Instructions For Completing

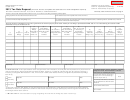

Form 614 (L-4029), 2007 Tax Rate Request

Millage Request Report To County Board Of Commissioners

These instructions are provided under MCL Sections 211.24e

or "roll up" of millage rates. Use 1.0000 for millages approved

(truth in taxation), 211.34 (truth in county equalization and

by the voters after April 30, 2007. For debt service or special

truth in assessing), 211.34d (Headlee), and 211.36 and

assessments not subject to a millage reduction fraction,

211.37 (apportionment).

enter 1.0000.

Column 1: Source. Enter the source of each millage. For

Column 7: 2007 Millage Rate Permanently Reduced by

example, allocated millage, separate millage limitations voted,

MCL 211.34d ("Headlee") Rollback. The number in column

charter, approved extra-voted millage, public act number,

7 is found by multiplying column 5 by column 6 on this 2007

etc. Do not include taxes levied on the Industrial Facilities

Form L-4029. This rate must be rounded DOWN to 4 decimal

Tax Roll.

places. (See STC Bulletin No. 11 of 1999.) For debt service

or special assessments not subject to a millage reduction

Column 2: Purpose of millage. Examples are: operating,

fraction, enter "NA" signifying "not applicable".

debt service, special assessments, school enhancement

millage, sinking fund millage, etc. A local school district must

Column 8: Section 211.34 Millage Rollback Fraction

separately list operating millages by whether they are levied

(Truth in Assessing or Truth in Equalization). List the

against ALL PROPERTIES in the school district or against

millage rollback fraction for 2007 for each millage which is an

the NON-HOMESTEAD AND NON-QUALIFIED AGRICUL-

operating rate. Round this millage rollback fraction to 4

TURAL group of properties. (See State Tax Commission

decimal places. Use 1.0000 for school districts, for special

Bulletin No. 1 of 2007 for more explanation.) A local school

assessments and for bonded debt retirement levies. For

district may use the following abbreviations when completing

counties, villages and authorities, enter the Truth in Equaliza-

Column 2: "Operating ALL" and "Operating NON-HOME".

tion Rollback Fraction calulated on STC Form L-4034 as

"Operating ALL" is short for "Operating millage to be levied on

TOTAL TAXABLE VALUE BASED ON CEV FOR ALL

ALL PROPERTIES in the local school district" such as

CLASSES/TOTAL TAXABLE VALUE BASED ON SEV FOR

Supplemental (Hold Harmless) Millages and Building and

ALL CLASSES. Use 1.0000 for an authority located in more

Site Sinking Fund Millages. "Operating NON-HOME" is short

than one county. For further information, see State Tax

for "Operating Millage to be levied on NON-HOMESTEAD

Commission Bulletin No. 1 of 2007. For townships and cities,

AND NON-QUALIFIED AGRICULTURAL PROPERTIES in

enter the Truth in Assessing Rollback Fraction calculated on

the local school district" such as the 18 mills in a district which

STC Form L-4034 as TOTAL TAXABLE VALUE BASED ON

does not levy a Supplemental (Hold Harmless) Millage.

ASSESSED VALUE FOR ALL CLASSES/TOTAL TAXABLE

VALUE BASED ON SEV FOR ALL CLASSES. The Section

Column 3: Date of Election. Enter the month and year of

211.34 Millage Rollback Fraction shall not exceed 1.0000.

the election for each millage authorized by direct voter

approval.

Column 9: Maximum Allowable Millage Levy. Multiply

column 7 (2007 Millage Rate Permanently Reduced by MCL

Column 4: Millage Authorized. List the allocated rate,

211.34d) by column 8 (Section 211.34 millage rollback frac-

charter aggregate rate, extra-voted authorized before 1979,

tion). Round the rate DOWN to 4 decimal places. (See STC

each separate rate authorized by voters after 1978, debt

Bulletin No. 11 of 1999.) For debt service or special assess-

service rate, etc. (This rate is the rate before any reductions.)

ments not subject to a millage reduction fraction, enter

millage from Column 4.

Column 5: 2006 Millage Rate Permanently Reduced by

MCL 211.34d ("Headlee") Rollback. Starting with taxes

Column 10/Column 11: Millage Requested to be Levied.

levied in 1994, the "Headlee" rollback permanently reduces

Enter the tax rate approved by the unit of local government

the maximum rate or rates authorized by law or charter. The

provided that the rate does not exceed the maximum allow-

2006 permanently reduced rate can be found in column 7 of

able millage levy (column 9). A millage rate that exceeds the

the 2006 Form L-4029. For operating millage approved by the

base tax rate (Truth in Taxation) cannot be requested unless

voters after April 30, 2006, enter the millage approved by the

the requirements of MCL 211.24e have been met. For further

voters. For debt service or special assessments not subject

information, see State Tax Commission Bulletin No. 1 of

to a millage reduction fraction, enter "NA" signifying "not

2007. A LOCAL School District which levies a Supplemental

applicable".

(Hold Harmless) Millage shall not levy a Supplemental Mill-

age in excess of that allowed by MCL 380.1211(3). Please

Column 6: Current Year Millage Reduction Fraction. List

see the memo to assessors dated October 26, 2004 regard-

the millage reduction fraction certified by the county treasurer

ing the change in the collection date of certain county taxes.

for the current year as calculated on 2007 Millage Reduction

Fraction Calculations Worksheet, Form L-4034. The millage

Column 12: Expiration Date of Millage. Enter the month

reduction fraction shall be rounded to four (4) decimal places.

and year on which the millage will expire.

The current year millage reduction fraction shall not exceed

1.0000 for 2007 and future years. This prevents any increase

1

1 2

2