Instructions For Form 720 - Quarterly Federal Excise Tax Return - 2002

ADVERTISEMENT

Department of the Treasury

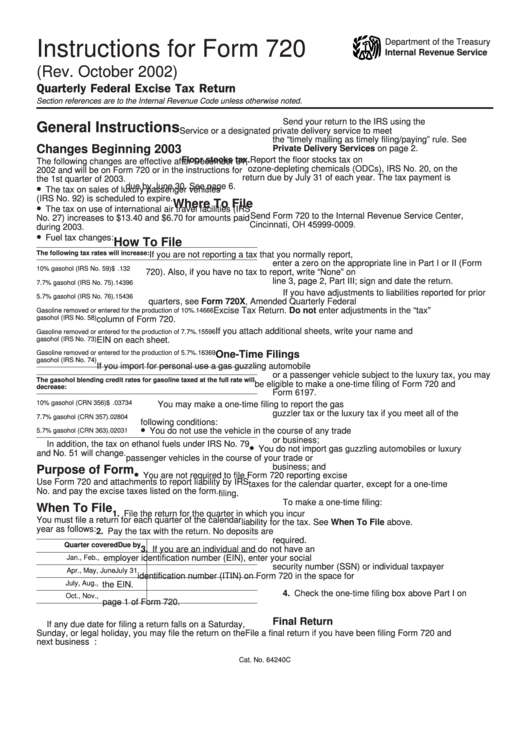

Instructions for Form 720

Internal Revenue Service

(Rev. October 2002)

Quarterly Federal Excise Tax Return

Section references are to the Internal Revenue Code unless otherwise noted.

Send your return to the IRS using the U.S. Postal

General Instructions

Service or a designated private delivery service to meet

the “timely mailing as timely filing/paying” rule. See

Changes Beginning 2003

Private Delivery Services on page 2.

Floor stocks tax. Report the floor stocks tax on

The following changes are effective after December 31,

ozone-depleting chemicals (ODCs), IRS No. 20, on the

2002 and will be on Form 720 or in the instructions for

return due by July 31 of each year. The tax payment is

the 1st quarter of 2003.

•

due by June 30. See page 6.

The tax on sales of luxury passenger vehicles

(IRS No. 92) is scheduled to expire.

Where To File

•

The tax on use of international air travel facilities (IRS

Send Form 720 to the Internal Revenue Service Center,

No. 27) increases to $13.40 and $6.70 for amounts paid

Cincinnati, OH 45999-0009.

during 2003.

•

Fuel tax changes:

How To File

The following tax rates will increase:

If you are not reporting a tax that you normally report,

enter a zero on the appropriate line in Part I or II (Form

10% gasohol (IRS No. 59) . . . . . . . . . . . . . . . . . . . . . . .

$

.132

720). Also, if you have no tax to report, write “None” on

line 3, page 2, Part III; sign and date the return.

7.7% gasohol (IRS No. 75) . . . . . . . . . . . . . . . . . . . . . . .

.14396

If you have adjustments to liabilities reported for prior

5.7% gasohol (IRS No. 76) . . . . . . . . . . . . . . . . . . . . . . .

.15436

quarters, see Form 720X, Amended Quarterly Federal

Excise Tax Return. Do not enter adjustments in the “tax”

Gasoline removed or entered for the production of 10%

.14666

gasohol (IRS No. 58) . . . . . . . . . . . . . . . . . . . . . . . . . . .

column of Form 720.

If you attach additional sheets, write your name and

Gasoline removed or entered for the production of 7.7%

.15596

gasohol (IRS No. 73) . . . . . . . . . . . . . . . . . . . . . . . . . . .

EIN on each sheet.

Gasoline removed or entered for the production of 5.7%

.16369

One-Time Filings

gasohol (IRS No. 74) . . . . . . . . . . . . . . . . . . . . . . . . . . .

If you import for personal use a gas guzzling automobile

or a passenger vehicle subject to the luxury tax, you may

The gasohol blending credit rates for gasoline taxed at the full rate will

be eligible to make a one-time filing of Form 720 and

decrease:

Form 6197.

10% gasohol (CRN 356) . . . . . . . . . . . . . . . . . . . . . . . . . .

$.03734

You may make a one-time filing to report the gas

guzzler tax or the luxury tax if you meet all of the

7.7% gasohol (CRN 357) . . . . . . . . . . . . . . . . . . . . . . . . .

.02804

following conditions:

•

You do not use the vehicle in the course of any trade

5.7% gasohol (CRN 363) . . . . . . . . . . . . . . . . . . . . . . . . .

.02031

or business;

In addition, the tax on ethanol fuels under IRS No. 79

•

You do not import gas guzzling automobiles or luxury

and No. 51 will change.

passenger vehicles in the course of your trade or

business; and

Purpose of Form

•

You are not required to file Form 720 reporting excise

Use Form 720 and attachments to report liability by IRS

taxes for the calendar quarter, except for a one-time

No. and pay the excise taxes listed on the form.

filing.

To make a one-time filing:

When To File

1. File the return for the quarter in which you incur

You must file a return for each quarter of the calendar

liability for the tax. See When To File above.

year as follows:

2. Pay the tax with the return. No deposits are

required.

Quarter covered

Due by

3. If you are an individual and do not have an

employer identification number (EIN), enter your social

Jan., Feb., Mar.

April 30

security number (SSN) or individual taxpayer

Apr., May, June

July 31

identification number (ITIN) on Form 720 in the space for

July, Aug., Sept.

October 31

the EIN.

4. Check the one-time filing box above Part I on

Oct., Nov., Dec.

January 31

page 1 of Form 720.

Final Return

If any due date for filing a return falls on a Saturday,

Sunday, or legal holiday, you may file the return on the

File a final return if you have been filing Form 720 and

next business day.

you:

Cat. No. 64240C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12