Instructions For Completing Rhode Island'S Up1 And Up2

ADVERTISEMENT

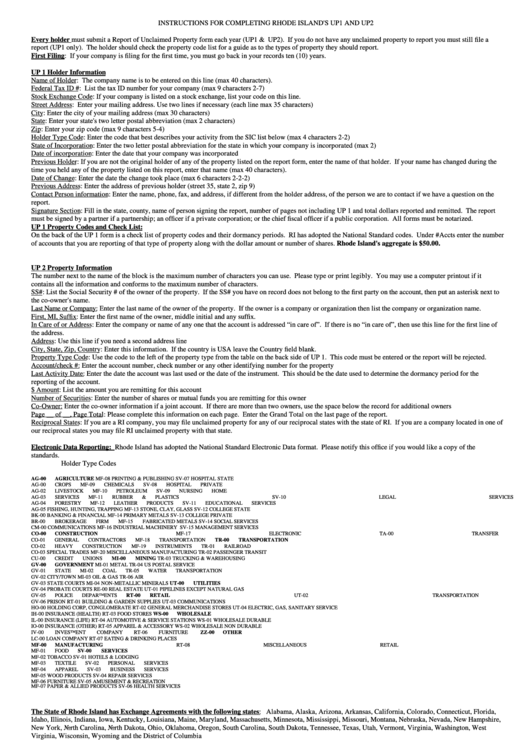

INSTRUCTIONS FOR COMPLETING RHODE ISLAND'S UP1 AND UP2

Every holder must submit a Report of Unclaimed Property form each year (UP1 & UP2). If you do not have any unclaimed property to report you must still file a

report (UP1 only). The holder should check the property code list for a guide as to the types of property they should report.

First Filing: If your company is filing for the first time, you must go back in your records ten (10) years.

UP 1 Holder Information

Name of Holder: The company name is to be entered on this line (max 40 characters).

Federal Tax ID #: List the tax ID number for your company (max 9 characters 2-7)

Stock Exchange Code: If your company is listed on a stock exchange, list your code on this line.

Street Address: Enter your mailing address. Use two lines if necessary (each line max 35 characters)

City: Enter the city of your mailing address (max 30 characters)

State: Enter your state's two letter postal abbreviation (max 2 characters)

Zip: Enter your zip code (max 9 characters 5-4)

Holder Type Code: Enter the code that best describes your activity from the SIC list below (max 4 characters 2-2)

State of Incorporation: Enter the two letter postal abbreviation for the state in which your company is incorporated (max 2)

Date of incorporation: Enter the date that your company was incorporated

Previous Holder: If you are not the original holder of any of the property listed on the report form, enter the name of that holder. If your name has changed during the

time you held any of the property listed on this report, enter that name (max 40 characters).

Date of Change: Enter the date the change took place (max 6 characters 2-2-2)

Previous Address: Enter the address of previous holder (street 35, state 2, zip 9)

Contact Person information: Enter the name, phone, fax, and address, if different from the holder address, of the person we are to contact if we have a question on the

report.

Signature Section: Fill in the state, county, name of person signing the report, number of pages not including UP 1 and total dollars reported and remitted. The report

must be signed by a partner if a partnership; an officer if a private corporation; or the chief fiscal officer if a public corporation. All forms must be notarized.

UP 1 Property Codes and Check List:

On the back of the UP 1 form is a check list of property codes and their dormancy periods. RI has adopted the National Standard codes. Under #Accts enter the number

of accounts that you are reporting of that type of property along with the dollar amount or number of shares. Rhode Island's aggregate is $50.00.

UP 2 Property Information

The number next to the name of the block is the maximum number of characters you can use. Please type or print legibly. You may use a computer printout if it

contains all the information and conforms to the maximum number of characters.

SS#: List the Social Security # of the owner of the property. If the SS# you have on record does not belong to the first party on the account, then put an asterisk next to

the co-owner's name.

Last Name or Company: Enter the last name of the owner of the property. If the owner is a company or organization then list the company or organization name.

First, MI, Suffix: Enter the first name of the owner, middle initial and any suffix.

In Care of or Address: Enter the company or name of any one that the account is addressed “in care of”. If there is no “in care of”, then use this line for the first line of

the address.

Address: Use this line if you need a second address line

City, State, Zip, Country: Enter this information. If the country is USA leave the Country field blank.

Property Type Code: Use the code to the left of the property type from the table on the back side of UP 1. This code must be entered or the report will be rejected.

Account/check #: Enter the account number, check number or any other identifying number for the property

Last Activity Date: Enter the date the account was last used or the date of the instrument. This should be the date used to determine the dormancy period for the

reporting of the account.

