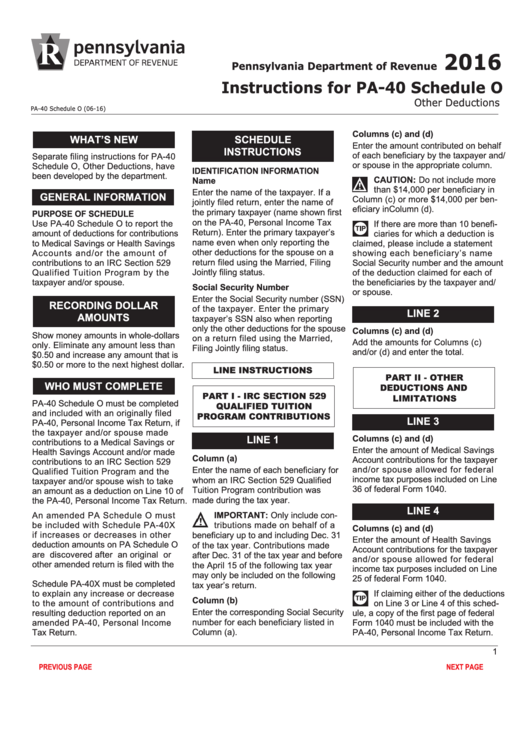

Instructions For Pa-40 Schedule O - Other Deductions - Pennsylvania Department Of Revenue - 2016

ADVERTISEMENT

2016

Pennsylvania Department of Revenue

Instructions for PA-40 Schedule O

Other Deductions

PA-40 Schedule O (06-16)

Columns (c) and (d)

WHAT’S NEW

SCHEDULE

Enter the amount contributed on behalf

INSTRUCTIONS

of each beneficiary by the taxpayer and/

Separate filing instructions for PA-40

or spouse in the appropriate column.

Schedule O, Other Deductions, have

IDENTIFICATION INFORMATION

been developed by the department.

CAUTION: Do not include more

Name

than $14,000 per beneficiary in

Enter the name of the taxpayer. If a

GENERAL INFORMATION

Column (c) or more $14,000 per ben-

jointly filed return, enter the name of

eficiary in Column (d).

the primary taxpayer (name shown first

PURPOSE OF SCHEDULE

on the PA-40, Personal Income Tax

Use PA-40 Schedule O to report the

If there are more than 10 benefi-

Return). Enter the primary taxpayer’s

amount of deductions for contributions

ciaries for which a deduction is

name even when only reporting the

to Medical Savings or Health Savings

claimed, please include a statement

other deductions for the spouse on a

Accounts and/or the amount of

showing each beneficiary’s name

contributions to an IRC Section 529

return filed using the Married, Filing

Social Security number and the amount

Qualified Tuition Program by the

Jointly filing status.

of the deduction claimed for each of

taxpayer and/or spouse.

the beneficiaries by the taxpayer and/

Social Security Number

or spouse.

Enter the Social Security number (SSN)

RECORDING DOLLAR

of the taxpayer. Enter the primary

LINE 2

AMOUNTS

taxpayer’s SSN also when reporting

only the other deductions for the spouse

Columns (c) and (d)

Show money amounts in whole-dollars

on a return filed using the Married,

Add the amounts for Columns (c)

only. Eliminate any amount less than

Filing Jointly filing status.

and/or (d) and enter the total.

$0.50 and increase any amount that is

$0.50 or more to the next highest dollar.

LINE INSTRUCTIONS

PART II - OTHER

WHO MUST COMPLETE

DEDUCTIONS AND

PART I - IRC SECTION 529

LIMITATIONS

PA-40 Schedule O must be completed

QUALIFIED TUITION

and included with an originally filed

PROGRAM CONTRIBUTIONS

LINE 3

PA-40, Personal Income Tax Return, if

the taxpayer and/or spouse made

LINE 1

Columns (c) and (d)

contributions to a Medical Savings or

Enter the amount of Medical Savings

Health Savings Account and/or made

Column (a)

Account contributions for the taxpayer

contributions to an IRC Section 529

and/or spouse allowed for federal

Enter the name of each beneficiary for

Qualified Tuition Program and the

income tax purposes included on Line

whom an IRC Section 529 Qualified

taxpayer and/or spouse wish to take

36 of federal Form 1040.

Tuition Program contribution was

an amount as a deduction on Line 10 of

made during the tax year.

the PA-40, Personal Income Tax Return.

LINE 4

IMPORTANT: Only include con-

An amended PA Schedule O must

be included with Schedule PA-40X

tributions made on behalf of a

Columns (c) and (d)

if increases or decreases in other

beneficiary up to and including Dec. 31

Enter the amount of Health Savings

deduction amounts on PA Schedule O

of the tax year. Contributions made

Account contributions for the taxpayer

are discovered after an original or

after Dec. 31 of the tax year and before

and/or spouse allowed for federal

other amended return is filed with the

the April 15 of the following tax year

income tax purposes included on Line

department. Part III on Page 2 of

may only be included on the following

25 of federal Form 1040.

Schedule PA-40X must be completed

tax year’s return.

to explain any increase or decrease

If claiming either of the deductions

Column (b)

to the amount of contributions and

on Line 3 or Line 4 of this sched-

Enter the corresponding Social Security

resulting deduction reported on an

ule, a copy of the first page of federal

number for each beneficiary listed in

amended PA-40, Personal Income

Form 1040 must be included with the

Tax Return.

Column (a).

PA-40, Personal Income Tax Return.

1

PREVIOUS PAGE

NEXT PAGE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2