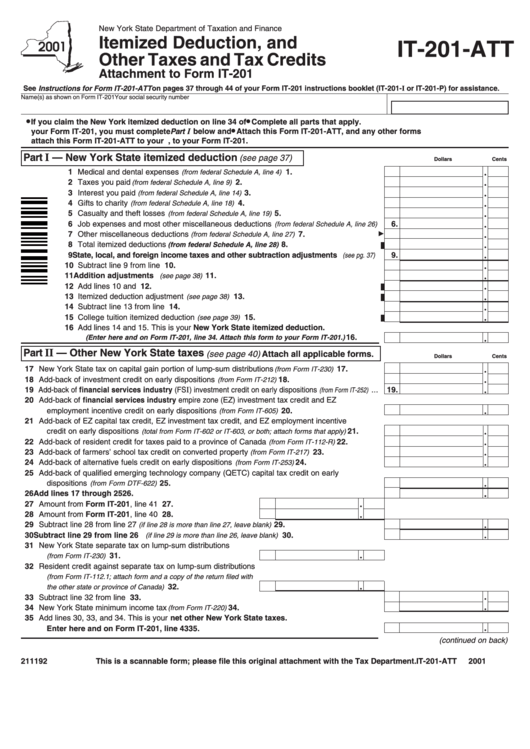

New York State Department of Taxation and Finance

Itemized Deduction, and

IT-201-ATT

Other Taxes and Tax Credits

Attachment to Form IT-201

See Instructions for Form IT-201-ATT on pages 37 through 44 of your Form IT-201 instructions booklet (IT-201-I or IT-201-P) for assistance.

Name(s) as shown on Form IT-201

Your social security number

•

•

If you claim the New York itemized deduction on line 34 of

Complete all parts that apply.

•

your Form IT-201, you must complete Part

I

below and

Attach this Form IT-201-ATT, and any other forms

attach this Form IT-201-ATT to your return.

that apply, to your Form IT-201.

Part I — New York State itemized deduction

(see page 37)

Dollars

Cents

1 Medical and dental expenses

..........................................

1.

(from federal Schedule A, line 4)

2 Taxes you paid

.................................................................

2.

(from federal Schedule A, line 9)

3 Interest you paid

.............................................................

3.

(from federal Schedule A, line 14)

4 Gifts to charity

................................................................

4.

(from federal Schedule A, line 18)

5 Casualty and theft losses

...............................................

5.

(from federal Schedule A, line 19)

6 Job expenses and most other miscellaneous deductions

6.

(from federal Schedule A, line 26)

7 Other miscellaneous deductions

....................................

7.

(from federal Schedule A, line 27)

8 Total itemized deductions

............................................

8.

(from federal Schedule A, line 28)

9 State, local, and foreign income taxes and other subtraction adjustments

9.

(see pg. 37)

10 Subtract line 9 from line 8 ................................................................................................

10.

11 Addition adjustments

(see page 38)

...............................................................................

11.

12 Add lines 10 and 11 .........................................................................................................

12.

13 Itemized deduction adjustment

..................................................................

13.

(see page 38)

14 Subtract line 13 from line 12 ............................................................................................

14.

15 College tuition itemized deduction

.............................................................

15.

(see page 39)

16 Add lines 14 and 15. This is your New York State itemized deduction.

..............

16.

(Enter here and on Form IT-201, line 34. Attach this form to your Form IT-201.)

Part II — Other New York State taxes

(see page 40) Attach all applicable forms.

Dollars

Cents

17 New York State tax on capital gain portion of lump-sum distributions

...................

17.

(from Form IT-230)

18 Add-back of investment credit on early dispositions

..............................................

18.

(from Form IT-212)

19 Add-back of financial services industry (FS

I

) investment credit on early dispositions

...

19.

(from Form IT-252)

20 Add-back of financial services industry empire zone (EZ) investment tax credit and EZ

employment incentive credit on early dispositions

.............................................

20.

(from Form IT-605)

21 Add-back of EZ capital tax credit, EZ investment tax credit, and EZ employment incentive

credit on early dispositions

..............

21.

(total from Form IT-602 or IT-603, or both; attach forms that apply)

22 Add-back of resident credit for taxes paid to a province of Canada

...................

22.

(from Form IT-112-R)

23 Add-back of farmers’ school tax credit on converted property

..............................

23.

(from Form IT-217)

24 Add-back of alternative fuels credit on early dispositions

......................................

24.

(from Form IT-253)

25 Add-back of qualified emerging technology company (QETC) capital tax credit on early

dispositions

25.

(from Form DTF-622) ..................................................................................................................

26 Add lines 17 through 25 ..................................................................................................................

26.

27 Amount from Form IT-201, line 41 ...........................................

27.

28 Amount from Form IT-201, line 40 ...........................................

28.

29 Subtract line 28 from line 27

................................................

29.

(if line 28 is more than line 27, leave blank)

30 Subtract line 29 from line 26

............................................

30.

(if line 29 is more than line 26, leave blank)

31 New York State separate tax on lump-sum distributions

..................................................................

31.

(from Form IT-230)

32 Resident credit against separate tax on lump-sum distributions

(from Form IT-112.1; attach form and a copy of the return filed with

.......................................

32.

the other state or province of Canada)

33 Subtract line 32 from line 31 ...............................................................................................................

33.

34 New York State minimum income tax

.....................................................................

34.

(from Form IT-220)

35 Add lines 30, 33, and 34. This is your net other New York State taxes.

Enter here and on Form IT-201, line 43 ......................................................................................

35.

(continued on back)

211192

This is a scannable form; please file this original attachment with the Tax Department.

IT-201-ATT

2001

1

1 2

2