Schedule Nl-5g Instructions - Illinois Department Of Revenue

ADVERTISEMENT

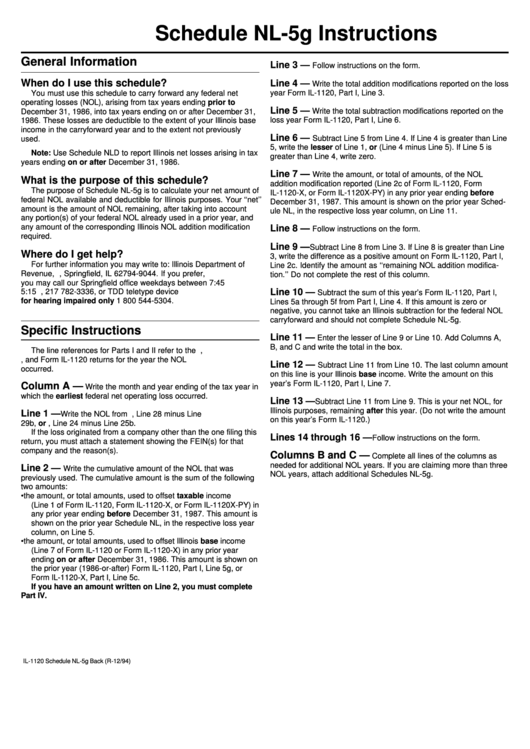

Schedule NL-5g Instructions

General Information

Line 3 —

Follow instructions on the form.

When do I use this schedule?

Line 4 —

Write the total addition modifications reported on the loss

year Form IL-1120, Part I, Line 3.

You must use this schedule to carry forward any federal net

operating losses (NOL), arising from tax years ending prior to

Line 5 —

Write the total subtraction modifications reported on the

December 31, 1986, into tax years ending on or after December 31,

loss year Form IL-1120, Part I, Line 6.

1986. These losses are deductible to the extent of your Illinois base

income in the carryforward year and to the extent not previously

Line 6 —

Subtract Line 5 from Line 4. If Line 4 is greater than Line

used.

5, write the lesser of Line 1, or (Line 4 minus Line 5). If Line 5 is

Note: Use Schedule NLD to report Illinois net losses arising in tax

greater than Line 4, write zero.

years ending on or after December 31, 1986.

Line 7 —

Write the amount, or total of amounts, of the NOL

What is the purpose of this schedule?

addition modification reported (Line 2c of Form IL-1120, Form

The purpose of Schedule NL-5g is to calculate your net amount of

IL-1120-X, or Form IL-1120X-PY) in any prior year ending before

federal NOL available and deductible for Illinois purposes. Your ‘‘net’’

December 31, 1987. This amount is shown on the prior year Sched-

amount is the amount of NOL remaining, after taking into account

ule NL, in the respective loss year column, on Line 11.

any portion(s) of your federal NOL already used in a prior year, and

any amount of the corresponding Illinois NOL addition modification

Line 8 —

Follow instructions on the form.

required.

Line 9 —

Subtract Line 8 from Line 3. If Line 8 is greater than Line

Where do I get help?

3, write the difference as a positive amount on Form IL-1120, Part I,

For further information you may write to: Illinois Department of

Line 2c. Identify the amount as ‘‘remaining NOL addition modifica-

Revenue, P.O. Box 19044, Springfield, IL 62794-9044. If you prefer,

tion.’’ Do not complete the rest of this column.

you may call our Springfield office weekdays between 7:45 a.m. and

Line 10 —

5:15 p.m. at 1 800 732-8866, 217 782-3336, or TDD teletype device

Subtract the sum of this year’s Form IL-1120, Part I,

for hearing impaired only 1 800 544-5304.

Lines 5a through 5f from Part I, Line 4. If this amount is zero or

negative, you cannot take an Illinois subtraction for the federal NOL

carryforward and should not complete Schedule NL-5g.

Specific Instructions

Line 11 —

Enter the lesser of Line 9 or Line 10. Add Columns A,

B, and C and write the total in the box.

The line references for Parts I and II refer to the U.S. Form 1120,

U.S. Form 1120-A, and Form IL-1120 returns for the year the NOL

Line 12 —

Subtract Line 11 from Line 10. The last column amount

occurred.

on this line is your Illinois base income. Write the amount on this

year’s Form IL-1120, Part I, Line 7.

Column A —

Write the month and year ending of the tax year in

which the earliest federal net operating loss occurred.

Line 13 —

Subtract Line 11 from Line 9. This is your net NOL, for

Illinois purposes, remaining after this year. (Do not write the amount

Line 1 —

Write the NOL from U.S. Form 1120, Line 28 minus Line

on this year’s Form IL-1120.)

29b, or U.S. Form 1120-A, Line 24 minus Line 25b.

If the loss originated from a company other than the one filing this

Lines 14 through 16 —

Follow instructions on the form.

return, you must attach a statement showing the FEIN(s) for that

company and the reason(s).

Columns B and C —

Complete all lines of the columns as

needed for additional NOL years. If you are claiming more than three

Line 2 —

Write the cumulative amount of the NOL that was

NOL years, attach additional Schedules NL-5g.

previously used. The cumulative amount is the sum of the following

two amounts:

• the amount, or total amounts, used to offset taxable income

(Line 1 of Form IL-1120, Form IL-1120-X, or Form IL-1120X-PY) in

any prior year ending before December 31, 1987. This amount is

shown on the prior year Schedule NL, in the respective loss year

column, on Line 5.

• the amount, or total amounts, used to offset Illinois base income

(Line 7 of Form IL-1120 or Form IL-1120-X) in any prior year

ending on or after December 31, 1986. This amount is shown on

the prior year (1986-or-after) Form IL-1120, Part I, Line 5g, or

Form IL-1120-X, Part I, Line 5c.

If you have an amount written on Line 2, you must complete

Part IV.

IL-1120 Schedule NL-5g Back (R-12/94)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1