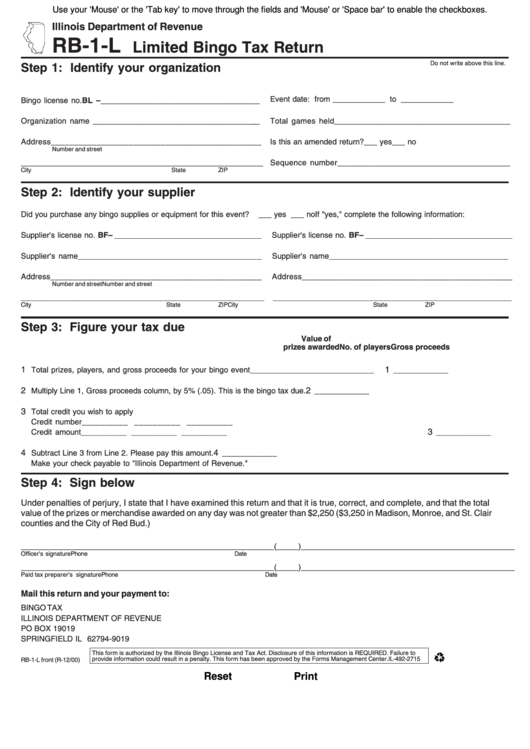

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

RB-1-L

Limited Bingo Tax Return

Do not write above this line.

Step 1: Identify your organization

Bingo license no. BL –___________________________________

Event date: from ____ ____ ____ to ____ ____ ____

Organization name _____________________________________

Total games held_______________________________________

Address______________________________________________

Is this an amended return?

___ yes

___ no

Number and street

________________________________________________________________

Sequence number______________________________________

City

State

ZIP

Step 2: Identify your supplier

Did you purchase any bingo supplies or equipment for this event?

___ yes ___ no

If "yes," complete the following information:

Supplier's license no. BF– ________________________________

Supplier's license no. BF– ________________________________

Supplier's name________________________________________

Supplier's name _______________________________________

Address______________________________________________

Address______________________________________________

Number and street

Number and street

_____________________________________________________

____________________________________________________

City

State

ZIP

City

State

ZIP

Step 3: Figure your tax due

Value of

prizes awarded

No. of players

Gross proceeds

1

1

Total prizes, players, and gross proceeds for your bingo event

______________

_____________

____________

2

2

Multiply Line 1, Gross proceeds column, by 5% (.05). This is the bingo tax due.

____________

3

Total credit you wish to apply

Credit number

__________ __________ __________

3

Credit amount

__________ __________ __________

____________

4

4

Subtract Line 3 from Line 2. Please pay this amount.

____________

Make your check payable to "Illinois Department of Revenue."

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and that it is true, correct, and complete, and that the total

value of the prizes or merchandise awarded on any day was not greater than $2,250 ($3,250 in Madison, Monroe, and St. Clair

counties and the City of Red Bud.)

__________________________________________________________(_____)_________________________________________________

Officer's signature

Phone

Date

__________________________________________________________(_____)_________________________________________________

Paid tax preparer's signature

Phone

Date

Mail this return and your payment to:

BINGO TAX

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19019

SPRINGFIELD IL 62794-9019

This form is authorized by the Illinois Bingo License and Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-2715

RB-1-L front (R-12/00)

Reset

Print

1

1 2

2