Instructions For Form Dr-15aw - Sales And Use Tax - 2001

ADVERTISEMENT

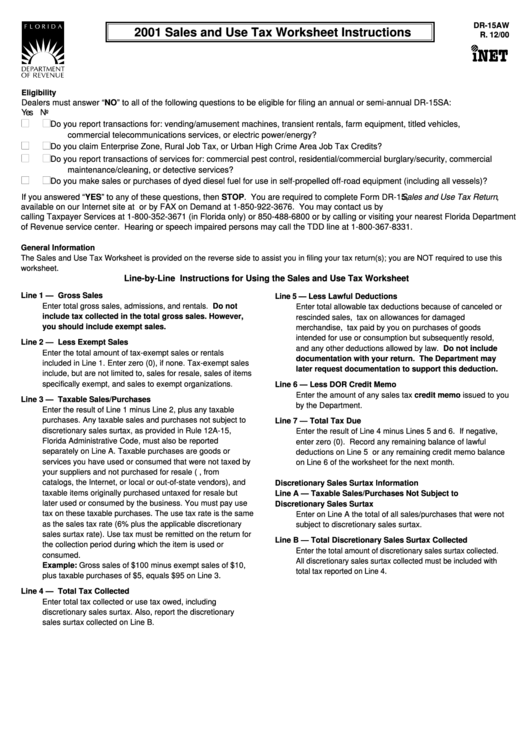

DR-15AW

2001 Sales and Use Tax Worksheet Instructions

R. 12/00

Eligibility

Dealers must answer “NO” to all of the following questions to be eligible for filing an annual or semi-annual DR-15SA:

Yes No

Do you report transactions for: vending/amusement machines, transient rentals, farm equipment, titled vehicles,

commercial telecommunications services, or electric power/energy?

Do you claim Enterprise Zone, Rural Job Tax, or Urban High Crime Area Job Tax Credits?

Do you report transactions of services for: commercial pest control, residential/commercial burglary/security, commercial

maintenance/cleaning, or detective services?

Do you make sales or purchases of dyed diesel fuel for use in self-propelled off-road equipment (including all vessels)?

If you answered “YES” to any of these questions, then STOP. You are required to complete Form DR-15, Sales and Use Tax Return ,

available on our Internet site at or by FAX on Demand at 1-850-922-3676. You may contact us by

calling Taxpayer Services at 1-800-352-3671 (in Florida only) or 850-488-6800 or by calling or visiting your nearest Florida Department

of Revenue service center. Hearing or speech impaired persons may call the TDD line at 1-800-367-8331.

General Information

The Sales and Use Tax Worksheet is provided on the reverse side to assist you in filing your tax return(s); you are NOT required to use this

worksheet.

Line-by-Line Instructions for Using the Sales and Use Tax Worksheet

Line 1 — Gross Sales

Line 5 — Less Lawful Deductions

Enter total gross sales, admissions, and rentals. Do not

Enter total allowable tax deductions because of canceled or

include tax collected in the total gross sales. However,

rescinded sales, tax on allowances for damaged

you should include exempt sales.

merchandise, tax paid by you on purchases of goods

intended for use or consumption but subsequently resold,

Line 2 — Less Exempt Sales

and any other deductions allowed by law. Do not include

Enter the total amount of tax-exempt sales or rentals

documentation with your return. The Department may

included in Line 1. Enter zero (0), if none. Tax-exempt sales

later request documentation to support this deduction.

include, but are not limited to, sales for resale, sales of items

specifically exempt, and sales to exempt organizations.

Line 6 — Less DOR Credit Memo

Enter the amount of any sales tax credit memo issued to you

Line 3 — Taxable Sales/Purchases

by the Department.

Enter the result of Line 1 minus Line 2, plus any taxable

purchases. Any taxable sales and purchases not subject to

Line 7 — Total Tax Due

discretionary sales surtax, as provided in Rule 12A-15,

Enter the result of Line 4 minus Lines 5 and 6. If negative,

Florida Administrative Code, must also be reported

enter zero (0). Record any remaining balance of lawful

separately on Line A. Taxable purchases are goods or

deductions on Line 5 or any remaining credit memo balance

services you have used or consumed that were not taxed by

on Line 6 of the worksheet for the next month.

your suppliers and not purchased for resale (e.g., from

catalogs, the Internet, or local or out-of-state vendors), and

Discretionary Sales Surtax Information

taxable items originally purchased untaxed for resale but

Line A — Taxable Sales/Purchases Not Subject to

later used or consumed by the business. You must pay use

Discretionary Sales Surtax

tax on these taxable purchases. The use tax rate is the same

Enter on Line A the total of all sales/purchases that were not

as the sales tax rate (6% plus the applicable discretionary

subject to discretionary sales surtax.

sales surtax rate). Use tax must be remitted on the return for

Line B — Total Discretionary Sales Surtax Collected

the collection period during which the item is used or

Enter the total amount of discretionary sales surtax collected.

consumed.

All discretionary sales surtax collected must be included with

Example: Gross sales of $100 minus exempt sales of $10,

total tax reported on Line 4.

plus taxable purchases of $5, equals $95 on Line 3.

Line 4 — Total Tax Collected

Enter total tax collected or use tax owed, including

discretionary sales surtax. Also, report the discretionary

sales surtax collected on Line B.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1