Form K-706 - Kansas Estate Tax Return - Kansas Deparetment Of Revenue - Kansas Page 3

ADVERTISEMENT

Estate of:

______________________________________________________________________________________

K-706 (Rev. 1/07)

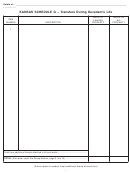

KANSAS SCHEDULE A – Real Estate

• Jointly owned property should be reported on Schedule E.

• Real estate that is part of a sole proprietorship should be reported on Schedule F.

• Real estate that is included in the gross estate as property transferred in contemplation of death, as property transferred with

a retained life estate, or as part of a revocable transfer should be reported on Schedule G.

• Real estate that is included in the gross estate as property in respect to which the decedent had a general power of

appointment should be reported on Schedule H.

VALUE OF

VALUE OF

ITEM

KANSAS

ALL

NUMBER

DESCRIPTION

PROPERTY

PROPERTY

1

Total from additional sheets attached to this schedule ......................................

TOTAL (Also enter under the Recapitulation, page 2, line 10) ..........................

(If more space is needed, insert additional sheets of same size)

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17