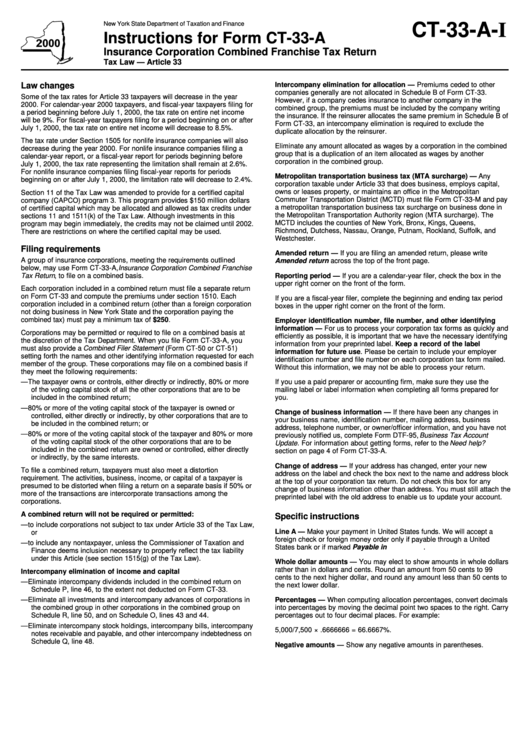

Instructions For Form Ct-33-A - Insurance Corporation Combined Franchise Tax Return - 2000

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-33-A-I

Instructions for Form CT-33-A

Insurance Corporation Combined Franchise Tax Return

Tax Law — Article 33

Intercompany elimination for allocation — Premiums ceded to other

Law changes

companies generally are not allocated in Schedule B of Form CT-33.

Some of the tax rates for Article 33 taxpayers will decrease in the year

However, if a company cedes insurance to another company in the

2000. For calendar-year 2000 taxpayers, and fiscal-year taxpayers filing for

combined group, the premiums must be included by the company writing

a period beginning before July 1, 2000, the tax rate on entire net income

the insurance. If the reinsurer allocates the same premium in Schedule B of

will be 9%. For fiscal-year taxpayers filing for a period beginning on or after

Form CT-33, an intercompany elimination is required to exclude the

July 1, 2000, the tax rate on entire net income will decrease to 8.5%.

duplicate allocation by the reinsurer.

The tax rate under Section 1505 for nonlife insurance companies will also

Eliminate any amount allocated as wages by a corporation in the combined

decrease during the year 2000. For nonlife insurance companies filing a

group that is a duplication of an item allocated as wages by another

calendar-year report, or a fiscal-year report for periods beginning before

corporation in the combined group.

July 1, 2000, the tax rate representing the limitation shall remain at 2.6%.

For nonlife insurance companies filing fiscal-year reports for periods

Metropolitan transportation business tax (MTA surcharge) — Any

beginning on or after July 1, 2000, the limitation rate will decrease to 2.4%.

corporation taxable under Article 33 that does business, employs capital,

owns or leases property, or maintains an office in the Metropolitan

Section 11 of the Tax Law was amended to provide for a certified capital

Commuter Transportation District (MCTD) must file Form CT-33-M and pay

company (CAPCO) program 3. This program provides $150 million dollars

a metropolitan transportation business tax surcharge on business done in

of certified capital which may be allocated and allowed as tax credits under

the Metropolitan Transportation Authority region (MTA surcharge). The

sections 11 and 1511(k) of the Tax Law. Although investments in this

MCTD includes the counties of New York, Bronx, Kings, Queens,

program may begin immediately, the credits may not be claimed until 2002.

Richmond, Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and

There are restrictions on where the certified capital may be used.

Westchester.

Filing requirements

Amended return — If you are filing an amended return, please write

A group of insurance corporations, meeting the requirements outlined

Amended return across the top of the front page.

below, may use Form CT-33-A, Insurance Corporation Combined Franchise

Tax Return , to file on a combined basis.

Reporting period — If you are a calendar-year filer, check the box in the

upper right corner on the front of the form.

Each corporation included in a combined return must file a separate return

on Form CT-33 and compute the premiums under section 1510. Each

If you are a fiscal-year filer, complete the beginning and ending tax period

corporation included in a combined return (other than a foreign corporation

boxes in the upper right corner on the front of the form.

not doing business in New York State and the corporation paying the

combined tax) must pay a minimum tax of $250.

Employer identification number, file number, and other identifying

information — For us to process your corporation tax forms as quickly and

Corporations may be permitted or required to file on a combined basis at

efficiently as possible, it is important that we have the necessary identifying

the discretion of the Tax Department. When you file Form CT-33-A, you

information from your preprinted label. Keep a record of the label

must also provide a Combined Filer Statement (Form CT-50 or CT-51)

information for future use. Please be certain to include your employer

setting forth the names and other identifying information requested for each

identification number and file number on each corporation tax form mailed.

member of the group. These corporations may file on a combined basis if

Without this information, we may not be able to process your return.

they meet the following requirements:

— The taxpayer owns or controls, either directly or indirectly, 80% or more

If you use a paid preparer or accounting firm, make sure they use the

of the voting capital stock of all the other corporations that are to be

mailing label or label information when completing all forms prepared for

included in the combined return;

you.

— 80% or more of the voting capital stock of the taxpayer is owned or

Change of business information — If there have been any changes in

controlled, either directly or indirectly, by other corporations that are to

your business name, identification number, mailing address, business

be included in the combined return; or

address, telephone number, or owner/officer information, and you have not

— 80% or more of the voting capital stock of the taxpayer and 80% or more

previously notified us, complete Form DTF-95, Business Tax Account

of the voting capital stock of the other corporations that are to be

Update . For information about getting forms, refer to the Need help?

included in the combined return are owned or controlled, either directly

section on page 4 of Form CT-33-A.

or indirectly, by the same interests.

Change of address — If your address has changed, enter your new

To file a combined return, taxpayers must also meet a distortion

address on the label and check the box next to the name and address block

requirement. The activities, business, income, or capital of a taxpayer is

at the top of your corporation tax return. Do not check this box for any

presumed to be distorted when filing a return on a separate basis if 50% or

change of business information other than address. You must still attach the

more of the transactions are intercorporate transactions among the

preprinted label with the old address to enable us to update your account.

corporations.

A combined return will not be required or permitted:

Specific instructions

— to include corporations not subject to tax under Article 33 of the Tax Law,

Line A — Make your payment in United States funds. We will accept a

or

foreign check or foreign money order only if payable through a United

— to include any nontaxpayer, unless the Commissioner of Taxation and

States bank or if marked Payable in U.S. funds .

Finance deems inclusion necessary to properly reflect the tax liability

under this Article (see section 1515(g) of the Tax Law).

Whole dollar amounts — You may elect to show amounts in whole dollars

rather than in dollars and cents. Round an amount from 50 cents to 99

Intercompany elimination of income and capital

cents to the next higher dollar, and round any amount less than 50 cents to

— Eliminate intercompany dividends included in the combined return on

the next lower dollar.

Schedule P, line 46, to the extent not deducted on Form CT-33.

— Eliminate all investments and intercompany advances of corporations in

Percentages — When computing allocation percentages, convert decimals

the combined group in other corporations in the combined group on

into percentages by moving the decimal point two spaces to the right. Carry

Schedule R, line 50, and on Schedule O, lines 43 and 44.

percentages out to four decimal places. For example:

— Eliminate intercompany stock holdings, intercompany bills, intercompany

5,000/7,500 × .6666666 = 66.6667%.

notes receivable and payable, and other intercompany indebtedness on

Schedule Q, line 48.

Negative amounts — Show any negative amounts in parentheses.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3