Instructions For Form 720 - Quarterly Federal Excise Tax Return - 2006

ADVERTISEMENT

Department of the Treasury

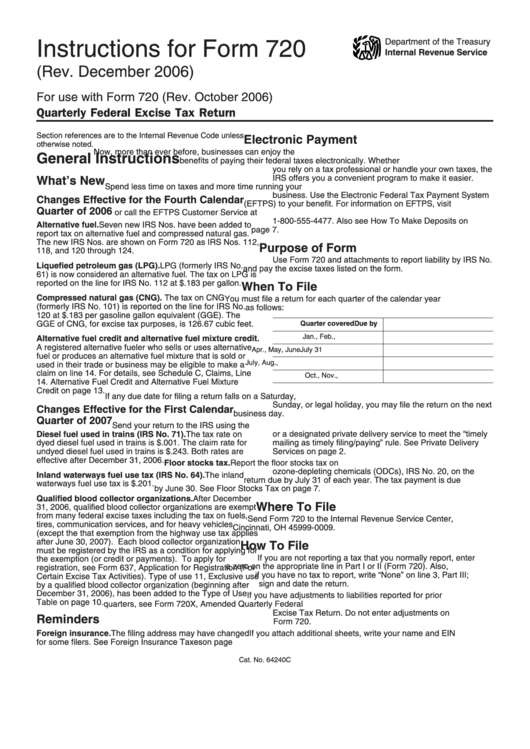

Instructions for Form 720

Internal Revenue Service

(Rev. December 2006)

For use with Form 720 (Rev. October 2006)

Quarterly Federal Excise Tax Return

Section references are to the Internal Revenue Code unless

Electronic Payment

otherwise noted.

Now, more than ever before, businesses can enjoy the

General Instructions

benefits of paying their federal taxes electronically. Whether

you rely on a tax professional or handle your own taxes, the

IRS offers you a convenient program to make it easier.

What’s New

Spend less time on taxes and more time running your

business. Use the Electronic Federal Tax Payment System

Changes Effective for the Fourth Calendar

(EFTPS) to your benefit. For information on EFTPS, visit

Quarter of 2006

or call the EFTPS Customer Service at

1-800-555-4477. Also see How To Make Deposits on

Alternative fuel. Seven new IRS Nos. have been added to

page 7.

report tax on alternative fuel and compressed natural gas.

The new IRS Nos. are shown on Form 720 as IRS Nos. 112,

Purpose of Form

118, and 120 through 124.

Use Form 720 and attachments to report liability by IRS No.

Liquefied petroleum gas (LPG). LPG (formerly IRS No.

and pay the excise taxes listed on the form.

61) is now considered an alternative fuel. The tax on LPG is

reported on the line for IRS No. 112 at $.183 per gallon.

When To File

Compressed natural gas (CNG). The tax on CNG

You must file a return for each quarter of the calendar year

(formerly IRS No. 101) is reported on the line for IRS No.

as follows:

120 at $.183 per gasoline gallon equivalent (GGE). The

GGE of CNG, for excise tax purposes, is 126.67 cubic feet.

Quarter covered

Due by

Jan., Feb., Mar.

April 30

Alternative fuel credit and alternative fuel mixture credit.

A registered alternative fueler who sells or uses alternative

Apr., May, June

July 31

fuel or produces an alternative fuel mixture that is sold or

July, Aug., Sept.

October 31

used in their trade or business may be eligible to make a

claim on line 14. For details, see Schedule C, Claims, Line

Oct., Nov., Dec.

January 31

14. Alternative Fuel Credit and Alternative Fuel Mixture

Credit on page 13.

If any due date for filing a return falls on a Saturday,

Sunday, or legal holiday, you may file the return on the next

Changes Effective for the First Calendar

business day.

Quarter of 2007

Send your return to the IRS using the U.S. Postal Service

Diesel fuel used in trains (IRS No. 71). The tax rate on

or a designated private delivery service to meet the “timely

dyed diesel fuel used in trains is $.001. The claim rate for

mailing as timely filing/paying” rule. See Private Delivery

undyed diesel fuel used in trains is $.243. Both rates are

Services on page 2.

effective after December 31, 2006.

Floor stocks tax. Report the floor stocks tax on

ozone-depleting chemicals (ODCs), IRS No. 20, on the

Inland waterways fuel use tax (IRS No. 64). The inland

return due by July 31 of each year. The tax payment is due

waterways fuel use tax is $.201.

by June 30. See Floor Stocks Tax on page 7.

Qualified blood collector organizations. After December

Where To File

31, 2006, qualified blood collector organizations are exempt

from many federal excise taxes including the tax on fuels,

Send Form 720 to the Internal Revenue Service Center,

tires, communication services, and for heavy vehicles

Cincinnati, OH 45999-0009.

(except the that exemption from the highway use tax applies

after June 30, 2007). Each blood collector organization

How To File

must be registered by the IRS as a condition for applying for

If you are not reporting a tax that you normally report, enter

the exemption (or credit or payments). To apply for

a zero on the appropriate line in Part I or II (Form 720). Also,

registration, see Form 637, Application for Registration (For

if you have no tax to report, write “None” on line 3, Part III;

Certain Excise Tax Activities). Type of use 11, Exclusive use

sign and date the return.

by a qualified blood collector organization (beginning after

December 31, 2006), has been added to the Type of Use

If you have adjustments to liabilities reported for prior

Table on page 10.

quarters, see Form 720X, Amended Quarterly Federal

Excise Tax Return. Do not enter adjustments on

Reminders

Form 720.

Foreign insurance. The filing address may have changed

If you attach additional sheets, write your name and EIN

for some filers. See Foreign Insurance Taxes on page 6.

on each sheet.

Cat. No. 64240C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16