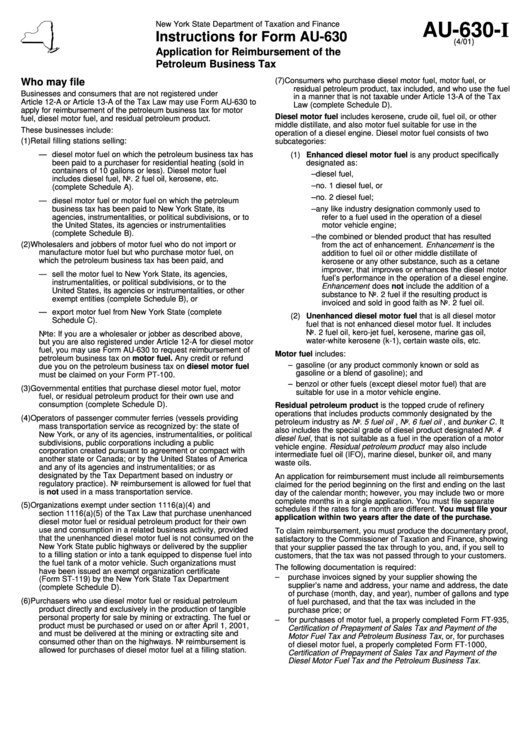

Instructions For Form Au-630 - Application For Reimbursement Of The Petroleum Business Tax - New York State Department Of Taxation And Finance

ADVERTISEMENT

New York State Department of Taxation and Finance

AU-630-I

Instructions for Form AU-630

(4/01)

Application for Reimbursement of the

Petroleum Business Tax

(7)

Consumers who purchase diesel motor fuel, motor fuel, or

Who may file

residual petroleum product, tax included, and who use the fuel

Businesses and consumers that are not registered under

in a manner that is not taxable under Article 13-A of the Tax

Article 12-A or Article 13-A of the Tax Law may use Form AU-630 to

Law (complete Schedule D).

apply for reimbursement of the petroleum business tax for motor

Diesel motor fuel includes kerosene, crude oil, fuel oil, or other

fuel, diesel motor fuel, and residual petroleum product.

middle distillate, and also motor fuel suitable for use in the

These businesses include:

operation of a diesel engine. Diesel motor fuel consists of two

(1) Retail filling stations selling:

subcategories:

— diesel motor fuel on which the petroleum business tax has

(1) Enhanced diesel motor fuel is any product specifically

been paid to a purchaser for residential heating (sold in

designated as:

containers of 10 gallons or less). Diesel motor fuel

– diesel fuel,

includes diesel fuel, No. 2 fuel oil, kerosene, etc.

– no. 1 diesel fuel, or

(complete Schedule A).

– no. 2 diesel fuel;

— diesel motor fuel or motor fuel on which the petroleum

business tax has been paid to New York State, its

– any like industry designation commonly used to

agencies, instrumentalities, or political subdivisions, or to

refer to a fuel used in the operation of a diesel

the United States, its agencies or instrumentalities

motor vehicle engine;

(complete Schedule B).

– the combined or blended product that has resulted

(2)

Wholesalers and jobbers of motor fuel who do not import or

from the act of enhancement. Enhancement is the

manufacture motor fuel but who purchase motor fuel, on

addition to fuel oil or other middle distillate of

which the petroleum business tax has been paid, and

kerosene or any other substance, such as a cetane

improver, that improves or enhances the diesel motor

— sell the motor fuel to New York State, its agencies,

fuel’s performance in the operation of a diesel engine.

instrumentalities, or political subdivisions, or to the

Enhancement does not include the addition of a

United States, its agencies or instrumentalities, or other

substance to No. 2 fuel if the resulting product is

exempt entities (complete Schedule B), or

invoiced and sold in good faith as No. 2 fuel oil.

— export motor fuel from New York State (complete

(2) Unenhanced diesel motor fuel that is all diesel motor

Schedule C).

fuel that is not enhanced diesel motor fuel. It includes

No. 2 fuel oil, kero-jet fuel, kerosene, marine gas oil,

Note: If you are a wholesaler or jobber as described above,

water-white kerosene (k-1), certain waste oils, etc.

but you are also registered under Article 12-A for diesel motor

fuel, you may use Form AU-630 to request reimbursement of

Motor fuel includes:

petroleum business tax on motor fuel. Any credit or refund

– gasoline (or any product commonly known or sold as

due you on the petroleum business tax on diesel motor fuel

gasoline or a blend of gasoline); and

must be claimed on your Form PT-100.

– benzol or other fuels (except diesel motor fuel) that are

(3)

Governmental entities that purchase diesel motor fuel, motor

suitable for use in a motor vehicle engine.

fuel, or residual petroleum product for their own use and

consumption (complete Schedule D).

Residual petroleum product is the topped crude of refinery

operations that includes products commonly designated by the

(4)

Operators of passenger commuter ferries (vessels providing

petroleum industry as No. 5 fuel oil , No. 6 fuel oil , and bunker C . It

mass transportation service as recognized by: the state of

also includes the special grade of diesel product designated No. 4

New York, or any of its agencies, instrumentalities, or political

diesel fuel , that is not suitable as a fuel in the operation of a motor

subdivisions, public corporations including a public

vehicle engine. Residual petroleum product may also include

corporation created pursuant to agreement or compact with

intermediate fuel oil (IFO), marine diesel, bunker oil, and many

another state or Canada; or by the United States of America

waste oils.

and any of its agencies and instrumentalities; or as

designated by the Tax Department based on industry or

An application for reimbursement must include all reimbursements

regulatory practice). No reimbursement is allowed for fuel that

claimed for the period beginning on the first and ending on the last

is not used in a mass transportation service.

day of the calendar month; however, you may include two or more

complete months in a single application. You must file separate

(5)

Organizations exempt under section 1116(a)(4) and

schedules if the rates for a month are different. You must file your

section 1116(a)(5) of the Tax Law that purchase unenhanced

application within two years after the date of the purchase.

diesel motor fuel or residual petroleum product for their own

use and consumption in a related business activity, provided

To claim reimbursement, you must produce the documentary proof,

that the unenhanced diesel motor fuel is not consumed on the

satisfactory to the Commissioner of Taxation and Finance, showing

New York State public highways or delivered by the supplier

that your supplier passed the tax through to you, and, if you sell to

to a filling station or into a tank equipped to dispense fuel into

customers, that the tax was not passed through to your customers.

the fuel tank of a motor vehicle. Such organizations must

The following documentation is required:

have been issued an exempt organization certificate

–

purchase invoices signed by your supplier showing the

(Form ST-119) by the New York State Tax Department

supplier’s name and address, your name and address, the date

(complete Schedule D).

of purchase (month, day, and year), number of gallons and type

(6)

Purchasers who use diesel motor fuel or residual petroleum

of fuel purchased, and that the tax was included in the

product directly and exclusively in the production of tangible

purchase price; or

personal property for sale by mining or extracting. The fuel or

–

for purchases of motor fuel, a properly completed Form FT-935,

product must be purchased or used on or after April 1, 2001,

Certification of Prepayment of Sales Tax and Payment of the

and must be delivered at the mining or extracting site and

Motor Fuel Tax and Petroleum Business Tax, or, for purchases

consumed other than on the highways. No reimbursement is

of diesel motor fuel, a properly completed Form FT-1000,

allowed for purchases of diesel motor fuel at a filling station.

Certification of Prepayment of Sales Tax and Payment of the

Diesel Motor Fuel Tax and the Petroleum Business Tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2