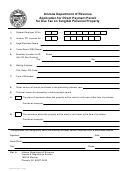

Form Dpp1 - Application For Direct Payment Permit Page 4

ADVERTISEMENT

Direct Payment Permit and Certificate

A Permit is issued after an application is approved. The Permit is mailed directly to the approved applicant.

All Permits are effective as of the first day of the month. Permits will be valid for a term of not greater than five

st

years and will expire on December 31

of the final calendar year of the term. Renewal permits are effective as of

the first day of the month following the expiration of the previous Permit, and are valid for the same period.

Taxpayers obtaining a renewal permit should forward a copy of the new permit to their Vendors as soon as it is

received.

The Form ST-14 combines the Direct Payment Permit and Certificate to Vendors. This form may be reproduced

or sent by electronic means to vendors. Note that Vendors must retain a copy of this certificate for inspection by

employees of the DOR.

Surrender, Forfeiture or Expiration of A Permit- Misuse of Permits

Taxpayers who forfeit or surrender a Permit, have a Permit revoked, or allow a Permit to expire without a renewal

are REQUIRED to notify EACH vendor immediately. A fine of $1,000.00 per vendor will be levied for the failure

of a Permit holder to notify the vendor that its Permit is no longer valid.

Tax Paid to a Vendor in Error

A Permit holder may find that although a permit was issued properly to a vendor, that vendor charged sales tax on

its invoice. In that case, the Permit holder should contact the Vendor, and request reimbursement. The vendor

may take the amount of the reimbursement as a credit on its next sales tax return. Both the purchaser and the

vendor should maintain records for a transaction of this type.

Change in Organization

DOR will assist taxpayers who wish to retain Direct Payment status, but who change their organization. As noted,

each Identification Number requires a separate Permit. Taxpayers who contact DOR in advance will likely be able

to effect a transition to a new Permit with a minimum of inconvenience to themselves and DOR. Taxpayers

should contact the Audit Support Unit for Assistance. See reverse cover.

Disclosure of Permit Holders by DOR

Form DPP1 includes a section which must be signed by the taxpayer to allow disclosure by DOR of the Permit

holder’s Direct Payment Permit status and effective dates to interested parties. You must complete this section of

the Application to be considered for a Direct Payment Permit.

Taxpayer Assistance

Please contact DOR with any questions regarding Direct Payment Permits. See reverse cover for telephone

numbers. You may also access the DOR website.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9