Instructions For Form 720 - Quarterly Federal Excise Tax Return - 2006

ADVERTISEMENT

Department of the Treasury

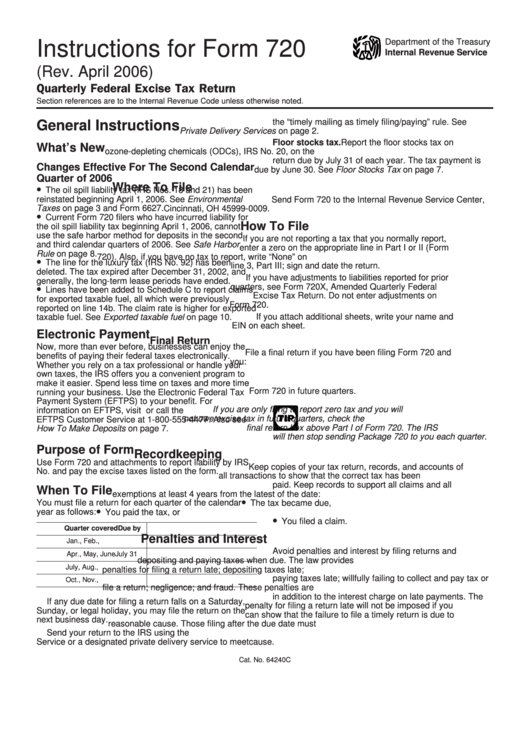

Instructions for Form 720

Internal Revenue Service

(Rev. April 2006)

Quarterly Federal Excise Tax Return

Section references are to the Internal Revenue Code unless otherwise noted.

the “timely mailing as timely filing/paying” rule. See

General Instructions

Private Delivery Services on page 2.

Floor stocks tax. Report the floor stocks tax on

What’s New

ozone-depleting chemicals (ODCs), IRS No. 20, on the

return due by July 31 of each year. The tax payment is

Changes Effective For The Second Calendar

due by June 30. See Floor Stocks Tax on page 7.

Quarter of 2006

•

Where To File

The oil spill liability tax (IRS Nos. 18 and 21) has been

reinstated beginning April 1, 2006. See Environmental

Send Form 720 to the Internal Revenue Service Center,

Taxes on page 3 and Form 6627.

Cincinnati, OH 45999-0009.

•

Current Form 720 filers who have incurred liability for

How To File

the oil spill liability tax beginning April 1, 2006, cannot

use the safe harbor method for deposits in the second

If you are not reporting a tax that you normally report,

and third calendar quarters of 2006. See Safe Harbor

enter a zero on the appropriate line in Part I or II (Form

Rule on page 8.

720). Also, if you have no tax to report, write “None” on

•

The line for the luxury tax (IRS No. 92) has been

line 3, Part III; sign and date the return.

deleted. The tax expired after December 31, 2002, and

If you have adjustments to liabilities reported for prior

generally, the long-term lease periods have ended.

•

quarters, see Form 720X, Amended Quarterly Federal

Lines have been added to Schedule C to report claims

Excise Tax Return. Do not enter adjustments on

for exported taxable fuel, all which were previously

Form 720.

reported on line 14b. The claim rate is higher for exported

If you attach additional sheets, write your name and

taxable fuel. See Exported taxable fuel on page 10.

EIN on each sheet.

Electronic Payment

Final Return

Now, more than ever before, businesses can enjoy the

File a final return if you have been filing Form 720 and

benefits of paying their federal taxes electronically.

you:

Whether you rely on a tax professional or handle your

1. Go out of business or

own taxes, the IRS offers you a convenient program to

2. Will not owe excise taxes that are reportable on

make it easier. Spend less time on taxes and more time

Form 720 in future quarters.

running your business. Use the Electronic Federal Tax

Payment System (EFTPS) to your benefit. For

If you are only filing to report zero tax and you will

information on EFTPS, visit or call the

TIP

not owe excise tax in future quarters, check the

EFTPS Customer Service at 1-800-555-4477. Also see

final return box above Part I of Form 720. The IRS

How To Make Deposits on page 7.

will then stop sending Package 720 to you each quarter.

Purpose of Form

Recordkeeping

Use Form 720 and attachments to report liability by IRS

Keep copies of your tax return, records, and accounts of

No. and pay the excise taxes listed on the form.

all transactions to show that the correct tax has been

paid. Keep records to support all claims and all

When To File

exemptions at least 4 years from the latest of the date:

•

You must file a return for each quarter of the calendar

The tax became due,

•

year as follows:

You paid the tax, or

•

You filed a claim.

Quarter covered

Due by

Penalties and Interest

Jan., Feb., Mar.

April 30

Avoid penalties and interest by filing returns and

Apr., May, June

July 31

depositing and paying taxes when due. The law provides

July, Aug., Sept.

October 31

penalties for filing a return late; depositing taxes late;

paying taxes late; willfully failing to collect and pay tax or

Oct., Nov., Dec.

January 31

file a return; negligence; and fraud. These penalties are

in addition to the interest charge on late payments. The

If any due date for filing a return falls on a Saturday,

penalty for filing a return late will not be imposed if you

Sunday, or legal holiday, you may file the return on the

can show that the failure to file a timely return is due to

next business day.

reasonable cause. Those filing after the due date must

Send your return to the IRS using the U.S. Postal

attach an explanation to the return to show reasonable

Service or a designated private delivery service to meet

cause.

Cat. No. 64240C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16