Form Eft-1 - Authorization Agreement For Electronic Funds Transfers

ADVERTISEMENT

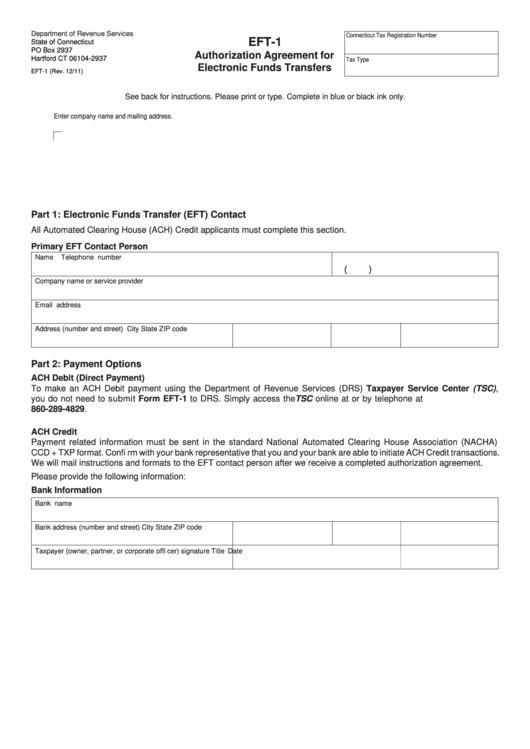

Department of Revenue Services

Connecticut Tax Registration Number

EFT-1

State of Connecticut

PO Box 2937

Authorization Agreement for

Hartford CT 06104-2937

Tax Type

Electronic Funds Transfers

EFT-1 (Rev. 12/11)

See back for instructions. Please print or type. Complete in blue or black ink only.

Enter company name and mailing address.

Part 1: Electronic Funds Transfer (EFT) Contact

All Automated Clearing House (ACH) Credit applicants must complete this section.

Primary EFT Contact Person

Name

Telephone number

(

)

Company name or service provider

Email address

Address (number and street)

City

State

ZIP code

Part 2: Payment Options

ACH Debit (Direct Payment)

To make an ACH Debit payment using the Department of Revenue Services (DRS) Taxpayer Service Center (TSC),

you do not need to submit Form EFT-1 to DRS. Simply access the TSC online at or by telephone at

860-289-4829.

ACH Credit

Payment related information must be sent in the standard National Automated Clearing House Association (NACHA)

CCD + TXP format. Confi rm with your bank representative that you and your bank are able to initiate ACH Credit transactions.

We will mail instructions and formats to the EFT contact person after we receive a completed authorization agreement.

Please provide the following information:

Bank Information

Bank name

Bank address (number and street)

City

State

ZIP code

Taxpayer (owner, partner, or corporate offi cer) signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2