Form 480.70(Oe) - Informative Return For Income Tax Exempt Organizations July 2008 Page 4

ADVERTISEMENT

Rev. 07.08

Form 480.70(OE) - Page 4

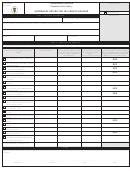

Part VI

Compensation in Excess of $5,000 Paid to Independent Contractors for Professional Services

Social security or employer

Name and address

Type of service

Compensation

identification number

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

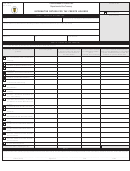

OATH

I hereby declare under penalty of perjury that this return (including the schedules and statements attached) has been examined by me, and to the best of my

knowledge and belief it is true, correct and complete.

CORPORATE

Title

Official's signature

SEAL

Date

For Specialist's Use Only

I hereby declare under penalty of perjury that this return (including the schedules and statements attached) has been examined by me, and to the best of my

knowledge and belief, the facts in the same are true, correct and they constitute as a whole, an exact and complete return. The declaration of the person that

prepares this return is with respect to the information received and this information may be verified.

Specialist's name (Print)

Registration number

Check if self - employed

specialist

Firm's name

Employer identification number

Specialist's signature

Date

Day _________ Month ________ Year ________

Address

Zip Code

NOTE TO TAXPAYER

Indicate if you made payments for the preparation of your return:

Yes

No. If you answered "Yes", require the Specialist's signature and registration number.

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5