Personal Income Tax Appeal Decision Form - California State Board Of Equalization

ADVERTISEMENT

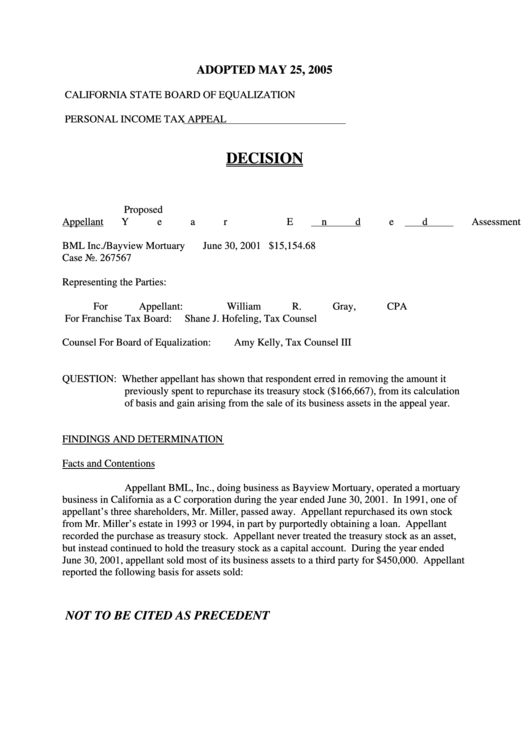

ADOPTED MAY 25, 2005

CALIFORNIA STATE BOARD OF EQUALIZATION

PERSONAL INCOME TAX APPEAL

DECISION

Proposed

Appellant

Year Ended

Assessment

BML Inc./Bayview Mortuary

June 30, 2001

$15,154.68

Case No. 267567

Representing the Parties:

For Appellant:

William R. Gray, CPA

For Franchise Tax Board:

Shane J. Hofeling, Tax Counsel

Counsel For Board of Equalization:

Amy Kelly, Tax Counsel III

QUESTION: Whether appellant has shown that respondent erred in removing the amount it

previously spent to repurchase its treasury stock ($166,667), from its calculation

of basis and gain arising from the sale of its business assets in the appeal year.

FINDINGS AND DETERMINATION

Facts and Contentions

Appellant BML, Inc., doing business as Bayview Mortuary, operated a mortuary

business in California as a C corporation during the year ended June 30, 2001. In 1991, one of

appellant’s three shareholders, Mr. Miller, passed away. Appellant repurchased its own stock

from Mr. Miller’s estate in 1993 or 1994, in part by purportedly obtaining a loan. Appellant

recorded the purchase as treasury stock. Appellant never treated the treasury stock as an asset,

but instead continued to hold the treasury stock as a capital account. During the year ended

June 30, 2001, appellant sold most of its business assets to a third party for $450,000. Appellant

reported the following basis for assets sold:

NOT TO BE CITED AS PRECEDENT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4