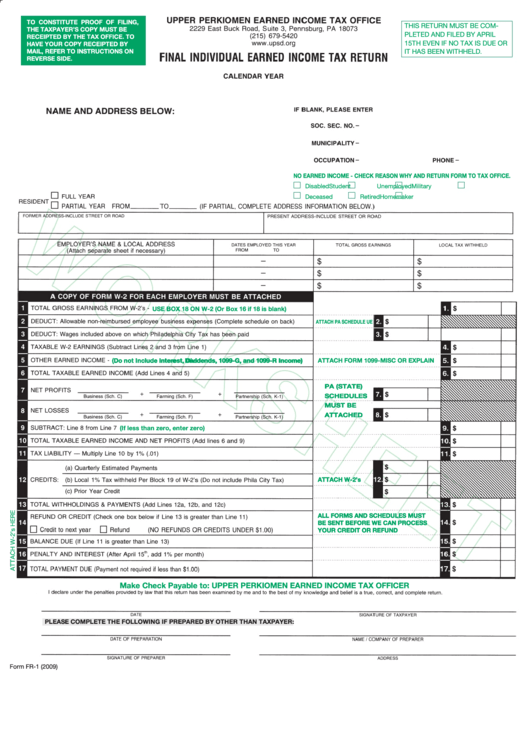

Form Fr-1 - Final Individual Earned Income Tax Return - 2009

ADVERTISEMENT

TO CONSTITUTE PROOF OF FILING,

THIS RETURN MUST BE COM-

THE TAXPAYER’S COPY MUST BE

PLETED AND FILED BY APRIL

RECEIPTED BY THE TAX OFFICE. TO

15TH EVEN IF NO TAX IS DUE OR

HAVE YOUR COPY RECEIPTED BY

MAIL, REFER TO INSTRUCTIONS ON

IT HAS BEEN WITHHELD

.

REVERSE SIDE.

NO EARNED INCOME - CHECK REASON WHY AND RETURN FORM TO TAX OFFICE.

Disabled

Student

Unemployed

Military

Deceased

Retired

Homemaker

USE BOX 18 ON W-2 (Or Box 16 if 18 is blank)

B X

ATTACH PA SCHEDULE UE

(Do not Include Interest, Dividends, 1099-G, and 1099-R Income)

(Do not Include interest, Dividends, 1099-G, and 1099-R Income)

e

D

nd

ATTACH FORM 1099-MISC OR EXPLAIN

PA (STATE)

PA (STATE)

SCHEDULES

SCHEDULES

MUST BE

MUST BE

ATTACHED

ATTACHED

(If less than zero, enter zero)

ATTACH W-2’s

ATTACH W-2’s

ALL FORMS AND SCHEDULES MUST

ALL FORMS AND SCHEDULES MUST

BE SENT BEFORE WE CAN PROCESS

BE SENT BEFORE WE CAN PROCESS

YOUR CREDIT OR REFUND

YOUR CREDIT OR REFUND

Make Check Payable to: UPPER PERKIOMEN EARNED INCOME TAX OFFICER

PLEASE COMPLETE THE FOLLOWING IF PREPARED BY OTHER THAN TAXPAYER:

Form FR-1 (2009)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2