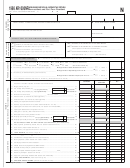

Form N-15 (Rev. 2005)

Page 2 of 4

Your Social Security Number

Your Spouse's SSN

!!! !! !!!!

!!! !! !!!!

}

Name(s) as shown on return

_____________________________________________________

MF052

If amount is negative (loss), shade the minus (-) in box. Example:

Col. A - Total Income

Col. B - Hawaii Income

l7l

7

Wages, salaries, tips, etc. (attach Form(s) W-2) .........

8

Interest income from the worksheet on page 37 of

the Instructions ............................................................

8l

9

Ordinary dividends ......................................................

9l

10

State income tax refund from the worksheet on

page 37 of the Instructions ..........................................

10l

11

Alimony received .........................................................

11

-

-

If negative number, place a minus sign (-)

If negative number, place a minus sign (-)

l12l

12

Business or farm income or (loss) ...............................

-

-

13

Capital gain or (loss) from the worksheet on

page 37 of the Instructions .........................................

13l

-

-

14

Supplemental gains or (losses)

(attach Schedule D-1) ................................................

14

15

IRA distributions ..........................................................

15l

16

Pensions and annuities

(see Instructions and

............................

16l

attach Schedule J, Form N-11/N-12/N-15/N-40)

-

-

17

Rents, royalties, partnerships, estates, trusts, etc. ....................

17l

18

Unemployment compensation (insurance). ................

18l

-

-

19

Other income (state nature and source)

________________________________ ....................

19l

-

-

➤

20

Add lines 7 through 19 ......................Total Income

20l

21

Educator expenses......................................................

21

22

Certain business expenses of reservists, performing artists, and

fee-basis government officials .............................................

22

23

IRA deduction..............................................................

23

24

Student loan interest deduction from the worksheet

on page 41 of the Instructions .....................................

24

25

Health savings account deduction...............................

25

26

Moving expenses (attach Form N-139) .......................

26

l27

27

One-half of self-employment tax .................................

28

Self-employed health insurance deduction ................

28

29

Self-employed SEP, SIMPLE, and qualified plans ......

29

30

Penalty on early withdrawal of savings .......................

30

31

Alimony paid

(Enter name and SS No. of recipient)

________________________________ ....................

31

]

32

Payments to an individual housing account ................

32l

ID No 01

FORM N-15

1

1 2

2 3

3 4

4