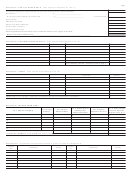

Form D-30 - Unincorporated Business Franchise Tax Return - 2001 Page 2

ADVERTISEMENT

*010300520000*

TAXPAYER NAME :

FEDERAL EMPLOYER I.D. NUMBER/SSN :

*010300520000*

ENTER DOLLAR AMOUNTS ONLY

$

23.

NET INCOME (Line 10 minus Line 22) .............................................. Fill in if minus

mmm

,

,

,

$

,

,

,

24.

NET OPERATING LOSS DEDUCTION .............................................................................

$

25.

NET INCOME AFTER NOL DEDUCTION (Line 23 minus Line 24) ....................................

,

,

,

26.

(a) NON-BUSINESS INCOME (Attach statement) .............................................................

$

,

,

,

(b) MINUS: RELATED EXPENSE (Attach statement) ........................................................

$

,

,

,

(c) SUBTRACT 26(b) FROM 26(a)

$

,

,

,

(see instructions) .................................................................... Fill in if minus

mmm

27.

NET INCOME FROM TRADE OR BUSINESS SUBJECT TO

$

,

,

,

APPORTIONMENT (Line 25 minus 26(c)) .............................................................

28.

D.C. APPORTIONMENT FACTOR (from Line 5, Schedule F) ........................................................................

29.

NET INCOME FROM TRADE OR BUSINESS APPORTIONED TO THE

$

,

,

,

DISTRICT (Multiply Line 27 by Line 28) .................................................................

30.

ADD PORTION OF LINE 26(c) ATTRIBUTABLE TO D.C. (Attach statement) .....................

$

,

,

,

.................................

Fill in if minus

31.

TOTAL DISTRICT NET INCOME (OR LOSS)

$

,

,

,

(line 29 plus line 30)

32.

MINUS: SALARY FOR TAXPAYER(S) SERVICES (from Schedule J,

$

,

,

,

Column 4) ...............................................................................................................

33.

EXEMPTION (if part year return, enter number of days in

$

,

,

,

___________

D.C. -

) .........................................................................................

34.

TOTAL TAXABLE INCOME (before Apportioned NOL Deduction) ....................................

$

,

,

,

(Line 31 minus Lines 32 and 33)

$

,

,

,

35.

APPORTIONED NOL DEDUCTION ...................................................................................

$

,

,

,

36.

TOTAL TAXABLE INCOME (Line 34 minus Line 35) ...........................................................

$

37.

TAX (9.975% of Line 36). If tax due is less than $100, enter $100 ...................................

,

,

,

38.

MINUS: (a) TAX PAID, IF ANY, WITH REQUEST FOR EXTENSION OF

$

,

,

,

TIME TO FILE .................................................................................................

(b) 2001 ESTIMATED TAX PAYMENTS .............................................................

$

,

,

,

(c) ECONOMIC DEVELOPMENT ZONE INCENTIVES CREDIT

$

,

,

,

(from worksheet) .......................................................................................

39.

TOTAL OF LINES 38(a), (b), and (c) ..................................................................................

$

,

,

,

40.

BALANCE DUE (Line 37 minus Line 39) ...........................................................................

$

,

,

,

41.

PENALTY $_________________ INTEREST $_________________

$

,

,

,

TOTAL PENALTY AND INTEREST .............

42.

TOTAL UNPAID BALANCE, PLUS PENALTY AND INTEREST.

$

,

,

,

(Add Lines 40 and 41) .............................................................................................

43.

OVERPAYMENT (Line 39 minus Line 37) .........................................................................

$

,

,

,

44.

(a) CREDIT TO 2002 ESTIMATED TAX ............................................................................

$

,

,

,

(b) AMOUNT TO BE REFUNDED - Line 43 minus Line 44a .............................................

$

,

,

,

Under penalties of law, including criminal penalties for false statements and tax preparer penalties under D.C. Code secs. 22-2514 and 47-161, et seq., I declare that I have examined this return

PLEASE

and, to the best of my knowledge, it is correct. If prepared by a person other than the taxpayer, this declaration is based on all information available to the preparer.

Telephone Number of Person to Contact

SIGN

HERE

-

-

TAXPAYER S SIGNATURE

DATE

PAID

PREPARER S SIGNATURE (If other than taxpayer)

DATE

FIRM NAME

FIRM ADDRESS

PREPARER

Preparer s Federal Employer I.D. Number

Preparer s SSN or PTIN

ONLY

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5