Form D-30 - Unincorporated Business Franchise Tax Return - 2001 Page 4

ADVERTISEMENT

Page 4

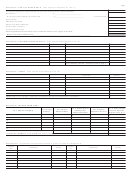

Schedule E - INTEREST EXPENSE (See specific instructions for Line 17.)

Name and Address of Payee

Amount

Name and Address of Payee

Amount

$

$

TOTAL (Enter on Line 17, page 1, that portion of the total not included in Schedule D.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Schedule F - D.C. APPORTIONMENT FACTOR (See Specific Instructions – Carry all factors to six decimal places)

Col. 3

Col. 1

Col. 2

FACTOR

TOTAL

IN D.C.

(Column 2 divided by

Column 1)

1. PROPERTY FACTOR: Average value of real estate and tangible

personal property owned by or rented to the unincorporated busi-

ness and used by that business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $___________________________

$__________________________

___________________

2. PAYROLL FACTOR: Total compensation paid or accrued by

the unincorporated business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $___________________________

$__________________________

___________________

3. SALES FACTOR: All gross receipts of the unincorporated busi-

ness, other than receipts from items of non-business income . . . .

$___________________________

$__________________________

4. SUM OF FACTORS: (Add Column 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. D.C. APPORTIONMENT FACTOR - Divide Line 4 by the number 3, or 3 reduced by the number of factors without a denominator. . . . . . . . . . . .

Schedule H - INCOME NOT REPORTED (Claimed as Nontaxable)

Schedule G

- OTHER ALLOWABLE DEDUCTIONS (See specific instructions for Line 21)

(See Instructions on page 7)

Nature of Deduction

Amount

Amount

Nature of Income

$

$

TOTAL (Enter also on Line 21, page 1). . . . . . . . . . . . . . . . . . .

TOTAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

Schedule I - BALANCE SHEET (See page 7 of Instructions)

BEGINNING OF TAX YEAR

END OF TAX YEAR

TOTAL

AMOUNT

AMOUNT

TOTAL

1.

Cash

2.

Trade notes and accounts receivable

(a) MINUS: Allowance for bad debts

3.

Inventories

4.

Gov't obligations: (a) U.S. and its instrumentalities

(b) States, subdivisions thereof, etc

5.

Other current assets (attach statement)

6.

Mortgage and real estate loans

7.

Other investments

8.

Buildings and other fixed depreciable assets

(a) MINUS: Accumulated depreciation

9.

Depletable assets

(a) MINUS: Accumulated depletion

10. Land (net of any amortization)

11. Intangible assets (amortizable only)

(a) MINUS: Accumulated amortization

12. Other assets (attach statement)

13. TOTAL ASSETS

14. Accounts payable

15. Mortgages, notes, bonds payable in less than 1 year

16. Other current liabilities (attach statement)

17. Mortgages, notes, bonds payable in 1 year or more

18. Other liabilities (attach statement)

19. Capital

20. TOTAL LIABILITIES AND CAPITAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5