Instructions For Form O-255

ADVERTISEMENT

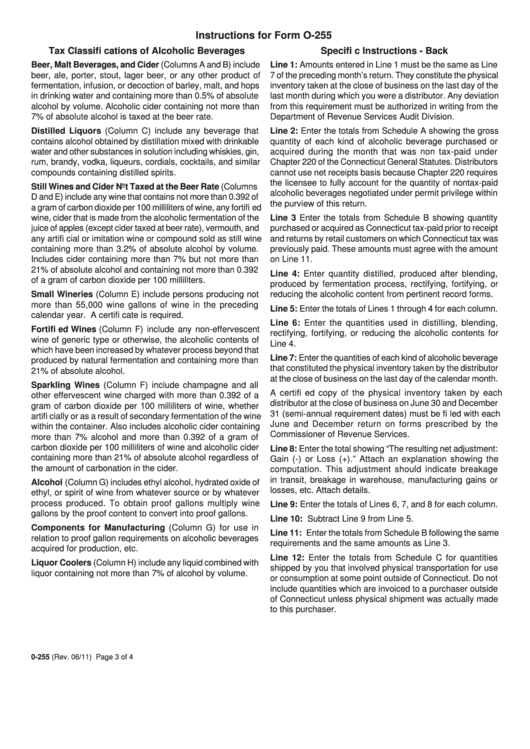

Instructions for Form O-255

Tax Classifi cations of Alcoholic Beverages

Specifi c Instructions - Back

Beer, Malt Beverages, and Cider (Columns A and B) include

Line 1: Amounts entered in Line 1 must be the same as Line

beer, ale, porter, stout, lager beer, or any other product of

7 of the preceding month’s return. They constitute the physical

fermentation, infusion, or decoction of barley, malt, and hops

inventory taken at the close of business on the last day of the

in drinking water and containing more than 0.5% of absolute

last month during which you were a distributor. Any deviation

alcohol by volume. Alcoholic cider containing not more than

from this requirement must be authorized in writing from the

7% of absolute alcohol is taxed at the beer rate.

Department of Revenue Services Audit Division.

Distilled Liquors (Column C) include any beverage that

Line 2: Enter the totals from Schedule A showing the gross

contains alcohol obtained by distillation mixed with drinkable

quantity of each kind of alcoholic beverage purchased or

water and other substances in solution including whiskies, gin,

acquired during the month that was non tax-paid under

rum, brandy, vodka, liqueurs, cordials, cocktails, and similar

Chapter 220 of the Connecticut General Statutes. Distributors

compounds containing distilled spirits.

cannot use net receipts basis because Chapter 220 requires

the licensee to fully account for the quantity of nontax-paid

Still Wines and Cider Not Taxed at the Beer Rate (Columns

alcoholic beverages negotiated under permit privilege within

D and E) include any wine that contains not more than 0.392 of

the purview of this return.

a gram of carbon dioxide per 100 milliliters of wine, any fortifi ed

wine, cider that is made from the alcoholic fermentation of the

Line 3 Enter the totals from Schedule B showing quantity

juice of apples (except cider taxed at beer rate), vermouth, and

purchased or acquired as Connecticut tax-paid prior to receipt

any artifi cial or imitation wine or compound sold as still wine

and returns by retail customers on which Connecticut tax was

containing more than 3.2% of absolute alcohol by volume.

previously paid. These amounts must agree with the amount

Includes cider containing more than 7% but not more than

on Line 11.

21% of absolute alcohol and containing not more than 0.392

Line 4: Enter quantity distilled, produced after blending,

of a gram of carbon dioxide per 100 milliliters.

produced by fermentation process, rectifying, fortifying, or

Small Wineries (Column E) include persons producing not

reducing the alcoholic content from pertinent record forms.

more than 55,000 wine gallons of wine in the preceding

Line 5: Enter the totals of Lines 1 through 4 for each column.

calendar year. A certifi cate is required.

Line 6: Enter the quantities used in distilling, blending,

Fortifi ed Wines (Column F) include any non-effervescent

rectifying, fortifying, or reducing the alcoholic contents for

wine of generic type or otherwise, the alcoholic contents of

Line 4.

which have been increased by whatever process beyond that

Line 7: Enter the quantities of each kind of alcoholic beverage

produced by natural fermentation and containing more than

that constituted the physical inventory taken by the distributor

21% of absolute alcohol.

at the close of business on the last day of the calendar month.

Sparkling Wines (Column F) include champagne and all

A certifi ed copy of the physical inventory taken by each

other effervescent wine charged with more than 0.392 of a

distributor at the close of business on June 30 and December

gram of carbon dioxide per 100 milliliters of wine, whether

31 (semi-annual requirement dates) must be fi led with each

artifi cially or as a result of secondary fermentation of the wine

June and December return on forms prescribed by the

within the container. Also includes alcoholic cider containing

Commissioner of Revenue Services.

more than 7% alcohol and more than 0.392 of a gram of

carbon dioxide per 100 milliliters of wine and alcoholic cider

Line 8: Enter the total showing “The resulting net adjustment:

containing more than 21% of absolute alcohol regardless of

Gain (-) or Loss (+).” Attach an explanation showing the

the amount of carbonation in the cider.

computation. This adjustment should indicate breakage

in transit, breakage in warehouse, manufacturing gains or

Alcohol (Column G) includes ethyl alcohol, hydrated oxide of

losses, etc. Attach details.

ethyl, or spirit of wine from whatever source or by whatever

process produced. To obtain proof gallons multiply wine

Line 9: Enter the totals of Lines 6, 7, and 8 for each column.

gallons by the proof content to convert into proof gallons.

Line 10: Subtract Line 9 from Line 5.

Components for Manufacturing (Column G) for use in

Line 11: Enter the totals from Schedule B following the same

relation to proof gallon requirements on alcoholic beverages

requirements and the same amounts as Line 3.

acquired for production, etc.

Line 12: Enter the totals from Schedule C for quantities

Liquor Coolers (Column H) include any liquid combined with

shipped by you that involved physical transportation for use

liquor containing not more than 7% of alcohol by volume.

or consumption at some point outside of Connecticut. Do not

include quantities which are invoiced to a purchaser outside

of Connecticut unless physical shipment was actually made

to this purchaser.

0-255 (Rev. 06/11)

Page 3 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2