Form 718-U - Residential And Commercial Utility Services - State Of New York Page 5

ADVERTISEMENT

Publication 718-U (6/01) Page 5 of 5

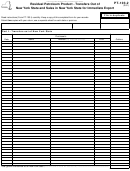

Reduced rate

applicable to certain

Nonresidential gas,

Reduced rate applicable to

transportation and

electricity, and steam; and

certain transportation and

Residential gas,

delivery charges for

Residential coal, fuel

all sales of refrigeration,

delivery charges for

electricity, and

residential gas and

oil, and wood (for

and telephone or telegraph

nonresidential

Locality

steam services

electricity*

heating)

services

gas and electricity*

Westchester County

(continued)

New Rochelle

6%

4 ½%

3%

11 ¼%

8

7

/

%

16

School District

(city of New Rochelle)

White Plains School

5 ½%

4

1

/

%

2 ½%

10 ¾%

8

1

/

%

8

16

District

(city of White Plains)

3

City of Mount Vernon

4%

3%

4%

8 ¼%

6

/

%

16

City of Yonkers

4%

3%

4%

8 ¼%

6

3

/

%

16

Wyoming County

Not taxed.

Not taxed.

Not taxed.

8%

6%

Yates County

Not taxed.

Not taxed.

Not taxed.

7%

5 ¼%

New York City

3

4%

3%

4%

8 ¼%

6

/

%

16

*The rate on transportation and delivery charges for both residential and nonresidential gas and electric will be phased down to 0% on

September 1, 2003.

The following paragraphs explain the applicable utility services:

Telephone services:

Applicable for both residential and commercial customers. These services include telephone answering

and telegraph services and are subject to state, local, and any additional school district** taxes where

applicable.

Nonresidential utility services:

For commercial customers. This includes gas, electric, steam, and refrigeration services, and gas,

electricity, steam, and refrigeration. These are subject to state, local, and any additional school district**

taxes where applicable. (Note: There is a reduced rate on sales tax for certain transportation and

delivery of natural gas and electricity; see column 6 of the rate table. There is no reduction for the

transportation and delivery of steam or refrigeration services.)

Residential utility services:

Applicable for residential customers. This includes gas, electric, steam, and refrigeration services, and

gas, electricity, steam, and refrigeration. These are subject to state, local, and any additional school

district** taxes where applicable. (Note: There is a reduced rate on sales tax for certain transportation

and delivery of natural gas and electricity; see column 6 of the rate table. There is no reduction for the

transportation and delivery of steam or refrigeration services.)

Coal, wood, and fuel oil:

For commercial customers, these commodities are subject to state and local taxes, but not any additional

school district taxes. (Note: There is no reduction for the transportation and delivery of these items.)

For residential customers, these commodities are exempt from state and any additional school district

taxes, but are taxable for certain localities. (Note: There is no reduction for the transportation and

delivery of these items.)

** School districts instituting additional taxes: Albany, Cohoes, Watervliet, Hudson, Lackawanna, Gloversville, Johnstown, Batavia,

Watertown, Glen Cove, Long Beach, Niagara Falls, Utica, Middletown, Ogdensburg, Schenectady, Hornell, New Rochelle, and White Plains.

Note: The rates shown on the table are effective as of June 1, 2001, and are subject to change.

Need help?

Internet access:

Telephone assistance is available from 8:30 a.m. to 4:25 p.m.

Persons with disabilities: In compliance with the Americans with

(eastern time), Monday through Friday.

Disabilities Act, we will ensure that our lobbies, offices, meeting

Business Tax information: 1 800 972-1233

rooms, and other facilities are accessible to persons with disabilities. If

Forms and publications: 1 800 462-8100

you have questions about special accommodations for persons with

From outside the U.S. and outside Canada: (518) 485-6800

disabilities, please call 1 800 225-5829.

Fax-on-demand forms: 1 800 748-3676

Hearing and speech impaired (telecommunications device for the

If you need to write, address your letter to: NYS Tax Department,

deaf (TDD) callers only): 1 800 634-2110 (8:30 a.m. to 4:25 p.m.,

Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

eastern time)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5