Form Sr-1 2005 Page 2

ADVERTISEMENT

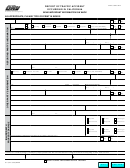

Amount Outstanding

As of:

As Adjusted

As Adjusted

/

/

(date)

Minimum

Maximum

Debt:

Short-term debt

(average interest rate

%)

$

$

$

Long-term debt

(average interest rate

%)

$

$

$

Total debt

$

$

$

Stockholders equity (deficit):

Preferred stock – par or stated value

(by class of preferred – in

order of preferences)

$

$

$

$

$

$

$

$

$

Common stock – par or

stated value

$

$

$

Additional paid in capital

$

$

$

Retained earnings (deficit)

$

$

$

Total stockholders equity (deficit)

$

$

$

Total Capitalization

$

$

$

9.

Summary of Earnings

A. Furnish a statement of income in comparative form for the latest three fiscal years (or since inception of the company if less than

three years).

B. Where the latest fiscal year ended more than 120 days prior to the date on which the registration statement is filed with the Missouri

Securities Division, also include statements of income for the interim period from the end of the fiscal year to the date of the latest

balance sheet required to be presented and for the same interim period during the prior fiscal year.

C. This statement should be presented in condensed form, but with specific exposure for provision for losses and interest expense, in

addition to other accounts of revenue and expense. If common stock is being registered, state earnings per share for shares presently

outstanding and on a fully-diluted basis, indicating the amount applicable to extraordinary items, if any, and total earnings per share.

Also, indicate dividends paid per share, if any.

D. Where long-term debt or preferred stock is being registered, a statement of the annual interest or dividend requirements should be

made in the text. In the case of an offering of long-term debt, include the ratio of earnings to fixed charges for the securities presently

outstanding and on a pro forma basis, assuming all securities offered are sold and the proceeds used as specified.

E. Indicate in an introductory paragraph to the statement of income the following items: the periods covered by the independent accoun-

tant’s opinion; unaudited periods, assurance that unaudited periods reflect the adjustments necessary for a fair presentation on a com-

parative basis; restatement of prior year’s net income; changes in the components if a consolidated group; changes in accounting prin-

ciples; a discussion of the significance of the results for the interim period in forecasting results for the full fiscal period, including

the presence or absence of particular factors during any period; and a reference to the other financial statements and their related

notes which appear elsewhere in the prospectus.

F. Any such adjustments, restatements and changes referred to should be described in full supplementally.

G. Immediately following the statement of income, insert a paragraph, if appropriate for comprehension of the statement, discussing the

significance of any information contained therein, including, for example, an explanation of any significant variation from year to

year of sales, net earnings or any other item.

6

FORM SR-1 (01-05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3