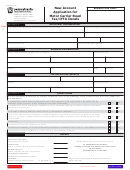

Form Omc-11a - Connecticut Motor Carrier Road Tax Return Page 2

ADVERTISEMENT

Make check or money order payable to: Commissioner of Revenue Services.

PENALTY: Failure to file or pay tax when due: $50 or 10% (.10) of the tax due, whichever is greater.

INTEREST: For late payment: 1% (.01) of the tax due per month, or fraction thereof, from due date.

DUE DATE: One month after end of period indicated.

A return must be filed by each registered carrier, even when no tax is due.

I declare under the penalty of false statement that I have examined

this return, Form OMC-11A , and, to the best of my knowledge and

belief it is true, complete, and correct. (The penalty for false

statement is imprisonment not to exceed one year or a fine not to

IMPORTANT!

exceed two thousand dollars, or both.)

FAILURE TO COMPLETE LINES 1, 2, 4, AND 6 MAY

RESULT IN A BILLING OR DELAY IN CREDIT TO

TAXPAYER SIGNATURE

YOUR ACCOUNT

DATE

TITLE

CREDITS ARE NOT AUTOMATIC REFUNDS.

SEE GENERAL INFORMATION

SECTION OF INSTRUCTION SHEET, OMC-11AT.

OMC-11A (Back) (Rev. 07/00)

GENERAL INFORMATION

OPERATIONS. Operations include any or all of the vehicles

may hold the lessor and lessee of vehicles used by a motor

subject to this tax which travel in Connecticut during the quarterly

carrier jointly and severally responsible for the payment of

period whether loaded or empty, whether or not for compensation,

the tax.

and whether owned by or leased to the motor carrier who

operates them or causes them to be operated.

• Each motor carrier required to register its vehicle under

Chapter 222 of the Connecticut General Statutes must

RETURNS. A return must be filed by each carrier registered in

register that vehicle annually with the Commissioner of

Connecticut, even when no tax is due. A motor carrier whose

Revenue Services.

vehicles did not travel in Connecticut during the quarter should

write “none” on Line 2. A motor carrier who fails to file will be

• Any motor carrier operating a vehicle over the Connecticut

listed as delinquent. Continued delinquencies may result in the

highways under a 10-day temporary permit must carry the

revocation of Connecticut Motor Carrier Registration and

letter or telegram granting such permission in said vehicle

forfeiture of renewal privileges for succeeding years.

and shall be responsible for filing a report and paying the

amount of the tax due for the quarter in which the trip or trips

CREDITS. Every motor carrier subject to the tax imposed is

occurred.

entitled to a credit equivalent to the rate per gallon of the Connecticut

motor fuel taxes currently in effect on all gasoline, diesel and

• The owner-lessor of any vehicle which is operated over

any other motor vehicle fuel purchased within Connecticut on

Connecticut highways under a lease or rental agreement of

which the Connecticut fuel taxes have been paid. If the credit

30 days or less duration shall be responsible for registering

allowed exceeds the amount of tax for which the motor carrier is

the vehicle. The lessor will be held primarily liable for the

liable, the excess may be carried forward to any of the succeeding

payment of tax found due, although the Commissioner of

4 quarters only and applied against the tax for which the carrier

Revenue Services may, at his discretion, hold the lessee

might otherwise be liable during such quarters.

jointly and severally liable with the lessor for the payment of

the tax.

REFUNDS. When the amount of credit to which any motor carrier

is entitled for any quarter exceeds the amount of tax for which

•

The lessee of any vehicle which is operated over

the carrier is liable for the same quarter, the excess may be

Connecticut highways under a lease agreement of more

refunded if the carrier, within one year from the due date for the

than 30 days duration shall be responsible for registering

quarter, files an application for a refund of the excess with the

the vehicle and filing the required quarterly reports. The

Department of Revenue Services. Applications for refunds must

lessee will be held primarily liable for the payment of tax

be supported by evidence as required by the Commissioner of

found due, although the Commissioner of Revenue Services

Revenue Services. Refund applications may be obtained from

may, at his descretion, hold the lessor jointly and severally

the Excise Unit at 860-541-3222. The Commissioner of Revenue

liable with the lessee for the payment of the tax.

Services will not allow a refund except after an audit of the

applicant’s records.

• A motor carrier is required to file all quarterly reports and

pay all taxes, fines and penalties due before annual motor

LIABILITY FOR TAX. The Commissioner of Revenue Services

carrier decals will be issued.

OMC-11AT (Rev. 07/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2