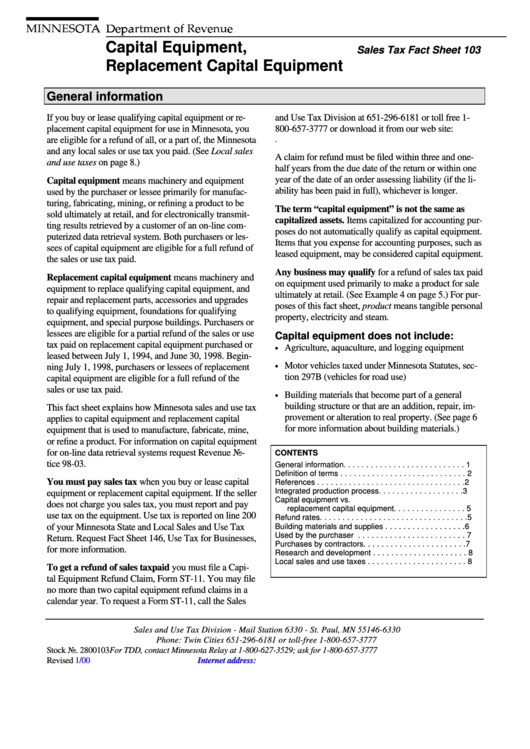

Capital Equipment, Replacement Capital Equipment Sales Tax Fact Sheet 103 - Minnesota Department Of Revenue

ADVERTISEMENT

Capital Equipment,

Sales Tax Fact Sheet 103

Replacement Capital Equipment

General information

If you buy or lease qualifying capital equipment or re-

and Use Tax Division at 651-296-6181 or toll free 1-

placement capital equipment for use in Minnesota, you

800-657-3777 or download it from our web site:

are eligible for a refund of all, or a part of, the Minnesota

and any local sales or use tax you paid. (See Local sales

A claim for refund must be filed within three and one-

and use taxes on page 8.)

half years from the due date of the return or within one

year of the date of an order assessing liability (if the li-

Capital equipment means machinery and equipment

ability has been paid in full), whichever is longer.

used by the purchaser or lessee primarily for manufac-

turing, fabricating, mining, or refining a product to be

The term “capital equipment” is not the same as

sold ultimately at retail, and for electronically transmit-

capitalized assets. Items capitalized for accounting pur-

ting results retrieved by a customer of an on-line com-

poses do not automatically qualify as capital equipment.

puterized data retrieval system. Both purchasers or les-

Items that you expense for accounting purposes, such as

sees of capital equipment are eligible for a full refund of

leased equipment, may be considered capital equipment.

the sales or use tax paid.

Any business may qualify for a refund of sales tax paid

Replacement capital equipment means machinery and

on equipment used primarily to make a product for sale

equipment to replace qualifying capital equipment, and

ultimately at retail. (See Example 4 on page 5.) For pur-

repair and replacement parts, accessories and upgrades

poses of this fact sheet, product means tangible personal

to qualifying equipment, foundations for qualifying

property, electricity and steam.

equipment, and special purpose buildings. Purchasers or

lessees are eligible for a partial refund of the sales or use

Capital equipment does not include:

tax paid on replacement capital equipment purchased or

•

Agriculture, aquaculture, and logging equipment

leased between July 1, 1994, and June 30, 1998. Begin-

•

Motor vehicles taxed under Minnesota Statutes, sec-

ning July 1, 1998, purchasers or lessees of replacement

tion 297B (vehicles for road use)

capital equipment are eligible for a full refund of the

sales or use tax paid.

•

Building materials that become part of a general

building structure or that are an addition, repair, im-

This fact sheet explains how Minnesota sales and use tax

provement or alteration to real property. (See page 6

applies to capital equipment and replacement capital

for more information about building materials.)

equipment that is used to manufacture, fabricate, mine,

or refine a product. For information on capital equipment

for on-line data retrieval systems request Revenue No-

CONTENTS

tice 98-03.

General information. . . . . . . . . . . . . . . . . . . . . . . . . . .

1

Definition of terms . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

You must pay sales tax when you buy or lease capital

References . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Integrated production process. . . . . . . . . . . . . . . . . . .

3

equipment or replacement capital equipment. If the seller

Capital equipment vs.

does not charge you sales tax, you must report and pay

replacement capital equipment. . . . . . . . . . . . . . . .

5

use tax on the equipment. Use tax is reported on line 200

Refund rates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

of your Minnesota State and Local Sales and Use Tax

Building materials and supplies . . . . . . . . . . . . . . . . . . 6

Used by the purchaser . . . . . . . . . . . . . . . . . . . . . . . .

7

Return. Request Fact Sheet 146, Use Tax for Businesses,

Purchases by contractors. . . . . . . . . . . . . . . . . . . . . . . 7

for more information.

Research and development . . . . . . . . . . . . . . . . . . . . . 8

Local sales and use taxes . . . . . . . . . . . . . . . . . . . . . .

8

To get a refund of sales tax paid you must file a Capi-

tal Equipment Refund Claim, Form ST-11. You may file

no more than two capital equipment refund claims in a

calendar year. To request a Form ST-11, call the Sales

Sales and Use Tax Division - Mail Station 6330 - St. Paul, MN 55146-6330

Phone: Twin Cities 651-296-6181 or toll-free 1-800-657-3777

Stock No. 2800103

For TDD, contact Minnesota Relay at 1-800-627-3529; ask for 1-800-657-3777

Revised

1/00

Internet address:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8