Schedule Ub/nl-5g Instructions - Illinois Department Of Revenue

ADVERTISEMENT

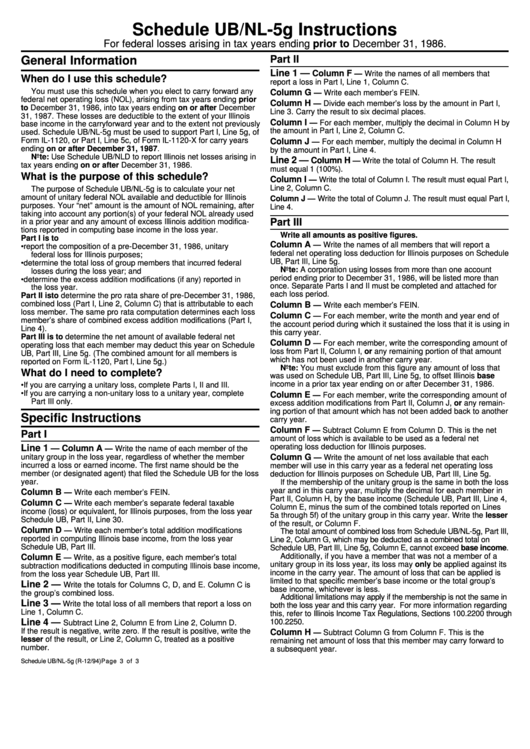

Schedule UB/NL-5g Instructions

For federal losses arising in tax years ending prior to December 31, 1986.

Part II

General Information

Line 1 —

Column F

— Write the names of all members that

When do I use this schedule?

report a loss in Part I, Line 1, Column C.

You must use this schedule when you elect to carry forward any

Column G

— Write each member’s FEIN.

federal net operating loss (NOL), arising from tax years ending prior

Column H

— Divide each member’s loss by the amount in Part I,

to December 31, 1986, into tax years ending on or after December

Line 3. Carry the result to six decimal places.

31, 1987. These losses are deductible to the extent of your Illinois

Column I

— For each member, multiply the decimal in Column H by

base income in the carryforward year and to the extent not previously

the amount in Part I, Line 2, Column C.

used. Schedule UB/NL-5g must be used to support Part I, Line 5g, of

Form IL-1120, or Part I, Line 5c, of Form IL-1120-X for carry years

Column J

— For each member, multiply the decimal in Column H

ending on or after December 31, 1987.

by the amount in Part I, Line 4.

Note: Use Schedule UB/NLD to report Illinois net losses arising in

Line 2 —

Column H

— Write the total of Column H. The result

tax years ending on or after December 31, 1986.

must equal 1 (100%).

What is the purpose of this schedule?

Column I

— Write the total of Column I. The result must equal Part I,

Line 2, Column C.

The purpose of Schedule UB/NL-5g is to calculate your net

amount of unitary federal NOL available and deductible for Illinois

Column J — Write the total of Column J. The result must equal Part I,

purposes. Your “net” amount is the amount of NOL remaining, after

Line 4.

taking into account any portion(s) of your federal NOL already used

Part III

in a prior year and any amount of excess Illinois addition modifica-

tions reported in computing base income in the loss year.

Write all amounts as positive figures.

Part I is to

Column A

— Write the names of all members that will report a

• report the composition of a pre-December 31, 1986, unitary

federal net operating loss deduction for Illinois purposes on Schedule

federal loss for Illinois purposes;

UB, Part III, Line 5g.

• determine the total loss of group members that incurred federal

Note: A corporation using losses from more than one account

losses during the loss year; and

period ending prior to December 31, 1986, will be listed more than

• determine the excess addition modifications (if any) reported in

once. Separate Parts I and II must be completed and attached for

the loss year.

each loss period.

Part II is to determine the pro rata share of pre-December 31, 1986,

combined loss (Part I, Line 2, Column C) that is attributable to each

Column B

— Write each member’s FEIN.

loss member. The same pro rata computation determines each loss

Column C

— For each member, write the month and year end of

member’s share of combined excess addition modifications (Part I,

the account period during which it sustained the loss that it is using in

Line 4).

this carry year.

Part III is to determine the net amount of available federal net

Column D

— For each member, write the corresponding amount of

operating loss that each member may deduct this year on Schedule

loss from Part II, Column I, or any remaining portion of that amount

UB, Part III, Line 5g. (The combined amount for all members is

which has not been used in another carry year.

reported on Form IL-1120, Part I, Line 5g.)

Note: You must exclude from this figure any amount of loss that

What do I need to complete?

was used on Schedule UB, Part III, Line 5g, to offset Illinois base

income in a prior tax year ending on or after December 31, 1986.

• If you are carrying a unitary loss, complete Parts I, II and III.

• If you are carrying a non-unitary loss to a unitary year, complete

Column E

— For each member, write the corresponding amount of

Part III only.

excess addition modifications from Part II, Column J, or any remain-

ing portion of that amount which has not been added back to another

Specific Instructions

carry year.

Column F

— Subtract Column E from Column D. This is the net

Part I

amount of loss which is available to be used as a federal net

operating loss deduction for Illinois purposes.

Line 1

— Column A

— Write the name of each member of the

unitary group in the loss year, regardless of whether the member

Column G

— Write the amount of net loss available that each

incurred a loss or earned income. The first name should be the

member will use in this carry year as a federal net operating loss

member (or designated agent) that filed the Schedule UB for the loss

deduction for Illinois purposes on Schedule UB, Part III, Line 5g.

year.

If the membership of the unitary group is the same in both the loss

year and in this carry year, multiply the decimal for each member in

Column B

— Write each member’s FEIN.

Part II, Column H, by the base income (Schedule UB, Part III, Line 4,

Column C

— Write each member’s separate federal taxable

Column E, minus the sum of the combined totals reported on Lines

income (loss) or equivalent, for Illinois purposes, from the loss year

5a through 5f) of the unitary group in this carry year. Write the lesser

Schedule UB, Part II, Line 30.

of the result, or Column F.

Column D

— Write each member’s total addition modifications

The total amount of combined loss from Schedule UB/NL-5g, Part III,

reported in computing Illinois base income, from the loss year

Line 2, Column G, which may be deducted as a combined total on

Schedule UB, Part III.

Schedule UB, Part III, Line 5g, Column E, cannot exceed base income.

Additionally, if you have a member that was not a member of a

Column E

— Write, as a positive figure, each member’s total

unitary group in its loss year, its loss may only be applied against its

subtraction modifications deducted in computing Illinois base income,

income in the carry year. The amount of loss that can be applied is

from the loss year Schedule UB, Part III.

limited to that specific member’s base income or the total group’s

Line 2 —

Write the totals for Columns C, D, and E. Column C is

base income, whichever is less.

the group’s combined loss.

Additional limitations may apply if the membership is not the same in

Line 3 —

Write the total loss of all members that report a loss on

both the loss year and this carry year. For more information regarding

Line 1, Column C.

this, refer to Illinois Income Tax Regulations, Sections 100.2200 through

Line 4 —

100.2250.

Subtract Line 2, Column E from Line 2, Column D.

If the result is negative, write zero. If the result is positive, write the

Column H

— Subtract Column G from Column F. This is the

lesser of the result, or Line 2, Column C, treated as a positive

remaining net amount of loss that this member may carry forward to

number.

a subsequent year.

Schedule UB/NL-5g (R-12/94)

Page 3 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1