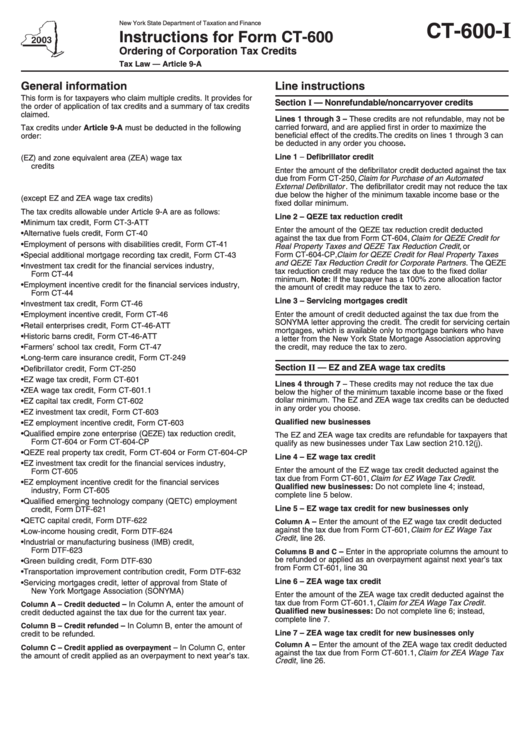

Instructions For Form Ct-600 - Ordering Of Corporation Tax Credits - New York State Department Of Taxation And Finance - 2003

ADVERTISEMENT

New York State Department of Taxation and Finance

I

CT-600-

Instructions for Form CT-600

Ordering of Corporation Tax Credits

Tax Law — Article 9-A

General information

Line instructions

This form is for taxpayers who claim multiple credits. It provides for

Section I — Nonrefundable/noncarryover credits

the order of application of tax credits and a summary of tax credits

claimed.

Lines 1 through 3 – These credits are not refundable, may not be

carried forward, and are applied first in order to maximize the

Tax credits under Article 9-A must be deducted in the following

beneficial effect of the credits. The credits on lines 1 through 3 can

order:

be deducted in any order you choose.

1. Noncarryover credits that are not refundable

Line 1 – Defibrillator credit

2. Empire zone (EZ) and zone equivalent area (ZEA) wage tax

credits

Enter the amount of the defibrillator credit deducted against the tax

3. Carryover credits of limited duration

due from Form CT-250, Claim for Purchase of an Automated

External Defibrillator . The defibrillator credit may not reduce the tax

4. Carryover credits of unlimited duration

due below the higher of the minimum taxable income base or the

5. Refundable credits (except EZ and ZEA wage tax credits)

fixed dollar minimum.

The tax credits allowable under Article 9-A are as follows:

Line 2 – QEZE tax reduction credit

• Minimum tax credit, Form CT-3-ATT

Enter the amount of the QEZE tax reduction credit deducted

• Alternative fuels credit, Form CT-40

against the tax due from Form CT-604, Claim for QEZE Credit for

• Employment of persons with disabilities credit, Form CT-41

Real Property Taxes and QEZE Tax Reduction Credit, or

Form CT-604-CP, Claim for QEZE Credit for Real Property Taxes

• Special additional mortgage recording tax credit, Form CT-43

and QEZE Tax Reduction Credit for Corporate Partners . The QEZE

• Investment tax credit for the financial services industry,

tax reduction credit may reduce the tax due to the fixed dollar

Form CT-44

minimum. Note: If the taxpayer has a 100% zone allocation factor

• Employment incentive credit for the financial services industry,

the amount of credit may reduce the tax to zero.

Form CT-44

Line 3 – Servicing mortgages credit

• Investment tax credit, Form CT-46

Enter the amount of credit deducted against the tax due from the

• Employment incentive credit, Form CT-46

SONYMA letter approving the credit. The credit for servicing certain

• Retail enterprises credit, Form CT-46-ATT

mortgages, which is available only to mortgage bankers who have

• Historic barns credit, Form CT-46-ATT

a letter from the New York State Mortgage Association approving

• Farmers’ school tax credit, Form CT-47

the credit, may reduce the tax to zero.

• Long-term care insurance credit, Form CT-249

Section II — EZ and ZEA wage tax credits

• Defibrillator credit, Form CT-250

• EZ wage tax credit, Form CT-601

Lines 4 through 7 – These credits may not reduce the tax due

• ZEA wage tax credit, Form CT-601.1

below the higher of the minimum taxable income base or the fixed

dollar minimum. The EZ and ZEA wage tax credits can be deducted

• EZ capital tax credit, Form CT-602

in any order you choose.

• EZ investment tax credit, Form CT-603

Qualified new businesses

• EZ employment incentive credit, Form CT-603

• Qualified empire zone enterprise (QEZE) tax reduction credit,

The EZ and ZEA wage tax credits are refundable for taxpayers that

Form CT-604 or Form CT-604-CP

qualify as new businesses under Tax Law section 210.12(j).

• QEZE real property tax credit, Form CT-604 or Form CT-604-CP

Line 4 – EZ wage tax credit

• EZ investment tax credit for the financial services industry,

Enter the amount of the EZ wage tax credit deducted against the

Form CT-605

tax due from Form CT-601, Claim for EZ Wage Tax Credit.

• EZ employment incentive credit for the financial services

Qualified new businesses: Do not complete line 4; instead,

industry, Form CT-605

complete line 5 below.

• Qualified emerging technology company (QETC) employment

Line 5 – EZ wage tax credit for new businesses only

credit, Form DTF-621

• QETC capital credit, Form DTF-622

– Enter the amount of the EZ wage tax credit deducted

Column A

against the tax due from Form CT-601, Claim for EZ Wage Tax

• Low-income housing credit, Form DTF-624

Credit , line 26.

• Industrial or manufacturing business (IMB) credit,

Form DTF-623

– Enter in the appropriate columns the amount to

Columns B and C

be refunded or applied as an overpayment against next year’s tax

• Green building credit, Form DTF-630

from Form CT-601, line 30 .

• Transportation improvement contribution credit, Form DTF-632

Line 6 – ZEA wage tax credit

• Servicing mortgages credit, letter of approval from State of

New York Mortgage Association (SONYMA)

Enter the amount of the ZEA wage tax credit deducted against the

tax due from Form CT-601.1, Claim for ZEA Wage Tax Credit .

– In Column A, enter the amount of

Column A – Credit deducted

Qualified new businesses: Do not complete line 6; instead,

credit deducted against the tax due for the current tax year.

complete line 7.

– In Column B, enter the amount of

Column B – Credit refunded

Line 7 – ZEA wage tax credit for new businesses only

credit to be refunded.

Column A

– Enter the amount of the ZEA wage tax credit deducted

Column C – Credit applied as overpayment

– In Column C, enter

against the tax due from Form CT-601.1, Claim for ZEA Wage Tax

the amount of credit applied as an overpayment to next year’s tax.

Credit , line 26.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4