Form Tc101ins - Application For Class Two Or Class Four Properties - 2010 Page 3

ADVERTISEMENT

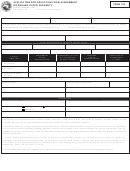

TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

TC101

2010

APPLICATION FOR CORRECTION OF ASSESSED VALUE

OF TAX CLASS TWO OR FOUR PROPERTY

READ THE INSTRUCTIONS BEFORE YOU BEGIN. COMPLETE ALL PARTS OF THE FORM. ANSWER YES OR NO TO QUESTIONS MARKED .

1

1. PROPERTY IDENTIFICATION - A separate application is required for each tax lot.

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

ASSESSMENT YEAR

2010/11

FULL ADDRESS OF PROPERTY (WITH ZIP CODE)

2. APPLICANT - The applicant must be an owner or other person aggrieved, not an attorney or agent.

Name of applicant

_______________________________________________________________________________________________________

Is applicant an owner/title holder of entire property? _____ If yes, is the entire property subject to a net lease? _____ See TC101 Instructions.

Is applicant a lessee of entire property who pays all property charges and is not barred from contesting the assessment? ____ If yes, select a or b.

a Lease from unrelated owner or sublease. Provide lease information on Form TC200 or TC201. See TC101 Instructions.

b Lease from a related owner. Specify applicant's relation to owner____________________________________________________________

If neither owner nor lessee, per above, specify applicant's relation to property: ______________________________________. Submit Form TC200.

Does applicant claim eligibility for review without filing an income schedule (TC201, 203, 208 or 214) or net lease rent on TC200? _______. If yes,

specify the reason: ________________________________________________________________________________________________________

If property is 4, 5, or 6-unit residential property and TC201 or TC203 is not filed, is any portion of the property rented or being offered for rent as of

January 5, 2010? _______. If yes, _______% floor area at or above grade rented or offered for rent. 2009 gross rent: $ ______________________

Apportionment notice.

If application is filed after March 1, applicant claims eligibility for review because filing is within 20 calendar days of:

Notice of increase by the Department of Finance. You must attach a copy of the apportionment notice or notice of increase.

3. REPRESENTATION - Complete this section even if you will represent yourself.

PHONE NO.

FAX NO.

(_____________)

______________-----______________

(____________)

______________-----_______________

NAME OF PERSON OR FIRM TO BE CONTACTED

GROUP #, IF ANY

MAILING ADDRESS

The applicant

An attorney

Other representative

Employee of owner corporation

The person listed is:

4. ATTACHMENTS - List all schedules and documents attached. Number the pages.

_________________________________

_________________________________

___________________________________

_________________________________

_________________________________

___________________________________

Refer to the attachments to application for block ________ lot ______

Last page number _____

Optional: Attach statement of facts and other documents supporting market value estimate or submit at hearing.

5. HEARING REQUEST - Check only one box.

Review on papers submitted without a personal hearing, OR Personal hearing in Manhattan Personal hearing in the Bronx

Personal hearing in Brooklyn

Personal hearing in Queens

Personal hearing in Staten Island

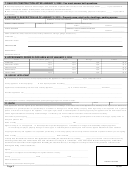

6. CLAIMS OF UNEQUAL OR EXCESSIVE ASSESSMENT

Applicant objects to the assessment on the grounds that it is (a) unequal or (b) excessive because the assessment exceeds

the full value of the property or statutory limits on increases, as follows:

a. Tentative actual assessment

$____________________________

b. Applicant's estimate of market value

$____________________________

c. Requested assessment = line b x 45% assessment ratio

$____________________________

The applicant reserves the right to allege an assessment ratio lower than 45% and seek a lower assessment in a proceeding

for judicial review of the assessment the applicant may commence.

Do not use this form to claim unlawful assessment, misclassification, or error in determining the amount of the exemption;

use Form TC106 with TC200.

DATE RECEIVED

Signer's initials _______. You must initial this page if you do not use a two-sided application form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4