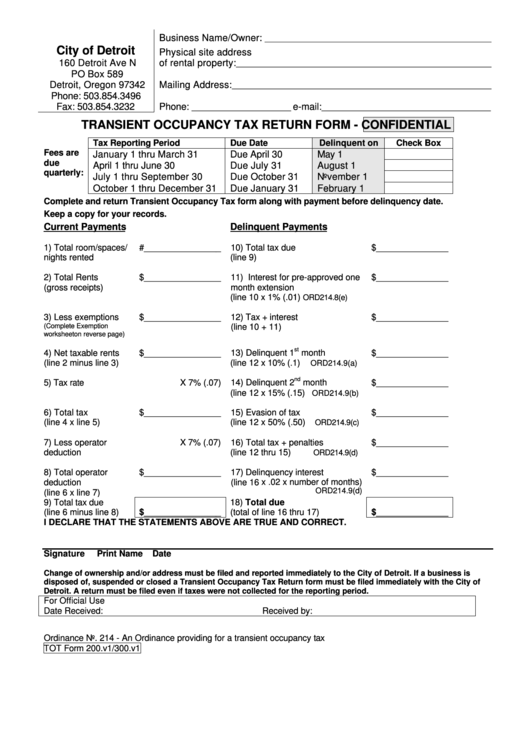

Transient Occupancy Tax Return Form

ADVERTISEMENT

Business Name/Owner:

__________________________________________________________

City of Detroit

Physical site address

160 Detroit Ave N

of rental property:

_________________________________________________________________

PO Box 589

Detroit, Oregon 97342

Mailing Address:

__________________________________________________________________

Phone: 503.854.3496

Fax: 503.854.3232

Phone:

e-mail:

__________________________

__________________________________________

TRANSIENT OCCUPANCY TAX RETURN FORM - CONFIDENTIAL

Tax Reporting Period

Due Date

Delinquent on

Check Box

Fees are

January 1 thru March 31

Due April 30

May 1

due

April 1 thru June 30

Due July 31

August 1

quarterly:

July 1 thru September 30

Due October 31

November 1

October 1 thru December 31

Due January 31

February 1

Complete and return Transient Occupancy Tax form along with payment before delinquency date.

Keep a copy for your records.

Current Payments

Delinquent Payments

1) Total room/spaces/

#________________

10) Total tax due

$_______________

nights rented

(line 9)

2) Total Rents

$________________

11) Interest for pre-approved one

$_______________

(gross receipts)

month extension

(line 10 x 1% (.01)

ORD214.8(e)

3) Less exemptions

$________________

12) Tax + interest

$_______________

(Complete Exemption

(line 10 + 11)

worksheet on reverse page)

st

4) Net taxable rents

$________________

13) Delinquent 1

month

$_______________

(line 2 minus line 3)

(line 12 x 10% (.1)

ORD214.9(a)

nd

5) Tax rate

X 7% (.07)

14) Delinquent 2

month

$_______________

(line 12 x 15% (.15)

ORD214.9(b)

6) Total tax

$________________

15) Evasion of tax

$_______________

(line 4 x line 5)

(line 12 x 50% (.50)

ORD214.9(c)

7) Less operator

X 7% (.07)

16) Total tax + penalties

$_______________

deduction

(line 12 thru 15)

ORD214.9(d)

8) Total operator

$________________

17) Delinquency interest

$_______________

deduction

(line 16 x .02 x number of months)

ORD214.9(d)

(line 6 x line 7)

9) Total tax due

18) Total due

$________________

$_______________

(line 6 minus line 8)

(total of line 16 thru 17)

I DECLARE THAT THE STATEMENTS ABOVE ARE TRUE AND CORRECT.

Signature

Print Name

Date

Change of ownership and/or address must be filed and reported immediately to the City of Detroit. If a business is

disposed of, suspended or closed a Transient Occupancy Tax Return form must be filed immediately with the City of

Detroit. A return must be filed even if taxes were not collected for the reporting period.

For Official Use

Date Received:

Received by:

Ordinance No. 214 - An Ordinance providing for a transient occupancy tax

TOT Form 200.v1/300.v1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2