner or share-

income from the entity or other entities electing compos-

partnership’s Minnesota source distributive income:

holder.

ite filing.

1 Multiply the partnership’s federal net income by the

Partnerships: The penalty is computed on an indi-

Nonresident individuals who have other Minnesota

percentage on line 9 of Schedule A (Form M-3). The

vidual basis using Schedule M-15, Underpayment of

income may not file on a composite schedule. Those

result is the partnership’s Minnesota source distribu-

Estimated Income Tax by Individuals, Trusts, and Partner-

individuals must file a Minnesota Individual Income Tax

tive income.

ships. The penalty is determined in the same manner as

Return, Form M-1.

for other individuals, except that the tax year of the

2 Multiply step 1 by the partner’s distributive share of

If the electing individuals are entitled to a pro rata share

partnership is used.

income or loss and fill in the result in column D for

of any unused employer transit pass credit, you must

the partner.

S corporations: The penalty is computed on an

call the department for instructions.

individual basis using Schedule EST, Underpayment of

S corporations: To determine the shareholder’s share

Estimated Income Tax.

of the S corporation’s Minnesota source distributive

Line instructions

income:

Column totals

Columns A and B

1 Multiply the S corporation’s federal net income by

Add the amounts in columns E, F and G. Enter the

the percentage on line 9 of Schedule A (Form

Enter the name, address and Social Security number of

totals at the bottom of each column.

M-3S-4). The result is the S corporation’s Minnesota

each nonresident individual partner or shareholder who

source distributive income.

has elected to be included on the composite schedule.

Partnerships: Enter the total of column E (Minnesota

income tax) on line 2 of Form M-3.

2 Multiply step 1 by the shareholder’s distributive

Column C

share of income or loss and fill in the result in

Include the total of column F (estimated tax paid) on

column D for the shareholder.

Enter the partner’s or shareholder’s share of the entity’s

line 8 of Form M-3.

Minnesota source gross income.

Include the total of column G (underpayment of

Column E

Minnesota source gross income is used to determine

estimated tax penalty) on line 11 of Form M-3.

If column C for the individual is $7,200 or more,

whether a nonresident individual is required to file a

S corporations: Enter the total of column E (Minne-

multiply column D by 7.85 percent (.0785) and enter the

Minnesota income tax return. The individual is re-

sota income tax) on line 3 of Form M-3S-4.

result in column E.

quired to file Form M-1 and is subject to Minnesota

income tax if their share of Minnesota source gross

Include the total of column F (estimated tax paid) on

If the individual’s share in column C is less than $7,200,

income is $7,200 or more.

line 11 of Form M-3S-4.

enter “0” in column E.

Partnerships: The Minnesota source gross income of

Include the total of column G (underpayment of

Column F

an electing nonresident partner is the partner’s share of

estimated tax penalty) on line 14 of Form M-3S-4.

the Minnesota source amounts on line 8 of federal Form

Enter the amount of estimated tax, if any, that is being

credited to the partner or shareholder.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1