Instructions For Form 720 - Quarterly Federal Excise Tax Return - 2007

ADVERTISEMENT

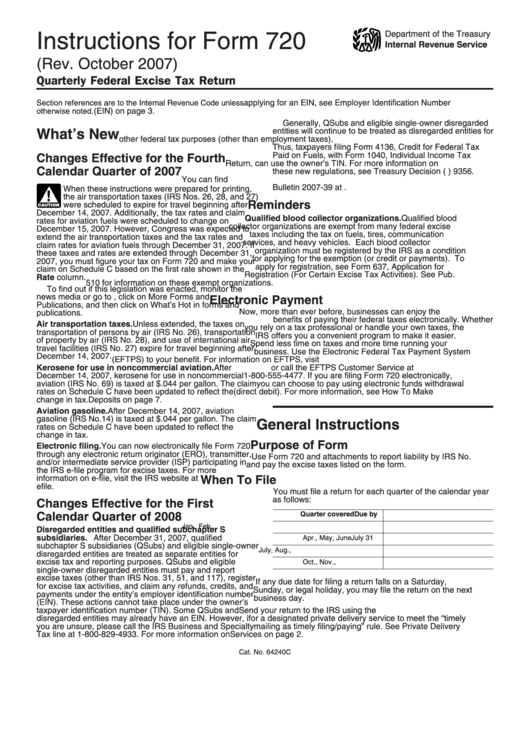

Department of the Treasury

Instructions for Form 720

Internal Revenue Service

(Rev. October 2007)

Quarterly Federal Excise Tax Return

Section references are to the Internal Revenue Code unless

applying for an EIN, see Employer Identification Number

otherwise noted.

(EIN) on page 3.

Generally, QSubs and eligible single-owner disregarded

entities will continue to be treated as disregarded entities for

What’s New

other federal tax purposes (other than employment taxes).

Thus, taxpayers filing Form 4136, Credit for Federal Tax

Paid on Fuels, with Form 1040, Individual Income Tax

Changes Effective for the Fourth

Return, can use the owner’s TIN. For more information on

Calendar Quarter of 2007

these new regulations, see Treasury Decision (T.D.) 9356.

You can find T.D. 9356 on page 675 of Internal Revenue

Bulletin 2007-39 at

When these instructions were prepared for printing,

!

the air transportation taxes (IRS Nos. 26, 28, and 27)

Reminders

were scheduled to expire for travel beginning after

CAUTION

December 14, 2007. Additionally, the tax rates and claim

Qualified blood collector organizations. Qualified blood

rates for aviation fuels were scheduled to change on

collector organizations are exempt from many federal excise

December 15, 2007. However, Congress was expected to

taxes including the tax on fuels, tires, communication

extend the air transportation taxes and the tax rates and

services, and heavy vehicles. Each blood collector

claim rates for aviation fuels through December 31, 2007. If

organization must be registered by the IRS as a condition

these taxes and rates are extended through December 31,

for applying for the exemption (or credit or payments). To

2007, you must figure your tax on Form 720 and make your

apply for registration, see Form 637, Application for

claim on Schedule C based on the first rate shown in the

Registration (For Certain Excise Tax Activities). See Pub.

Rate column.

510 for information on these exempt organizations.

To find out if this legislation was enacted, monitor the

news media or go to , click on More Forms and

Electronic Payment

Publications, and then click on What’s Hot in forms and

Now, more than ever before, businesses can enjoy the

publications.

benefits of paying their federal taxes electronically. Whether

Air transportation taxes. Unless extended, the taxes on

you rely on a tax professional or handle your own taxes, the

transportation of persons by air (IRS No. 26), transportation

IRS offers you a convenient program to make it easier.

of property by air (IRS No. 28), and use of international air

Spend less time on taxes and more time running your

travel facilities (IRS No. 27) expire for travel beginning after

business. Use the Electronic Federal Tax Payment System

December 14, 2007.

(EFTPS) to your benefit. For information on EFTPS, visit

Kerosene for use in noncommercial aviation. After

or call the EFTPS Customer Service at

December 14, 2007, kerosene for use in noncommercial

1-800-555-4477. If you are filing Form 720 electronically,

aviation (IRS No. 69) is taxed at $.044 per gallon. The claim

you can choose to pay using electronic funds withdrawal

rates on Schedule C have been updated to reflect the

(direct debit). For more information, see How To Make

change in tax.

Deposits on page 7.

Aviation gasoline. After December 14, 2007, aviation

gasoline (IRS No.14) is taxed at $.044 per gallon. The claim

General Instructions

rates on Schedule C have been updated to reflect the

change in tax.

Purpose of Form

Electronic filing. You can now electronically file Form 720

through any electronic return originator (ERO), transmitter,

Use Form 720 and attachments to report liability by IRS No.

and/or intermediate service provider (ISP) participating in

and pay the excise taxes listed on the form.

the IRS e-file program for excise taxes. For more

information on e-file, visit the IRS website at /

When To File

efile.

You must file a return for each quarter of the calendar year

as follows:

Changes Effective for the First

Quarter covered

Due by

Calendar Quarter of 2008

Jan., Feb., Mar.

April 30

Disregarded entities and qualified subchapter S

subsidiaries. After December 31, 2007, qualified

Apr., May, June

July 31

subchapter S subsidiaries (QSubs) and eligible single-owner

July, Aug., Sept.

October 31

disregarded entities are treated as separate entities for

excise tax and reporting purposes. QSubs and eligible

Oct., Nov., Dec.

January 31

single-owner disregarded entities must pay and report

excise taxes (other than IRS Nos. 31, 51, and 117), register

If any due date for filing a return falls on a Saturday,

for excise tax activities, and claim any refunds, credits, and

Sunday, or legal holiday, you may file the return on the next

payments under the entity’s employer identification number

business day.

(EIN). These actions cannot take place under the owner’s

taxpayer identification number (TIN). Some QSubs and

Send your return to the IRS using the U.S. Postal Service

disregarded entities may already have an EIN. However, if

or a designated private delivery service to meet the “timely

you are unsure, please call the IRS Business and Specialty

mailing as timely filing/paying” rule. See Private Delivery

Tax line at 1-800-829-4933. For more information on

Services on page 2.

Cat. No. 64240C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16