Form Dpp1 - Application For Direct Payment Permit Page 7

ADVERTISEMENT

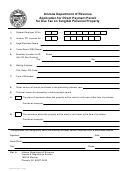

Massachusetts

Department of

Revenue

Form DPP-1-Instructions – Direct Payment Permit Application

General Information

How does a business obtain a

What is a Direct Payment Permit?

Direct Payment Permit?

A Direct Payment Permit Holder may issue a

Complete form DPP-1 and return it to the

certificate to a vendor of an item subject to

Audit Support Unit at the address on the

the Sales tax. This certificate relieves sale

form.

Include all supporting documents.

from taxation at the time of purchase. Permit

Provide an explanation if required. Be sure

holders remit sales tax on taxable purchases

to answer all questions, or indicate why a

directly

to

the

Commonwealth

of

question does not apply. You may submit

Massachusetts on Form ST-9 Monthly

samples to substantiate the response to any

Sales/Use Tax Return.

question.

IMPORTANT: Each business with a

separate

identification

number

must

Who is eligible to obtain a Direct

make

application

separately.

Each

Payment Permit?

business must meet all of the criteria

individually. Applicants may not aggregate

Any purchaser who operates a business and

related business entities to meet the criteria

who acquires tangible personal property

for issuance of a Direct Payment Permit.

subject

to

taxation

may

apply.

The

Commissioner

of

Revenue

has

the

Do all applicants have to be a

discretion to issue a permit and has

registered vendor?

established criteria which must be met

before a permit will be issued. Applicants:

YES. If a business is NOT a REGISTERED

•

VENDOR, it may register as a vendor at the

Are limited to businesses

•

same time as the Application for a Direct

Must be a registered vendor under

Payment Permit is submitted. Form TA-1

Massachusetts General Laws, Chapters

(or Form TA-2, in the case of a business

64H and 64I for the Permit to be issued

which is registered for taxes other than

•

File (or agree to file) monthly sales/use

sales/use) Application for Registration must

tax returns

be completed in detail. Be sure to indicate

•

Purchase in the range of $1,000,000 or

clearly

that

you

are

applying

for

a

more of tangible personal property

Registration as a sales/use tax vendor and a

and/or

taxable

services

subject

to

Direct Payment Permit at the same time.

Massachusetts sales tax per year

•

Exhibit an acceptable record of timely

NOTE:

All taxpayers holding a Direct

filing and payment of Massachusetts

Payment Permit must file all sales/use tax

taxes

returns monthly.

•

Use computerized accounting methods

which track all transactions in an

Call the DOR at 1-617-887-MDOR [6367]

accurate, understandable manner, and

for

questions

about

sales/use

tax

provide an audit trail

registration.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9