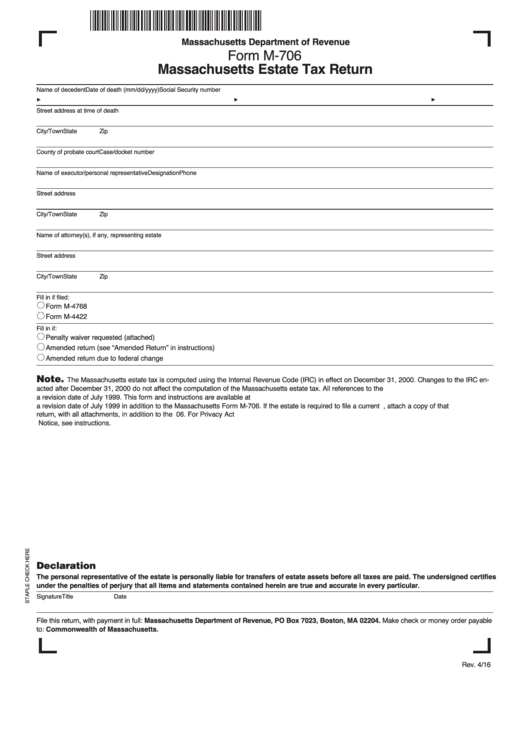

Form M-706 - Massachusetts Estate Tax Return - 2016

ADVERTISEMENT

Massachusetts Department of Revenue

Form M-706

Massachusetts Estate Tax Return

Name of decedent

Date of death (mm/dd/yyyy)

Social Security number

3

3

3

Street address at time of death

City/Town

State

Zip

County of probate court

Case/docket number

Name of executor/personal representative

Designation

Phone

Street address

City/Town

State

Zip

Name of attorney(s), if any, representing estate

Street address

City/Town

State

Zip

Fill in if filed:

Form M-4768

Form M-4422

Fill in if:

Penalty waiver requested (attached)

Amended return (see “Amended Return” in instructions)

Amended return due to federal change

Note.

The Massachusetts estate tax is computed using the Internal Revenue Code (IRC) in effect on December 31, 2000. Changes to the IRC en-

acted after December 31, 2000 do not affect the computation of the Massachusetts estate tax. All references to the U.S. Form 706 are to the form with

a revision date of July 1999. This form and instructions are available at mass.gov/dor. All estates are required to submit a completed U.S. Form 706 with

a revision date of July 1999 in addition to the Massachusetts Form M-706. If the estate is required to file a current U.S. Form 706, attach a copy of that

return, with all attachments, in addition to the U.S. Form 706 with a revision date of July 1999 and the Massachusetts Form M-706. For Privacy Act

Notice, see instructions.

Declaration

The personal representative of the estate is personally liable for transfers of estate assets before all taxes are paid. The undersigned certifies

under the penalties of perjury that all items and statements contained herein are true and accurate in every particular.

Signature

Title

Date

File this return, with payment in full: Massachusetts Department of Revenue, PO Box 7023, Boston, MA 02204. Make check or money order payable

to: Commonwealth of Massachusetts.

Rev. 4/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5