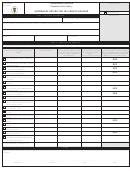

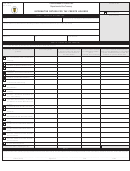

Form 480.70(Oe) - Informative Return For Income Tax Exempt Organizations July 2008 Page 5

ADVERTISEMENT

Informative Return for

Income Tax Exempt Organizations

Form 480.70(OE)

INSTRUCTIONS

Rev. 07.08

WHO MUST FILE THIS RETURN?

PART I

In general terms, every income tax exempt organization under Section 1101 of the Puerto

Provide all the information requested in the questionnaire in order to process your return.

Rico Internal Revenue Code of 1994, as amended (Code), must file the Informative

If it is necessary include schedules (for example: evidence of the exemption under the

Return for Income Tax Exempt Organizations (Form 480.70(OE)). Notwithstanding, this

Federal Internal Revenue Code) to support the information provided.

form shall not be filed if the income tax exempt organization under the provisions of Section

PART II AND III

1101 is:

a religious organization exempt under Section 1101(4); or

In all cases where the amount on line 1 or 2, Part II includes money or property of $3,000

(1)

or more, and lines 3 through 8, Part II include money or property of $1,000 or more,

an organization exempt under Section 1101(11), if such organization is a corporation

(2)

received directly or indirectly from one person, in one or more transactions during the year,

wholly owned by the Commonwealth of Puerto Rico or any agency or instrumentality

there shall be included detailed schedules indicating the amount received and the name

thereof, or a wholly owned subsidiary of such corporation.

and address of each one of those persons. The term "person" includes individuals,

fiduciaries, partnerships, corporations, associations and other organizations. The amounts

In the case of failure to file the return within the date prescribed (considering any extension

received by a central organization from organizations included in a group return do not

of time granted) there shall be paid, upon notice and demand from the Secretary of the

have to be detailed in the return that the central organization will file separately.

Treasury, a penalty of $500 for each annual return required.

If line 25, Part III is not equal to line 9, Part II, include an explanatory schedule of the

GENERAL INFORMATION

difference.

Those organizations required to file this return, shall do it on the annual basis period

PART IV

established by the organization and according to the accounting method regularly used to

The balance sheet must be reconciled with the accounting books. Any difference must be

keep the accounting books. The informative return shall contain and be verified by a

reconciled. All organizations that inform to a national official, of the Commonwealth of

written declaration, under penalties of perjury, stating the items of gross income, receipts

Puerto Rico, municipal or other public official, may submit copies of the balance sheets

and disbursements, and such other information that the Secretary of the Treasury (Secretary)

required by such authority for the beginning and end of the year.

may prescribe by regulations. It is important, also, to keep records, render under oath its

statements, file such other returns, and comply with such rules and regulations that the

In all cases in which line 6 includes 10% or more of any class of stocks of any

Secretary may prescribe from time to time.

corporation, include a list indicating the name of the corporation, the number of shares of

Fill out the lines on pages 2 and 3 only to the extent that they are applicable to your

each class of stock owned (indicate whether the stocks include the right to vote or not) and

organization. Registered investment companies are in general totally tax exempt, while

the book value of the stocks included on line 6.

the real estate investment trusts are exempt only with respect to the income derived from:

Include a detailed statement indicating the relationship with respect to each unit of property

(a) interest received from liabilities secured by mortgages on real estate; (b) interest,

sold: (a) date and form of acquisition; (b) gross sales price; (c) cost or other basis (if

commissions, service charges, etc., related to the financing of such real estate. The

donated, value at the time of acquisition); (d) sales expenses and cost of improvements

taxable income of a real estate investment trust shall be informed in the Corporation

after acquisition; (e) depreciation since acquisition; and (f) gain or loss (difference between

Income Tax Return (Form 480.20).

(b) and the total of (c) less (e) plus (d)).

A group return may be filed on this form by a central, parent or like organization for two or

Signature and Oath - The return shall be signed by the president, vice-president,

more of its constituted, affiliated or associated local organizations which: (a) are subject to

treasurer, assistant treasurer, chief accounting officer or any other officer authorized to sign.

the general supervision and examination by the central organization; (b) are tax exempt

under the same provision of Section 1101 as the central organization; (c) have authorized

A depositary, trustee or syndic must sign any return required to file on behalf of a corporation.

in writing the central organization to include them in the group return; and (d) have prepared

If you pay for the preparation of the return, require that the specialist signs and

and filed with such central organization their statements, including written declarations to

includes the registration number on the same. The Code provides administrative

the effect that they are prepared under penalty of perjury, with the information related to said

and penal sanctions to the specialist that does not provide this information.

organizations that is required to indicate in the group return. There shall be included with the

group return a schedule showing separately: (a) the total number, names and addresses

WHEN AND WHERE TO FILE THIS RETURN?

of the local organizations included and (b) the same information related to those that were

not included.

This return shall be filed not later than the 15th day of the fourth month following the end of

For additional information see the Regulations under Sections 1054(f) and 1101

the period for which the filing of said return is required. In the case of employee's trusts

of the Code.

exempt under Section 1165 of the Code, this return shall be filed not later than the last day

of the seventh month following the trust's year end.

HEADING

In case of failure to file the return within the date prescribed (considering any

Indicate the taxable year established by the organization, specifying the dates on which

extension of time granted), the organization shall pay, upon notice and demand

such taxable year begins and ends.

from the Secretary, a penalty of $500 for each return required by Section 1054(f).

Enter the name of the organization, indicate the type of organization, the Department of

The return shall be filed in the Department of the Treasury, Returns Processing Bureau, 10

State registry number, and the date and place of incorporation, if applicable.

Paseo Covadonga, Intendente Ramírez Building in Old San Juan, or mailed to:

Enter the employer identification number, since it is required to process the return. It is

DEPARTMENT OF THE TREASURY

important that you provide the merchant's registration number in the Department of the

PO BOX 9024140

Treasury, your case number, and the paragraph of Section 1101 under which the exemption

SAN JUAN PR 00902-4140

was granted.

IMPORTANT NOTICE

Inform the type of activities carried out by the organization and the date in which the

Every organization that has established its right to tax exemption, required to file an annual

operations began.

informative return or not, shall submit annually to the Tax Assistance and Specialized

Consulting Bureau of the Department of the Treasury, an income and expenses statement,

as well as any additional information that may be required by the Secretary.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5