Form Nh-1120-We - Summary Of Combined Net Income Schedule

ADVERTISEMENT

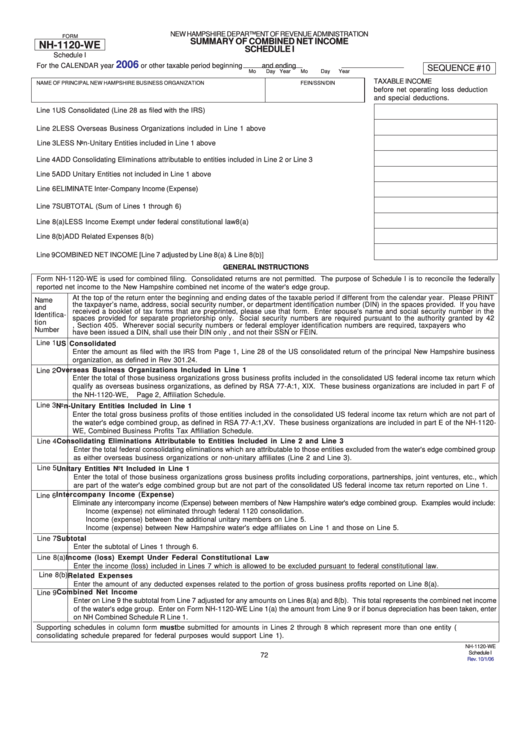

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

SUMMARY OF COMBINED NET INCOME

NH-1120-WE

SCHEDULE I

Schedule I

2006

For the CALENDAR year

or other taxable period beginning

and ending

SEQUENCE #10

Mo

Day

Year

Mo

Day

Year

TAXABLE INCOME

NAME OF PRINCIPAL NEW HAMPSHIRE BUSINESS ORGANIZATION

FEIN/SSN/DIN

before net operating loss deduction

and special deductions.

Line 1

US Consolidated (Line 28 as filed with the IRS) ...................................................................... 1

Line 2

LESS Overseas Business Organizations included in Line 1 above ....................................... 2

Line 3

LESS Non-Unitary Entities included in Line 1 above ................................................................ 3

Line 4

ADD Consolidating Eliminations attributable to entities included in Line 2 or Line 3 above ... 4

Line 5

ADD Unitary Entities not included in Line 1 above ................................................................... 5

Line 6

ELIMINATE Inter-Company Income (Expense) .......................................................................... 6

Line 7

SUBTOTAL (Sum of Lines 1 through 6) ................................................................................... 7

Line 8(a)

LESS Income Exempt under federal constitutional law ........................................................... 8(a)

Line 8(b)

ADD Related Expenses ............................................................................................................. 8(b)

Line 9

COMBINED NET INCOME [Line 7 adjusted by Line 8(a) & Line 8(b)] ....................................... 9

GENERAL INSTRUCTIONS

Form NH-1120-WE is used for combined filing. Consolidated returns are not permitted. The purpose of Schedule I is to reconcile the federally

reported net income to the New Hampshire combined net income of the water's edge group.

At the top of the return enter the beginning and ending dates of the taxable period if different from the calendar year. Please PRINT

Name

the taxpayer’s name, address, social security number, or department identification number (DIN) in the spaces provided. If you have

and

received a booklet of tax forms that are preprinted, please use that form. Enter spouse's name and social security number in the

Identifica-

spaces provided for separate proprietorship only. Social security numbers are required pursuant to the authority granted by 42

tion

U.S.C.S., Section 405. Wherever social security numbers or federal employer identification numbers are required, taxpayers who

Number

have been issued a DIN, shall use their DIN only , and not their SSN or FEIN.

Line 1

US Consolidated

Enter the amount as filed with the IRS from Page 1, Line 28 of the US consolidated return of the principal New Hampshire business

organization, as defined in Rev 301.24.

Overseas Business Organizations Included in Line 1

Line 2

Enter the total of those business organizations gross business profits included in the consolidated US federal income tax return which

qualify as overseas business organizations, as defined by RSA 77-A:1, XIX. These business organizations are included in part F of

the NH-1120-WE,

Page 2, Affiliation Schedule.

Line 3

Non-Unitary Entities Included in Line 1

Enter the total gross business profits of those entities included in the consolidated US federal income tax return which are not part of

the water's edge combined group, as defined in RSA 77-A:1,XV. These business organizations are included in part E of the NH-1120-

WE, Combined Business Profits Tax Affiliation Schedule.

Consolidating Eliminations Attributable to Entities Included in Line 2 and Line 3

Line 4

Enter the total federal consolidating eliminations which are attributable to those entities excluded from the water's edge combined group

as either overseas business organizations or non-unitary affiliates (Line 2 and Line 3).

Line 5

Unitary Entities Not Included in Line 1

Enter the total of those business organizations gross business profits including corporations, partnerships, joint ventures, etc., which

are part of the water's edge combined group but are not part of the consolidated US federal income tax return reported on Line 1.

Intercompany Income (Expense)

Line 6

Eliminate any intercompany income (Expense) between members of New Hampshire water's edge combined group. Examples would include:

Income (expense) not eliminated through federal 1120 consolidation.

Income (expense) between the additional unitary members on Line 5.

Income (expense) between New Hampshire water's edge affiliates on Line 1 and those on Line 5.

Line 7

Subtotal

Enter the subtotal of Lines 1 through 6.

Line 8(a)

Income (loss) Exempt Under Federal Constitutional Law

Enter the income (loss) included in Lines 7 which is allowed to be excluded pursuant to federal constitutional law.

Line 8(b)

Related Expenses

Enter the amount of any deducted expenses related to the portion of gross business profits reported on Line 8(a).

Combined Net Income

Line 9

Enter on Line 9 the subtotal from Line 7 adjusted for any amounts on Lines 8(a) and 8(b). This total represents the combined net income

of the water's edge group. Enter on Form NH-1120-WE Line 1(a) the amount from Line 9 or if bonus depreciation has been taken, enter

on NH Combined Schedule R Line 1.

Supporting schedules in column form must be submitted for amounts in Lines 2 through 8 which represent more than one entity (e.g. the US

consolidating schedule prepared for federal purposes would support Line 1).

NH-1120-WE

Schedule I

72

Rev. 10/1/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1