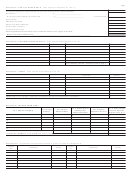

Form D-30 - Unincorporated Business Franchise Tax Return - 2001 Page 3

ADVERTISEMENT

Page 3

Schedule A - COST OF GOODS SOLD (See specific instructions for Line 2.)

1 Inventory at beginning of year (if different from last year's closing inventory, attach explanation)

2 Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $_________________________________

Minus cost of items withdrawn for personal use . . . . . . . . . . . . . . . $_________________________________

Enter result here

3 Cost of Labor

4 Material and supplies

5 Other costs (attach statement)

6 Total of lines 1 through 5

7 Inventory at end of year

8 Cost of goods sold (Line 6 minus Line 7). Enter here and on Line 2, page 1 of this form

Method of inventory valuation used____________________________________________________________________

Schedule B - CONTRIBUTIONS OR GIFTS (See specific instructions for Line 18.)

$

$

TOTAL (Subject to 15% limit – enter also on Line 18, page 1)

$

Schedule C - TAXES (See specific instructions for Line 16.)

Type of Tax

Amount

Type of Tax

Amount

$

$

TOTAL (Enter on Line 16, page 1 of this form, that portion of the total not included below in Schedule D)

$

Schedule D - INCOME FROM RENT

Col. 4 Depreciation or

Col. 6 Taxes, Interest

Col. 3 Gross

Col. 2 Kind of

Col. 5 Repairs

Col. 1 Address of Property

Depletion (Per

and other Expenses

Amount of Rent

Property

(Explain in Sch. D-1)

Federal Form 4562)

(Explain in Sch. D-1)

1.

$

$

$

$

2.

3.

4.

5.

6.

7.

$

$

$

TOTAL (Enter the total of Col. 3 on Line 6, page 1 )

$

8. TOTAL OF COLUMNS 4, 5, and 6 (Enter also on Line 14, page 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Schedule D-1 - Explanation of deductions claimed in Columns 5 and 6 of Schedule D

Column

Column

Explanation

Amount

Explanation

Amount

No.

No.

$

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5