Instructions For Form Au-474 - Application For Refund Of The Petroleum Business Tax Because Of A Bad Debt - New York State Department Of Taxation And Finance Page 2

ADVERTISEMENT

AU-474-I (3/95) (back)

Examples

Example 3 - On September 25 your company delivered 190

gallons of aviation gas to Three Sons Aviation. The total selling

Example 1 - On September 20 your company delivered 190

price of $238.07 included a PBT of $27.57. A finance charge for

gallons of aviation gas to Solo Aviation. The invoice showed a total

late payment was charged in the amount of $30.45 on

selling price of $238.07 and a petroleum business tax of $27.57.

November 30. Your company becomes a monthly filer as of

Since no payment was ever received on the account, the amount of

December 1. On December 4 a second sale totaling $587.56 was

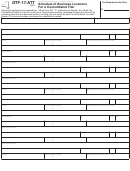

the refund requested would be $27.57. See sample schedule

made. The PBT included on the invoice was $66.75. On

below.

January 30 a late payment charge of $56.34 was charged.

Payments totaling $660 were made before the account was written

Example 2 - On September 30 your company delivered 190

off as a bad debt. The payments were applied to the earliest sale

gallons of aviation gas to Two Brothers Aviation for a total selling

first, paying it in full. Payment was applied to the finance charge of

price of $238.07. A payment of $150 was received on the account.

November 30. The remaining amount of $391.48 ($660 - 238.07 -

Using the Worksheet for Partial Payments, the following

30.45) is the partial payment on the second sale. The charges for

calculations are made:

late payment that occurred after the sale do not affect the amount

of the bad debt. Using the Worksheet for Partial Payments, the

(a) Selling price ............................................................. $238.07

refund would be calculated as follows:

(b) PBT included in selling price (190 gals X .1451*) ..

27.57

(a) Selling price .............................................................. $587.56

(c) Percentage of PBT in selling price (27.57/238.07)

.1158

(b) PBT included on invoice ...........................................

66.75

(d) Partial payment ....................................................... $150.00

(c) Percentage of PBT (66.75/587.56) ...........................

.1136

(e) Amount of partial payment applied to PBT

(d) Partial payment ......................................................... $391.48

(.1158 X 150) .......................................................

17.37

(e) Amount of partial payment applied to PBT

(f) PBT allowed as bad debt refund (25.57 - 17.37) ...

10.20

(.1136 X 391.48) ....................................................

44.47

See sample schedule below.

(f) PBT allowed as refund (66.75 - 44.47) .....................

22.28

* Rate obtained from Publication 908, Article 13-A Tax Rates

See sample schedule below.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2