Form Nc-478c - 2001 Tax Credit Research And Development

ADVERTISEMENT

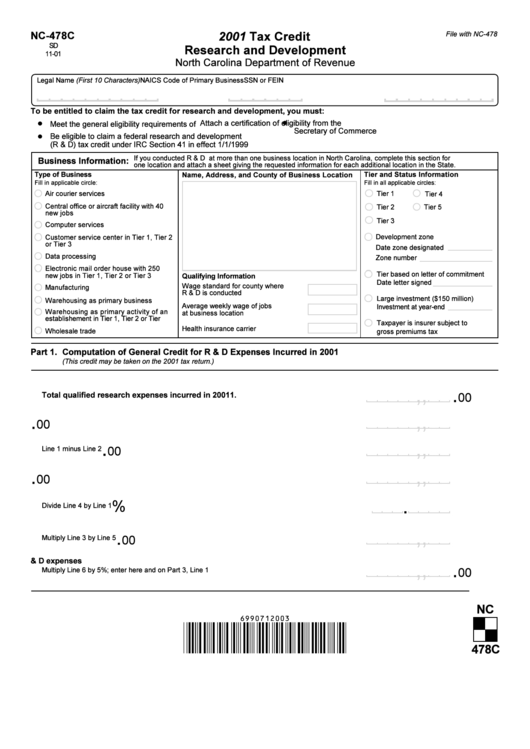

NC-478C

2001 Tax Credit

File with NC-478

Research and Development

North Carolina Department of Revenue

(First 10 Characters)

To be entitled to claim the tax credit for research and development, you must:

Attach a certification of eligibility from the N.C.

Meet the general eligibility requirements of G.S. 105-129.4

Secretary of Commerce

Be eligible to claim a federal research and development

(R & D) tax credit under IRC Section 41 in effect 1/1/1999

Business Information:

Type of Business

Tier and Status Information

Name, Address, and County of Business Location

Fill in applicable circle:

Fill in all applicable circles:

Qualifying Information

Part 1.

Computation of General Credit for R & D Expenses Incurred in 2001

(This credit may be taken on the 2001 tax return.)

,

,

.

1.

Total qualified research expenses incurred in 2001

00

,

,

.

2. Base amount of qualified research expenses

00

3. Excess qualified research expenses

,

,

.

00

,

,

.

4. Qualified research expenses in N.C.

00

5. Research expenses apportionment percentage

.

%

6. Excess research expenses apportioned to N.C.

,

,

.

00

7. General credit for 2001 R & D expenses

,

,

.

00

NC

478C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2