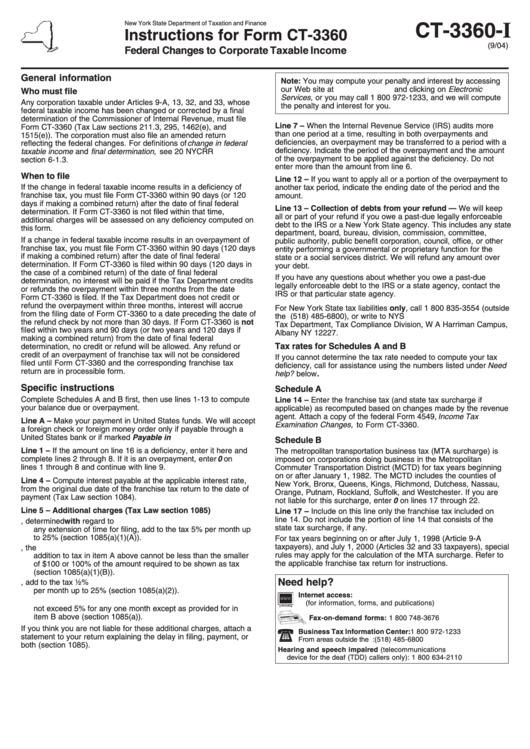

Instructions For Form Ct-3360 - Federal Changes To Corporate Taxable Income - New York State Department Of Taxation And Finance

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-3360- I

Instructions for Form CT-3360

(9/04)

Federal Changes to Corporate Taxable Income

General information

Note: You may compute your penalty and interest by accessing

our Web site at and clicking on Electronic

Who must file

Services, or you may call 1 800 972-1233, and we will compute

Any corporation taxable under Articles 9-A, 13, 32, and 33, whose

the penalty and interest for you.

federal taxable income has been changed or corrected by a final

determination of the Commissioner of Internal Revenue, must file

Line 7 – When the Internal Revenue Service (IRS) audits more

Form CT-3360 (Tax Law sections 211.3, 295, 1462(e), and

than one period at a time, resulting in both overpayments and

1515(e)). The corporation must also file an amended return

deficiencies, an overpayment may be transferred to a period with a

reflecting the federal changes. For definitions of change in federal

deficiency. Indicate the period of the overpayment and the amount

taxable income and final determination, see 20 NYCRR

of the overpayment to be applied against the deficiency. Do not

section 6-1.3.

enter more than the amount from line 6.

When to file

Line 12 – If you want to apply all or a portion of the overpayment to

If the change in federal taxable income results in a deficiency of

another tax period, indicate the ending date of the period and the

franchise tax, you must file Form CT-3360 within 90 days (or 120

amount.

days if making a combined return) after the date of final federal

Line 13 – Collection of debts from your refund — We will keep

determination. If Form CT-3360 is not filed within that time,

all or part of your refund if you owe a past-due legally enforceable

additional charges will be assessed on any deficiency computed on

debt to the IRS or a New York State agency. This includes any state

this form.

department, board, bureau, division, commission, committee,

If a change in federal taxable income results in an overpayment of

public authority, public benefit corporation, council, office, or other

franchise tax, you must file Form CT-3360 within 90 days (120 days

entity performing a governmental or proprietary function for the

if making a combined return) after the date of final federal

state or a social services district. We will refund any amount over

determination. If Form CT-3360 is filed within 90 days (120 days in

your debt.

the case of a combined return) of the date of final federal

If you have any questions about whether you owe a past-due

determination, no interest will be paid if the Tax Department credits

legally enforceable debt to the IRS or a state agency, contact the

or refunds the overpayment within three months from the date

IRS or that particular state agency.

Form CT-3360 is filed. If the Tax Department does not credit or

refund the overpayment within three months, interest will accrue

For New York State tax liabilities only, call 1 800 835-3554 (outside

from the filing date of Form CT-3360 to a date preceding the date of

the U.S. and outside Canada call (518) 485-6800), or write to NYS

the refund check by not more than 30 days. If Form CT-3360 is not

Tax Department, Tax Compliance Division, W A Harriman Campus,

filed within two years and 90 days (or two years and 120 days if

Albany NY 12227.

making a combined return) from the date of final federal

Tax rates for Schedules A and B

determination, no credit or refund will be allowed. Any refund or

credit of an overpayment of franchise tax will not be considered

If you cannot determine the tax rate needed to compute your tax

filed until Form CT-3360 and the corresponding franchise tax

deficiency, call for assistance using the numbers listed under Need

return are in processible form.

help? below .

Specific instructions

Schedule A

Complete Schedules A and B first, then use lines 1-13 to compute

Line 14 – Enter the franchise tax (and state tax surcharge if

your balance due or overpayment.

applicable) as recomputed based on changes made by the revenue

agent. Attach a copy of the federal Form 4549, Income Tax

Line A – Make your payment in United States funds. We will accept

Examination Changes, to Form CT-3360.

a foreign check or foreign money order only if payable through a

United States bank or if marked Payable in U.S. Funds.

Schedule B

Line 1 – If the amount on line 16 is a deficiency, enter it here and

The metropolitan transportation business tax (MTA surcharge) is

complete lines 2 through 8. If it is an overpayment, enter 0 on

imposed on corporations doing business in the Metropolitan

lines 1 through 8 and continue with line 9.

Commuter Transportation District (MCTD) for tax years beginning

on or after January 1, 1982. The MCTD includes the counties of

Line 4 – Compute interest payable at the applicable interest rate,

New York, Bronx, Queens, Kings, Richmond, Dutchess, Nassau,

from the original due date of the franchise tax return to the date of

Orange, Putnam, Rockland, Suffolk, and Westchester. If you are

payment (Tax Law section 1084).

not liable for this surcharge, enter 0 on lines 17 through 22.

Line 5 – Additional charges (Tax Law section 1085)

Line 17 – Include on this line only the franchise tax included on

line 14. Do not include the portion of line 14 that consists of the

A. If you do not file a return when due, determined with regard to

state tax surcharge, if any.

any extension of time for filing, add to the tax 5% per month up

to 25% (section 1085(a)(1)(A)).

For tax years beginning on or after July 1, 1998 (Article 9-A

taxpayers), and July 1, 2000 (Articles 32 and 33 taxpayers), special

B. If you do not file a return within 60 days of the due date, the

rules may apply for the calculation of the MTA surcharge. Refer to

addition to tax in item A above cannot be less than the smaller

the applicable franchise tax return for instructions.

of $100 or 100% of the amount required to be shown as tax

(section 1085(a)(1)(B)).

Need help?

C. If you do not pay the tax shown on a return, add to the tax ½%

per month up to 25% (section 1085(a)(2)).

Internet access:

D. The total of the additional charges in items A and C above may

(for information, forms, and publications)

not exceed 5% for any one month except as provided for in

item B above (section 1085(a)).

Fax-on-demand forms:

1 800 748-3676

If you think you are not liable for these additional charges, attach a

Business Tax Information Center:

1 800 972-1233

statement to your return explaining the delay in filing, payment, or

From areas outside the U.S. and outside Canada:

(518) 485-6800

both (section 1085).

Hearing and speech impaired (telecommunications

device for the deaf (TDD) callers only):

1 800 634-2110

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1