Retail Excise Tax Return On Liquor By The Drink

ADVERTISEMENT

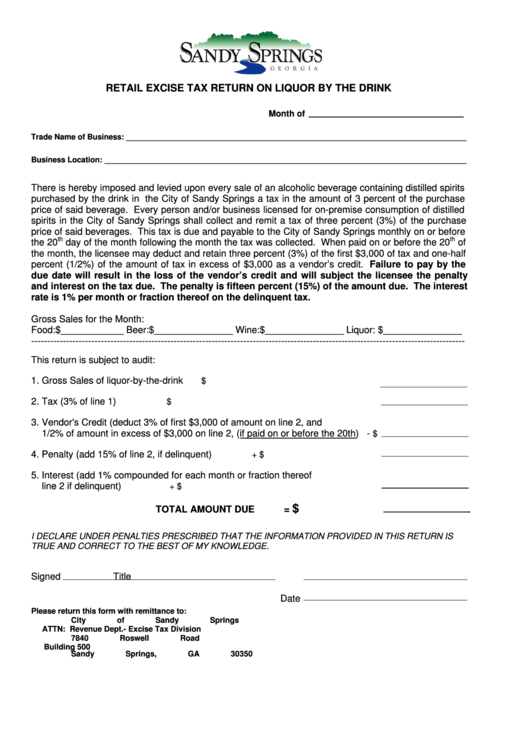

RETAIL EXCISE TAX RETURN ON LIQUOR BY THE DRINK

Month of

Trade Name of Business: ______________________________________________________________________________

Business Location: ___________________________________________________________________________________

There is hereby imposed and levied upon every sale of an alcoholic beverage containing distilled spirits

purchased by the drink in the City of Sandy Springs a tax in the amount of 3 percent of the purchase

price of said beverage. Every person and/or business licensed for on-premise consumption of distilled

spirits in the City of Sandy Springs shall collect and remit a tax of three percent (3%) of the purchase

price of said beverages. This tax is due and payable to the City of Sandy Springs monthly on or before

th

th

the 20

day of the month following the month the tax was collected. When paid on or before the 20

of

the month, the licensee may deduct and retain three percent (3%) of the first $3,000 of tax and one-half

percent (1/2%) of the amount of tax in excess of $3,000 as a vendor’s credit. Failure to pay by the

due date will result in the loss of the vendor’s credit and will subject the licensee the penalty

and interest on the tax due. The penalty is fifteen percent (15%) of the amount due. The interest

rate is 1% per month or fraction thereof on the delinquent tax.

Gross Sales for the Month:

Food:$____________ Beer:$_______________ Wine:$_______________ Liquor: $_______________

-----------------------------------------------------------------------------------------------------------------------------------------

This return is subject to audit:

1. Gross Sales of liquor-by-the-drink

$

2. Tax (3% of line 1)

$

3. Vendor's Credit (deduct 3% of first $3,000 of amount on line 2, and

1/2% of amount in excess of $3,000 on line 2, (if paid on or before the 20th) -

$

4. Penalty (add 15% of line 2, if delinquent)

+ $

5. Interest (add 1% compounded for each month or fraction thereof

line 2 if delinquent)

+ $

$

TOTAL AMOUNT DUE

=

I DECLARE UNDER PENALTIES PRESCRIBED THAT THE INFORMATION PROVIDED IN THIS RETURN IS

TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE.

Signed

Title

Date

Please return this form with remittance to:

City of Sandy Springs

ATTN: Revenue Dept.- Excise Tax Division

7840 Roswell Road

Building 500

Sandy Springs, GA 30350

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1