Form D-30 - Unincorporated Business Franchise Tax Return - 2001 Page 5

ADVERTISEMENT

Page 5

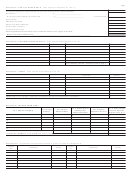

Schedule J - DISTRIBUTION AND RECONCILIATION OF NET INCOME (OR LOSS)

Col. 2

Col. 8

Col. 7

Col. 1

Percentage

Col. 3

Total Income (or

Net Income

Col. 5

Col. 6

of Time

Percent-

Col. 4

Loss) Not Taxable to

(or Loss)

Exemption

Net Loss

Salary Claimed

Devoted

age of

the Unincorporated

Social Security

from

Claimed

D.C. Sources

Name and Address of Owner(s)

to this

Ownership

Business

Number

Outside D.C.

Business

(Add Cols. 4 thru 7)

$

$

$

$

$

%

%

$

TOTAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

$

$

Col. 4 - See page 7 of Instructions

Enter total taxable income as shown on Line 34 of return

Col. 5 - See page 7 of Instructions

Col. 6 - Amount from Line 31 of return

Net income of Unincorporated Business from both within and outside

Col. 7 - Enter the difference between Line 23 and Line 31 of return

the District (from Line 23 of return) . . . . . . . . . . . . . . . . . . . . . . . . .

$

SUPPLEMENTAL INFORMATION (See page 7 of instructions)

2. PRINCIPAL BUSINESS ACTIVITY

3. DATE BUSINESS BEGAN

1. During 2001, has the Internal Revenue Service made or

proposed any adjustments in your federal income tax re-

turns, or did you file any amended returns with the Internal

4. IF BUSINESS HAS TERMINATED, STATE REASON

5. TERMINATION DATE

Yes

No

Revenue Service?

. If "Yes", submit sepa-

rately an amended D-30 and a detailed statement to the

6. TYPE OF OWNERSHIP (sole proprietor, partnership, etc.)

Office of Tax and Revenue, P.O.Box 610, Washington,

D.C. 20044-0610.

7. Place where federal income tax return for period covered by this return was filed:

8. Name(s) under which federal return for period covered by this return was filed:

9. Have you filed annual Federal Information Returns, (forms

Yes No

If no, please state reason:

1096 and 1099) pertaining to compensation payments for 2001?

10. Is this return reported on the accrual basis?

Yes

No

If no, check method used:

Cash basis

Other (specify)

11. Did you withhold D.C. income tax from the wages

Yes

No

If no, state reason:

of your employees during 2001?

12. Did you file a franchise tax return for the business

Yes

No

If no, state reason:

with the District of Columbia for the year 2000?

If yes, enter name under which return was filed:

13. Does this return include income from more than one business

Yes

No

conducted by the taxpayer?

(If yes, list businesses and net income (loss) of each)

14. Is the income from any other business or business interest

Yes No

owned by the proprietors of this business being reported

in a separate return?

(If yes, list names and addresses of these businesses)

15. Is this business an adjunct of a corporation, or affiliated with

Yes No

any corporation?

(If yes, explain affiliation to stockholders and proprietors)

16. Did you file a 2001 D.C. Arena Fee Return?

Yes No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5