$ Amount: List the amount you are remitting for this account

Number of Securities: Enter the number of shares or mutual funds you are remitting for this owner

Co-Owner: Enter the co-owner information if a joint account. If there are more than two owners, use the space below the record for additional owners

Page __ of __, Page Total: Please complete this information on each page. Enter the Grand Total on the last page of the report.

Reciprocal States: If you are a RI company, you may file unclaimed property for any of our reciprocal states with the state of RI. If you are a company located in one of

our reciprocal states you may file RI unclaimed property with that state.

Electronic Data Reporting: Rhode Island has adopted the National Standard Electronic Data format. Please notify this office if you would like a copy of the

standards.

Holder Type Codes

AG-00

AGRICULTURE

MF-08

PRINTING & PUBLISHING

SV-07

HOSPITAL STATE

AG-00

CROPS

MF-09

CHEMICALS

SV-08

HOSPITAL PRIVATE

AG-02

LIVESTOCK

MF-10

PETROLEUM

SV-09

NURSING HOME

AG-03

SERVICES

MF-11

RUBBER & PLASTICS

SV-10

LEGAL SERVICES

AG-04

FORESTRY

MF-12

LEATHER PRODUCTS

SV-11

EDUCATIONAL SERVICES

AG-05

FISHING, HUNTING, TRAPPING

MF-13

STONE, CLAY, GLASS

SV-12

COLLEGE STATE

BK-00

BANKING & FINANCIAL

MF-14

PRIMARY METALS

SV-13

COLLEGE PRIVATE

BR-00

BROKERAGE FIRM

MF-15

FABRICATED METALS

SV-14

SOCIAL SERVICES

CM-00

COMMUNICATIONS

MF-16

INDUSTRIAL MACHINERY

SV-15

MANAGEMENT SERVICES

CO-00

CONSTRUCTION

MF-17

ELECTRONIC

TA-00

TRANSFER AGENT

CO-01

GENERAL CONTRACTORS

MF-18

TRANSPORTATION

TR-00

TRANSPORTATION

CO-02

HEAVY CONSTRUCTION

MF-19

INSTRUMENTS

TR-01

RAILROAD

CO-03

SPECIAL TRADES

MF-20

MISCELLANEOUS MANUFACTURING

TR-02

PASSENGER TRANSIT

CU-00

CREDIT UNIONS

MI-00

MINING

TR-03

TRUCKING & WAREHOUSING

GV-00

GOVERNMENT

MI-01

METAL

TR-04

US POSTAL SERVICE

GV-01

STATE

MI-02

COAL

TR-05

WATER TRANSPORTATION

GV-02

CITY/TOWN

MI-03

OIL & GAS

TR-06

AIR

GV-03

STATE COURTS

MI-04

NON-METALLIC MINERALS

UT-00

UTILITIES

GV-04

PROBATE COURTS

RE-00

REAL ESTATE

UT-01

PIPELINES EXCEPT NATURAL GAS

GV-05

POLICE DEPARTMENTS

RT-00

RETAIL

UT-02

TRANSPORTATION SERVICE

GV-06

PRISON

RT-01

BUILDING & GARDEN SUPPLIES

UT-03

COMMUNICATIONS

HO-00

HOLDING CORP, CONGLOMERATE

RT-02

GENERAL MERCHANDISE STORES

UT-04

ELECTRIC, GAS, SANITARY SERVICE

IH-00

INSURANCE (HEALTH)

RT-03

FOOD STORES

WS-00

WHOLESALE

IL-00

INSURANCE (LIFE)

RT-04

AUTOMOTIVE & SERVICE STATIONS

WS-01

WHOLESALE DURABLE

IO-00

INSURANCE (OTHER)

RT-05

APPAREL & ACCESSORY

WS-02

WHOLESALE NON DURABLE

IV-00

INVESTMENT COMPANY

RT-06

FURNITURE

ZZ-00

OTHER

LC-00

LOAN COMPANY

RT-07

EATING & DRINKING PLACES

MF-00

MANUFACTURING

RT-08

MISCELLANEOUS RETAIL

MF-01

FOOD

SV-00

SERVICES

MF-02

TOBACCO

SV-01

HOTELS & LODGING

MF-03

TEXTILE

SV-02

PERSONAL SERVICES

MF-04

APPAREL

SV-03

BUSINESS SERVICES

MF-05

WOOD PRODUCTS

SV-04

REPAIR SERVICES

MF-06

FURNITURE

SV-05

AMUSEMENT & RECREATION

MF-07

PAPER & ALLIED PRODUCTS

SV-06

HEALTH SERVICES

The State of Rhode Island has Exchange Agreements with the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Florida,

Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire,

New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West

Virginia, Wisconsin, Wyoming and the District of Columbia

UP-2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1