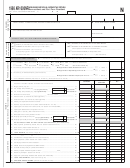

Form N-15 (Rev. 2005)

Page 3 of 4

Your Social Security Number

Your Spouse's SSN

!!! !! !!!!

!!! !! !!!!

}

Name(s) as shown on return

_____________________________________________________

MF053

33

First $2,594 of military reserve or Hawaii national

guard duty pay.............................................................

33l

34

Exceptional trees deduction (attach affidavit)

(see page 19 of the Instructions) ................................

34l

➤

35

Add lines 21 through 34 ...........Total Adjustments

35l

-

-

If negative number, place a minus sign (-)

If negative number, place a minus sign (-)

➤

l36l

36

Line 20 minus line 35 ......Adjusted Gross Income

!.!!

37

Ratio of Hawaii AGI to Total AGI.

Divide line 36, Column B, by line 36, Column A (Compute to 3 decimal places and round to 2 decimal places) .............

37l

•

CAUTION: If you can be claimed as a dependent on another person’s return, fill in this oval

and see the Instructions on page 19.

38

If you do not itemize deductions, enter zero on line 39 and go to line 40a.

Otherwise go to page 19 of the Instructions and enter your Hawaii itemized deductions here.

38a

Medical and dental expenses

TOTAL ITEMIZED

DEDUCTIONS

(from Worksheet NR-1 or PY-1)

....................................38al

39

If line 36, Column B is more than

38b

Taxes (from Worksheet NR-2 or PY-2)

.........................38bl

$100,000 ($50,000 for married

filing separately), see the

38c

Interest expense (from Worksheet NR-3 or

PY-3).........38cl

worksheet on page 40 of the

Instructions. If not, add lines 38a

38d

Contributions (from Worksheet NR-4 or

PY-4)..............38dl

through 38f. Enter total here and

38e

Casualty and theft losses

go to line 41

(from Worksheet NR-5 or PY-5)

....................................38el

38f

Miscellaneous deductions

(from Worksheet NR-6 or PY-6)

.....................................38fl

40a

If you checked filing status box:

[

]

1, enter $1,500

3, enter $950

Prorated Standard Deduction

2 or 5, enter $1,900

4, enter $1,650

..................40a

Multiply line 40a by the ratio on line 37 ..................................................................................... ➤

40b

40bl

If negative number, place a minus sign (-)

-

41

Line 36, Column B minus line 39 or 40b, whichever applies. (This line MUST be filled in)...........

41l

42a

Multiply $1,040 by the total number of exemptions claimed on line 6e. If you and/or your spouse are blind, deaf, or disabled,

=

=

•

•

fill in the applicable oval(s)

Yourself

Spouse

and see page 25 of the Instructions

................................42a

Multiply line 42a by the ratio on line 37 ..............................................Prorated Exemption(s) ➤

42b

42bl

Taxable Income. Line 41 minus line 42b (but not less than zero)................Taxable Income ➤

43

43l

=

=

=

=

=

44

Tax. Fill in oval if from:

Tax Table;

Tax Rate Schedule;

Form N-168;

Form N-615; or

Capital Gains Tax Worksheet on

page 40 of the Instructions. Enter the net capital gain

from the Capital Gains Tax Worksheet, line 14

.............44al

=

•

(

Include separate tax from Forms N-2, N-103, N-152, N-312, N-318, N-405,

N-586, or N-814) ................................................................................................................Tax ➤

44l

45

Total nonrefundable tax credits (attach Schedule CR)..................................................................

45

Line 44 minus line 45 (but not less than zero).............................................................Balance ➤

46

46

47

Hawaii State Income tax withheld, and

tax withheld on Forms N-2 or

N-4....................................47l

48

2005 estimated tax payments on

]

Forms N-1 _________ ; N-288A _________

...............48l

ID No 01

FORM N-15

1

1 2

2 3

3 4

4