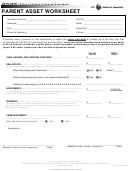

NAME:_________________________________

UCFID:____________________________

Section III:

Family 2014 Untaxed Income

Do not include financial aid, social security benefits, or welfare benefits. Be sure to enter N/A for items that do not apply.

Leaving items blank can result in processing delays.

STUDENT

SPOUSE

1. Did you or your spouse receive child support for family members (listed in Section II) in 2014?_____yes_____no (check

$_______ $_______

one). If yes, the total amount received in 2014: (Do not include foster care or adoption payments.)………….………………..

2. Housing, food, and other living allowances paid to members of the military, clergy, and others (including cash payments

and cash value of benefits). Do not include the value of on-base military housing or the value of a basic military allowance

$_______

$_______

for housing:………………………………………………………………………………………………………………………….………

3. Cash received or any money paid on your or your spouse’s behalf in 2014:……………….……………………………………

$_______

$ _______

4. 2014 Untaxed IRA distribution or pensions/annuities. Check the 2014 tax return for:

(IRS form 1040: lines (15a minus 15b) + (16a minus 16b) = untaxed portion)

(IRS form 1040A: lines (11a minus 11b) + (12a minus 12b) = untaxed portion)

Total untaxed amount received in 2014:………….………..….……………….…………………………………………………..…….

$_______

$_______

WAS THE ABOVE AMOUNT REINVESTED IN A RETIREMENT ACCOUNT?

(You must indicate the correct answer.)

yes/

no

yes/

no

5. 2014 payments to tax-deferred pension and savings plans (paid directly to or withheld from earnings) such as a 401k

and 403b plans. Check student’s and spouse’s 2014 W2 forms, box 12a through 12d (Codes D, E, F, G, H, & S). Total

$_______

$_______

amount received in 2014……………………………………………………………….………………………..……………….……….

ATTACH COPIES OF ALL 2014 W2s

6. Untaxed Veterans’ 2014 Benefits:

a. 2014 Untaxed Non-Educational Veterans’ benefits such as Disability Pension, Death Pension, Dependency & Indemnity

$_______

$_______

Compensation (DIC), etc. Total amount received in 2014:……………………………………………………………………………

$_______

$_______

b. 2014 Untaxed Veteran Administration Education Work-Study Allowances received in 2014:..…………..………………..

7. Other 2014 Untaxed Income Not Reported such as workers’ compensation or disability. Do not include items such as

$_______

$_______

those listed in Section VI on page 4

……………………………………………………………………………………………………………………………………..

ATTACH COPIES OF ALL 2014 W2s

ATTACH COPIES OF ALL 2014 W2 FORMS WHEN REPORTING ITEMS #5 AND #7.

Section IV:

Asset Information

Complete every question in this section to report the net value of assets as of the day you first completed the FAFSA. The net value is

defined as the cash out or sale value minus the debt directly related to the asset. Do not leave any answer blank. If the tax return

indicates the existence of an asset such as interest, dividends, capital gains, rental real estate, partnerships, and S

corporations, and you report a $0 net value, please provide a written explanation below.

STUDENT

SPOUSE

CASH, SAVINGS, AND CHECKING ACCOUNTS:…………………………………………………………..

$_________

$________

$__________

$________

REAL ESTATE:……………………………………………………………………………………………………

(Ex: land, rental property, second and summer homes. DO NOT INCLUDE THE HOME YOU LIVE IN.)

Was rental property sold?..............................................................................................................

Yes /

No

When?______

Address of rental property

____________________________

INVESTMENTS:…………………………………………………………………………………………………..

$__________

$________

(Ex: Qualified tuition plans such as Florida Prepaid and 529s, CDs, trusts, mutual funds, stocks, bonds,

Education IRAs, S corporations, partnerships, etc.)

BUSINESS:………………………………………………………………………………………………………..

$__________

$________

(Ex: land, buildings, inventories, equipment, machinery, etc. Note: Do not report small businesses that you or your

spouse own and control that has 100 or fewer full time or full time equivalent employees.)

FARM INVESTMENT:……………………………………………………………………………………………

$__________

$_________

(Ex: livestock, machinery, land, buildings, equipment, etc.)

Does the family live on a farm?

_____

Yes

______No

Explanation:______________________________________________________________

Explanation:_______________________________________________________________________________________

-INDEPENDENT-

VERIFICATION WORKSHEET 2015-2016, page 3

Continue to the next page.

1

1 2

2 3

3 4

4