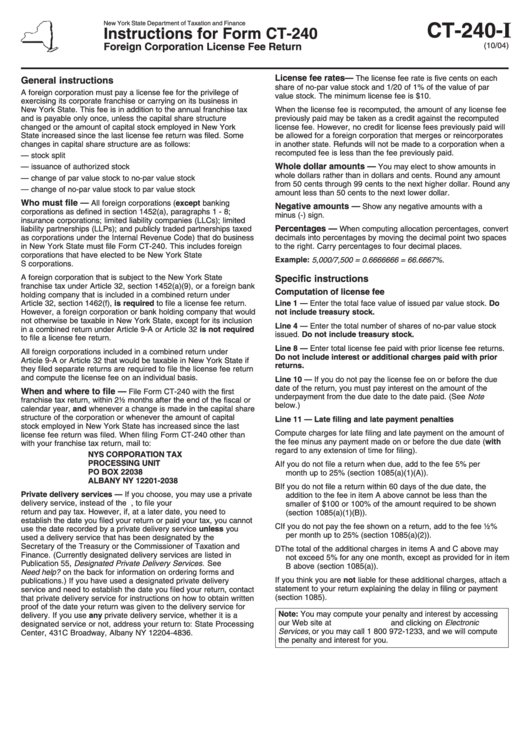

Instructions For Form Ct-240 - Foreign Corporation License Fee Return - New York State Department Of Taxation And Finance

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-240- I

Instructions for Form CT-240

Foreign Corporation License Fee Return

(10/04)

License fee rates —

The license fee rate is five cents on each

General instructions

share of no-par value stock and 1/20 of 1% of the value of par

A foreign corporation must pay a license fee for the privilege of

value stock. The minimum license fee is $10.

exercising its corporate franchise or carrying on its business in

New York State. This fee is in addition to the annual franchise tax

When the license fee is recomputed, the amount of any license fee

and is payable only once, unless the capital share structure

previously paid may be taken as a credit against the recomputed

changed or the amount of capital stock employed in New York

license fee. However, no credit for license fees previously paid will

State increased since the last license fee return was filed. Some

be allowed for a foreign corporation that merges or reincorporates

changes in capital share structure are as follows:

in another state. Refunds will not be made to a corporation when a

recomputed fee is less than the fee previously paid.

— stock split

Whole dollar amounts —

— issuance of authorized stock

You may elect to show amounts in

whole dollars rather than in dollars and cents. Round any amount

— change of par value stock to no-par value stock

from 50 cents through 99 cents to the next higher dollar. Round any

— change of no-par value stock to par value stock

amount less than 50 cents to the next lower dollar.

Who must file —

All foreign corporations (except banking

Negative amounts —

Show any negative amounts with a

corporations as defined in section 1452(a), paragraphs 1 - 8;

minus (-) sign.

insurance corporations; limited liability companies (LLCs); limited

Percentages —

liability partnerships (LLPs); and publicly traded partnerships taxed

When computing allocation percentages, convert

as corporations under the Internal Revenue Code) that do business

decimals into percentages by moving the decimal point two spaces

in New York State must file Form CT-240. This includes foreign

to the right. Carry percentages to four decimal places.

corporations that have elected to be New York State

Example: 5,000/7,500 = 0.6666666 = 66.6667%.

S corporations.

A foreign corporation that is subject to the New York State

Specific instructions

franchise tax under Article 32, section 1452(a)(9), or a foreign bank

Computation of license fee

holding company that is included in a combined return under

Article 32, section 1462(f), is required to file a license fee return.

Line 1 — Enter the total face value of issued par value stock. Do

However, a foreign corporation or bank holding company that would

not include treasury stock.

not otherwise be taxable in New York State, except for its inclusion

Line 4 — Enter the total number of shares of no-par value stock

in a combined return under Article 9-A or Article 32 is not required

issued. Do not include treasury stock.

to file a license fee return.

Line 8 — Enter total license fee paid with prior license fee returns.

All foreign corporations included in a combined return under

Do not include interest or additional charges paid with prior

Article 9-A or Article 32 that would be taxable in New York State if

returns.

they filed separate returns are required to file the license fee return

and compute the license fee on an individual basis.

Line 10 — If you do not pay the license fee on or before the due

date of the return, you must pay interest on the amount of the

When and where to file —

File Form CT-240 with the first

underpayment from the due date to the date paid. (See Note

franchise tax return, within 2½ months after the end of the fiscal or

below.)

calendar year, and whenever a change is made in the capital share

structure of the corporation or whenever the amount of capital

Line 11 — Late filing and late payment penalties

stock employed in New York State has increased since the last

Compute charges for late filing and late payment on the amount of

license fee return was filed. When filing Form CT-240 other than

the fee minus any payment made on or before the due date (with

with your franchise tax return, mail to:

regard to any extension of time for filing).

NYS CORPORATION TAX

PROCESSING UNIT

A If you do not file a return when due, add to the fee 5% per

PO BOX 22038

month up to 25% (section 1085(a)(1)(A)).

ALBANY NY 12201-2038

B If you do not file a return within 60 days of the due date, the

Private delivery services — If you choose, you may use a private

addition to the fee in item A above cannot be less than the

delivery service, instead of the U.S. Postal Service, to file your

smaller of $100 or 100% of the amount required to be shown

return and pay tax. However, if, at a later date, you need to

(section 1085(a)(1)(B)).

establish the date you filed your return or paid your tax, you cannot

C If you do not pay the fee shown on a return, add to the fee ½%

use the date recorded by a private delivery service unless you

per month up to 25% (section 1085(a)(2)).

used a delivery service that has been designated by the U.S.

Secretary of the Treasury or the Commissioner of Taxation and

D The total of the additional charges in items A and C above may

Finance. (Currently designated delivery services are listed in

not exceed 5% for any one month, except as provided for in item

Publication 55, Designated Private Delivery Services. See

B above (section 1085(a)).

Need help? on the back for information on ordering forms and

If you think you are not liable for these additional charges, attach a

publications.) If you have used a designated private delivery

statement to your return explaining the delay in filing or payment

service and need to establish the date you filed your return, contact

(section 1085).

that private delivery service for instructions on how to obtain written

proof of the date your return was given to the delivery service for

Note: You may compute your penalty and interest by accessing

delivery. If you use any private delivery service, whether it is a

our Web site at and clicking on Electronic

designated service or not, address your return to: State Processing

Services, or you may call 1 800 972-1233, and we will compute

Center, 431C Broadway, Albany NY 12204-4836.

the penalty and interest for you.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2