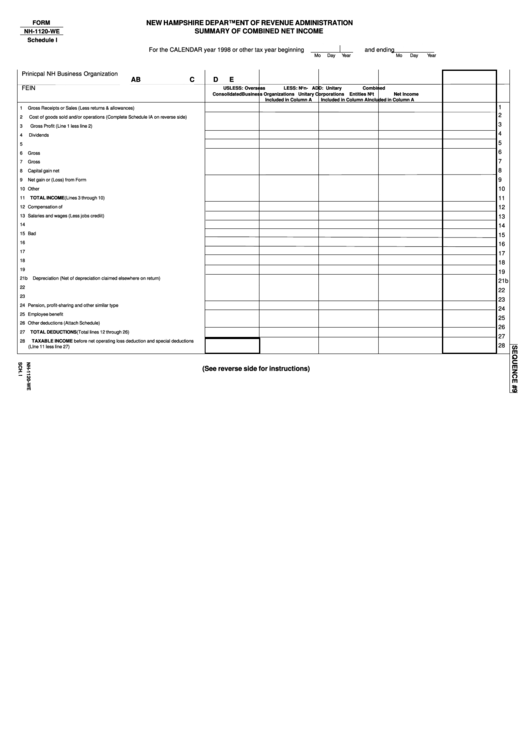

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

SUMMARY OF COMBINED NET INCOME

NH-1120-WE

Schedule I

For the CALENDAR year 1998 or other tax year beginning

and ending

Mo

Day

Year

Mo

Day

Year

Prinicpal NH Business Organization

A

B

C

D

E

FEIN

US

LESS: Overseas

LESS: Non-

ADD: Unitary

Combined

Consolidated

Business Organizations Unitary Corporations

Entities Not

Net Income

Included in Column A

Included in Column A

Included in Column A

1

1

Gross Receipts or Sales (Less returns & allowances)..................................................1

2

2

Cost of goods sold and/or operations (Complete Schedule IA on reverse side).........2

3

3

Gross Profit (Line 1 less line 2)...................................................................................3

4

4

Dividends......... .............................................................................................................4

5

5

Interest...........................................................................................................................5

6

6

Gross rents....................................................................................................................6

7

7

Gross royalties...............................................................................................................7

8

8

Capital gain net income................................................................................................8

9

9

Net gain or (Loss) from Form 4797..............................................................................9

10

10 Other income..............................................................................................................10

11

TOTAL INCOME (Lines 3 through 10)........................................................................11

11

12 Compensation of Officers...........................................................................................12

12

13

Salaries and wages (Less jobs crediit)......................................................................13

13

14 Repairs.......................................................................................................................14

14

15 Bad debts...................................................................................................................15

15

16 Rents..........................................................................................................................16

16

17 Taxes..........................................................................................................................17

17

18

Interest......................................................................................................................18

18

19

Contributions............................................................................................................19

19

21b

Depreciation (Net of depreciation claimed elsewhere on return)............................21b

21b

22 Depletion................................................................................................................... 22

22

23 Advertising.................................................................................................................23

23

24

Pension, profit-sharing and other similar type plans.................................................24

24

25 Employee benefit programs.......................................................................................25

25

26

Other deductions (Attach Schedule)..........................................................................26

26

27

TOTAL DEDUCTIONS (Total lines 12 through 26)....................................................27

27

28

TAXABLE INCOME before net operating loss deduction and special deductions

28

(LIne 11 less line 27)..................................................................................................28

(See reverse side for instructions)

1

1