Instructions For Form Ct-60-Qsss - Affiliated Entity Information Schedule - New York State Department Of Taxation And Finance - 2004

ADVERTISEMENT

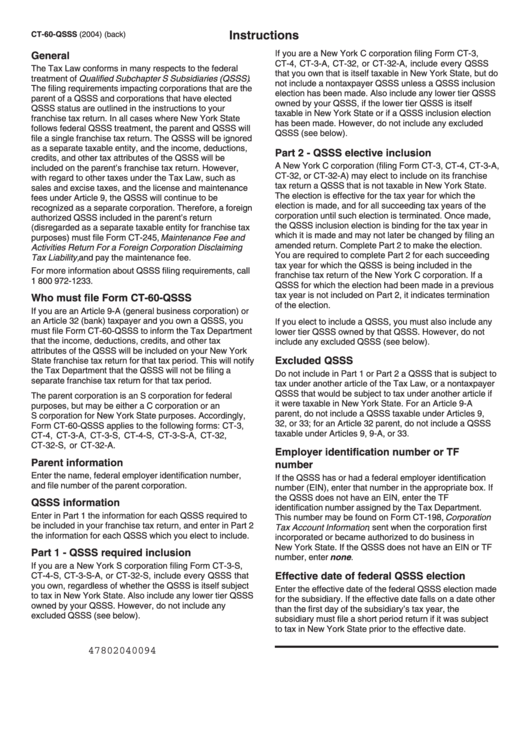

Instructions

CT-60-QSSS (2004) (back)

If you are a New York C corporation filing Form CT-3,

General

CT-4, CT-3-A, CT-32, or CT-32-A, include every QSSS

The Tax Law conforms in many respects to the federal

that you own that is itself taxable in New York State, but do

treatment of Qualified Subchapter S Subsidiaries (QSSS) .

not include a nontaxpayer QSSS unless a QSSS inclusion

The filing requirements impacting corporations that are the

election has been made. Also include any lower tier QSSS

parent of a QSSS and corporations that have elected

owned by your QSSS, if the lower tier QSSS is itself

QSSS status are outlined in the instructions to your

taxable in New York State or if a QSSS inclusion election

franchise tax return. In all cases where New York State

has been made. However, do not include any excluded

follows federal QSSS treatment, the parent and QSSS will

QSSS (see below).

file a single franchise tax return. The QSSS will be ignored

as a separate taxable entity, and the income, deductions,

Part 2 - QSSS elective inclusion

credits, and other tax attributes of the QSSS will be

A New York C corporation (filing Form CT-3, CT-4, CT-3-A,

included on the parent’s franchise tax return. However,

CT-32, or CT-32-A) may elect to include on its franchise

with regard to other taxes under the Tax Law, such as

tax return a QSSS that is not taxable in New York State.

sales and excise taxes, and the license and maintenance

The election is effective for the tax year for which the

fees under Article 9, the QSSS will continue to be

election is made, and for all succeeding tax years of the

recognized as a separate corporation. Therefore, a foreign

corporation until such election is terminated. Once made,

authorized QSSS included in the parent’s return

the QSSS inclusion election is binding for the tax year in

(disregarded as a separate taxable entity for franchise tax

which it is made and may not later be changed by filing an

purposes) must file Form CT-245, Maintenance Fee and

amended return. Complete Part 2 to make the election.

Activities Return For a Foreign Corporation Disclaiming

You are required to complete Part 2 for each succeeding

Tax Liability, and pay the maintenance fee.

tax year for which the QSSS is being included in the

For more information about QSSS filing requirements, call

franchise tax return of the New York C corporation. If a

1 800 972-1233.

QSSS for which the election had been made in a previous

tax year is not included on Part 2, it indicates termination

Who must file Form CT-60-QSSS

of the election.

If you are an Article 9-A (general business corporation) or

an Article 32 (bank) taxpayer and you own a QSSS, you

If you elect to include a QSSS, you must also include any

must file Form CT-60-QSSS to inform the Tax Department

lower tier QSSS owned by that QSSS. However, do not

that the income, deductions, credits, and other tax

include any excluded QSSS (see below).

attributes of the QSSS will be included on your New York

Excluded QSSS

State franchise tax return for that tax period. This will notify

the Tax Department that the QSSS will not be filing a

Do not include in Part 1 or Part 2 a QSSS that is subject to

separate franchise tax return for that tax period.

tax under another article of the Tax Law, or a nontaxpayer

QSSS that would be subject to tax under another article if

The parent corporation is an S corporation for federal

it were taxable in New York State. For an Article 9-A

purposes, but may be either a C corporation or an

parent, do not include a QSSS taxable under Articles 9,

S corporation for New York State purposes. Accordingly,

32, or 33; for an Article 32 parent, do not include a QSSS

Form CT-60-QSSS applies to the following forms: CT-3,

taxable under Articles 9, 9-A, or 33.

CT-4, CT-3-A, CT-3-S, CT-4-S, CT-3-S-A, CT-32,

CT-32-S, or CT-32-A.

Employer identification number or TF

Parent information

number

Enter the name, federal employer identification number,

If the QSSS has or had a federal employer identification

and file number of the parent corporation.

number (EIN), enter that number in the appropriate box. If

the QSSS does not have an EIN, enter the TF

QSSS information

identification number assigned by the Tax Department.

Enter in Part 1 the information for each QSSS required to

This number may be found on Form CT-198, Corporation

be included in your franchise tax return, and enter in Part 2

Tax Account Information , sent when the corporation first

the information for each QSSS which you elect to include.

incorporated or became authorized to do business in

New York State. If the QSSS does not have an EIN or TF

Part 1 - QSSS required inclusion

number, enter none .

If you are a New York S corporation filing Form CT-3-S,

Effective date of federal QSSS election

CT-4-S, CT-3-S-A, or CT-32-S, include every QSSS that

you own, regardless of whether the QSSS is itself subject

Enter the effective date of the federal QSSS election made

to tax in New York State. Also include any lower tier QSSS

for the subsidiary. If the effective date falls on a date other

owned by your QSSS. However, do not include any

than the first day of the subsidiary’s tax year, the

excluded QSSS (see below).

subsidiary must file a short period return if it was subject

to tax in New York State prior to the effective date.

47802040094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1