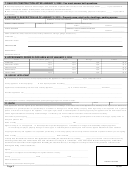

Form Tc101ins - Application For Class Two Or Class Four Properties - 2010 Page 2

ADVERTISEMENT

property produced rental income in 2009.

Use

Unless title has been conveyed to a trust, the trust

Form TC203 for residential and commercial

is not the owner.

cooperatives and condominiums. Use Form TC208

Related

persons.

Related

persons

include

for hotels and motels.

Use Form TC214 for

individuals related by blood, marriage or adoption,

department stores, public parking garages and lots,

individuals and the business entities they control,

and theaters where the applicant is the business

business entities under common control, and

operator or a related person.

If the applicant

fiduciaries and the beneficiaries for whom they act.

operates its business in part of the property, and

A person includes a corporation or other business

rents part of the property, attach both Form TC201

entity.

and Form TC214. Form TC214 is not required for

an operator of a department store having less than

Construction. Construction of a new building.

10,000 gross square feet of retail space.

Year of purchase. The year of purchase is the year

A net lessor, leasing to a related lessee that

the owner or other applicant or any related person

occupies the property, may use Form TC200, Part

purchased the property or acquired its interest in

5, instead of TC201. A net lessor, with a related

the property.

lessee that sublets to unrelated tenants, must use

Major alteration.

Any work which increases the

TC201.

enclosed floor area or cubic content of a building,

An income and expense schedule is not required

which

renovates

a

building

that

had

been

when:

predominately vacant or which changes the use of

one or more floors of a building, such as from office

Property produced no rental income in 2009.

to residential or from storage to office; renovation,

Applicant’s operation began after July 1, 2009,

interior demolition, or tenant installations affecting

unless the prior operator was a related person.

at least 25% of building area; other work not

covered by repair and maintenance expense,

Property that is exclusively residential with six or

including, but not limited to, new installation or

fewer apartments.

replacement of any one of the following systems:

HVAC, elevators, electric wiring or plumbing; or

Property is owner-occupied and used by a business

replacement of at least one of the exterior faces of

for which Form TC214 is not required, such as a

the building; or any work which has or is expected

factory, bank, club, nursing home or office.

to cost an amount that equals or exceeds the

TC201 Part 4 information for certain applicants

tentative total actual assessment under review.

not otherwise required to report rental income

Forms

and

information.

Copies

of

Tax

and expenses.

An applicant who owned an

Commission

forms

may

be

obtained

at

income-producing property before January 1, 2009,

,

at

the

Tax

but is not required to report income and expenses

Commission’s main office and Finance Business

for an application to be eligible for review under

Centers in each borough. If you have questions

governing law, must complete Part 4 of TC201 if

about the application procedure, contact the Tax

the property is rented or offered for rent on January

Commission by e-mailing

tcinfo@oata.nyc.gov

or

5, 2010. Attach it to the application, or submit it at

calling 311.

Address questions about how your

the hearing with Form TC159.

assessment was determined or general questions

Part 9 - Floor area. Approximate gross floor area

about real property tax assessments to the

to the best of your knowledge and ability. Measure

Department

of

Finance

via

their

website,

from exterior wall to exterior wall for each floor.

or by calling 311.

This section is optional for exclusively residential

property with ten or fewer apartments, residential

property with six or fewer apartments and no more

than

one

commercial

unit,

and

residential

cooperatives with less than 2,500 square feet of

commercial space, not including a garage.

Definitions.

Owner.

The individual(s) or entity

having legal title to the real property assessed.

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4